What is the 52 Week Money Challenge?

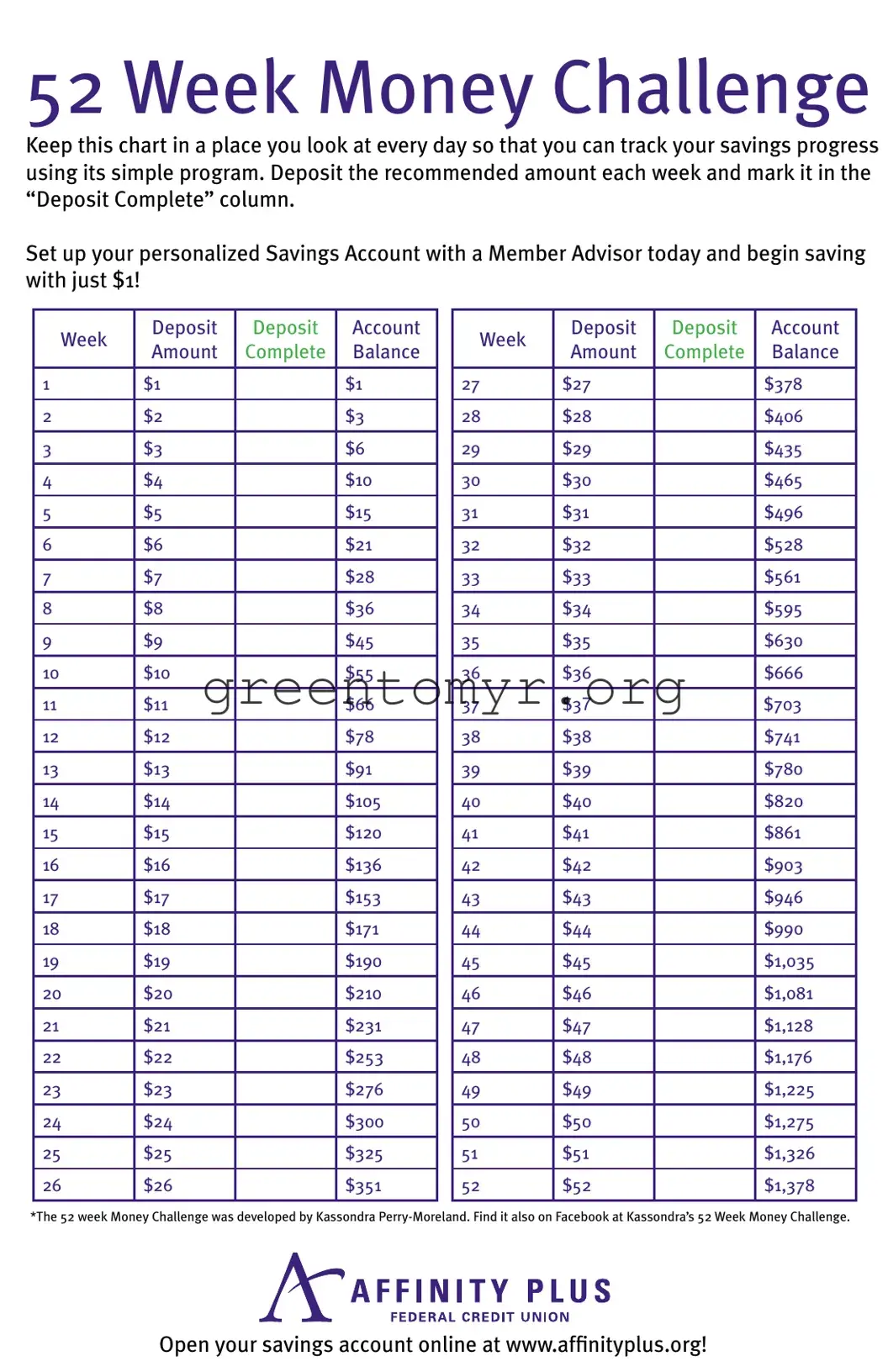

The 52 Week Money Challenge is a popular savings program designed to help individuals save a specific amount of money over the course of a year. Participants start with a small amount in the first week and gradually increase their savings each week. At the end of the year, individuals will have saved a total of $1,378.

How does the challenge work?

The challenge begins with saving $1 in the first week, then $2 in the second week, and continues increasing by $1 each week for 52 weeks. For example:

-

Week 1: Save $1

-

Week 2: Save $2

-

Week 3: Save $3

-

..and so on until..

-

Week 52: Save $52

At the end of week 52, your total savings will amount to $1,378.

What are the benefits of this challenge?

The 52 Week Money Challenge helps develop a consistent savings habit. It allows participants to gradually increase their savings without feeling overwhelmed. Additionally, it provides a clear goal and a visual representation of progress, making saving feel more achievable and rewarding.

Can I start the challenge at any time?

Yes, the 52 Week Money Challenge can begin at any point during the year. You do not need to wait for the beginning of the year. Start whenever it feels right for you, adapting the weekly savings amount according to your budget.

What if I miss a week?

If you miss a week, consider two options: catch up by saving double in the next week or adjust your savings plan to meet the end goal. The key is to keep moving forward and establish a sustainable savings routine that works for you.

Yes, many websites and financial blogs offer printable forms for the 52 Week Money Challenge. You can use these forms to track your savings progress. Look for options that suit your preference, whether digital or physical formats.

Is this challenge suitable for everyone?

While it is a flexible savings method, the challenge might be challenging for those with limited income or financial obligations. Adjust the weekly savings amounts based on your financial situation to ensure it is feasible for you.

How can I motivate myself to finish the challenge?

Setting milestones or rewards can boost motivation. Celebrate small achievements along the way, like completing a month. Visual reminders and tracking your progress can also help keep your goals in sight and encourage adherence to the challenge.

What can I do with the money saved at the end of the challenge?

At the end of the challenge, you can use your savings for various purposes, such as creating an emergency fund, making a large purchase, investing, or planning a special trip. The choice is entirely yours, based on your financial needs and goals.

Can I involve my family or friends in the challenge?

Involving family or friends can add accountability and increase motivation. You can create a group challenge, share progress, and support each other along the way. This communal approach can make saving more enjoyable and engaging.