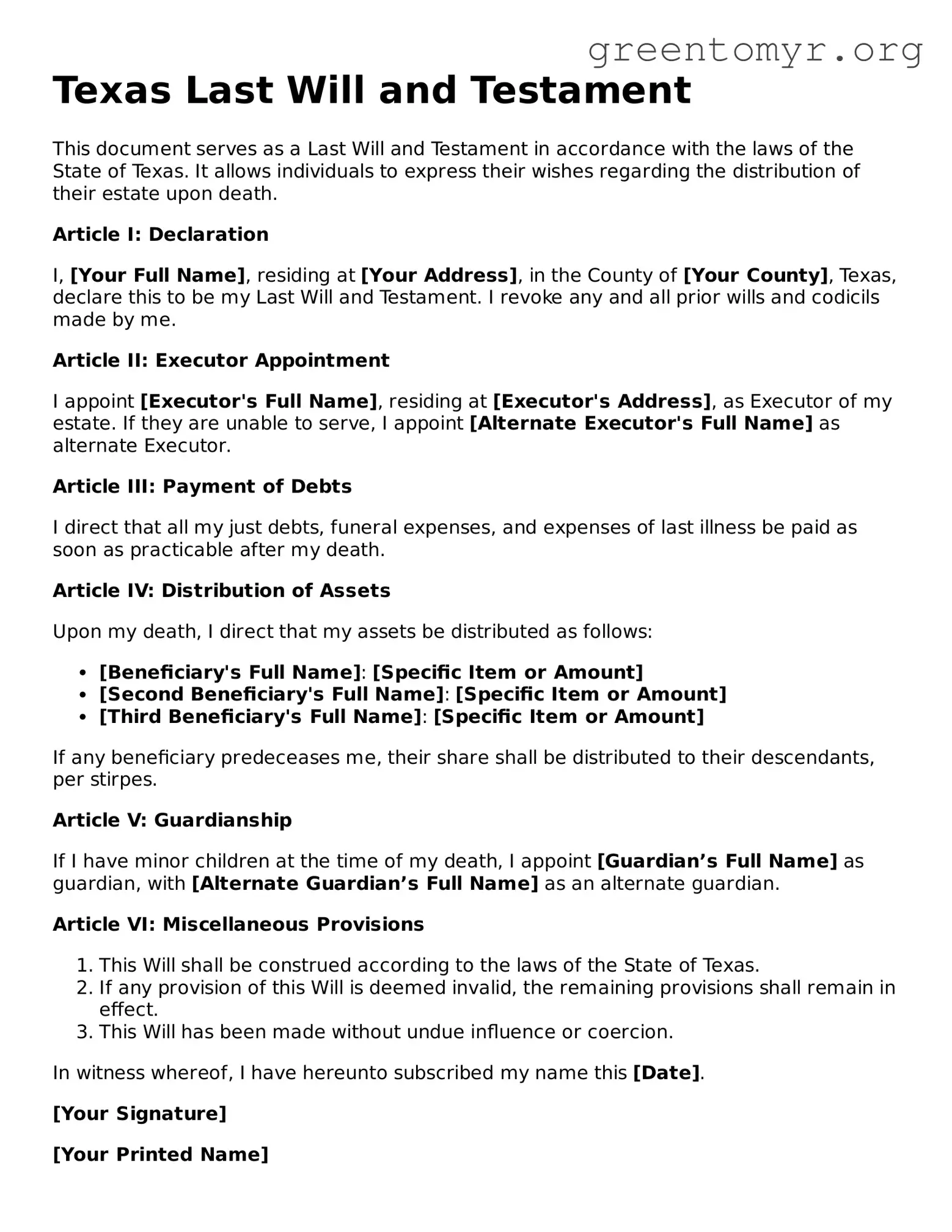

Texas Last Will and Testament

This document serves as a Last Will and Testament in accordance with the laws of the State of Texas. It allows individuals to express their wishes regarding the distribution of their estate upon death.

Article I: Declaration

I, [Your Full Name], residing at [Your Address], in the County of [Your County], Texas, declare this to be my Last Will and Testament. I revoke any and all prior wills and codicils made by me.

Article II: Executor Appointment

I appoint [Executor's Full Name], residing at [Executor's Address], as Executor of my estate. If they are unable to serve, I appoint [Alternate Executor's Full Name] as alternate Executor.

Article III: Payment of Debts

I direct that all my just debts, funeral expenses, and expenses of last illness be paid as soon as practicable after my death.

Article IV: Distribution of Assets

Upon my death, I direct that my assets be distributed as follows:

- [Beneficiary's Full Name]: [Specific Item or Amount]

- [Second Beneficiary's Full Name]: [Specific Item or Amount]

- [Third Beneficiary's Full Name]: [Specific Item or Amount]

If any beneficiary predeceases me, their share shall be distributed to their descendants, per stirpes.

Article V: Guardianship

If I have minor children at the time of my death, I appoint [Guardian’s Full Name] as guardian, with [Alternate Guardian’s Full Name] as an alternate guardian.

Article VI: Miscellaneous Provisions

- This Will shall be construed according to the laws of the State of Texas.

- If any provision of this Will is deemed invalid, the remaining provisions shall remain in effect.

- This Will has been made without undue influence or coercion.

In witness whereof, I have hereunto subscribed my name this [Date].

[Your Signature]

[Your Printed Name]

We, the undersigned witnesses, hereby declare that we witnessed the signing of this Last Will and Testament by [Your Full Name] on [Date], and that he/she is of sound mind and body.

Witness 1: ____________________

Witness 1 Printed Name: ____________________

Witness 2: ____________________

Witness 2 Printed Name: ____________________