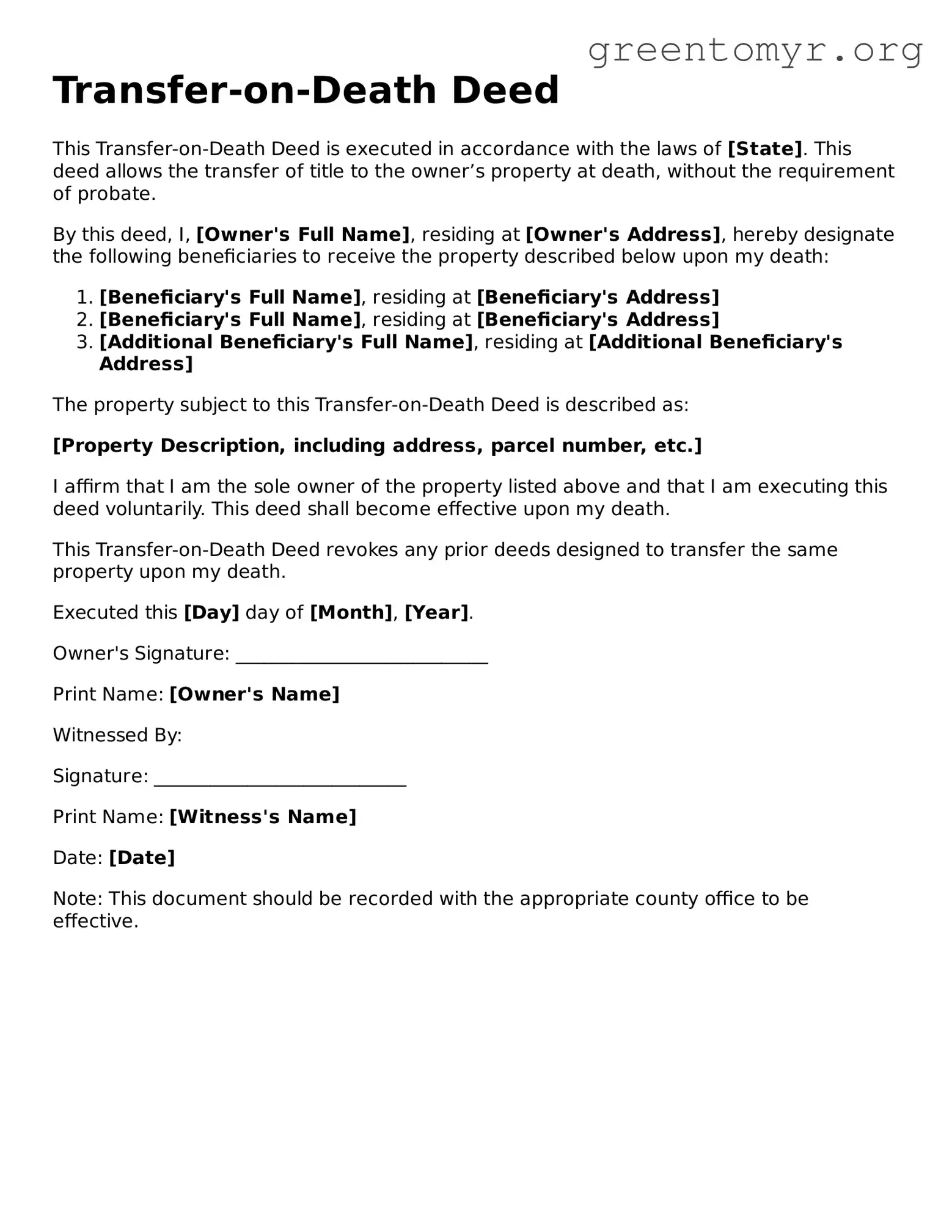

Transfer-on-Death Deed

This Transfer-on-Death Deed is executed in accordance with the laws of [State]. This deed allows the transfer of title to the owner’s property at death, without the requirement of probate.

By this deed, I, [Owner's Full Name], residing at [Owner's Address], hereby designate the following beneficiaries to receive the property described below upon my death:

- [Beneficiary's Full Name], residing at [Beneficiary's Address]

- [Beneficiary's Full Name], residing at [Beneficiary's Address]

- [Additional Beneficiary's Full Name], residing at [Additional Beneficiary's Address]

The property subject to this Transfer-on-Death Deed is described as:

[Property Description, including address, parcel number, etc.]

I affirm that I am the sole owner of the property listed above and that I am executing this deed voluntarily. This deed shall become effective upon my death.

This Transfer-on-Death Deed revokes any prior deeds designed to transfer the same property upon my death.

Executed this [Day] day of [Month], [Year].

Owner's Signature: ___________________________

Print Name: [Owner's Name]

Witnessed By:

Signature: ___________________________

Print Name: [Witness's Name]

Date: [Date]

Note: This document should be recorded with the appropriate county office to be effective.