An ACH Payment Authorization Form allows you to give permission for electronic payments to be made from your bank account. This form typically is used for recurring payments such as utilities, subscriptions, or loan payments. By signing this form, you authorize a company to withdraw funds directly from your bank account on specified dates.

This form is useful for anyone setting up automatic payments to businesses or service providers. It is commonly used by individuals for bills, mortgages, and regular subscriptions. Businesses may also use it to collect payments from customers or clients efficiently.

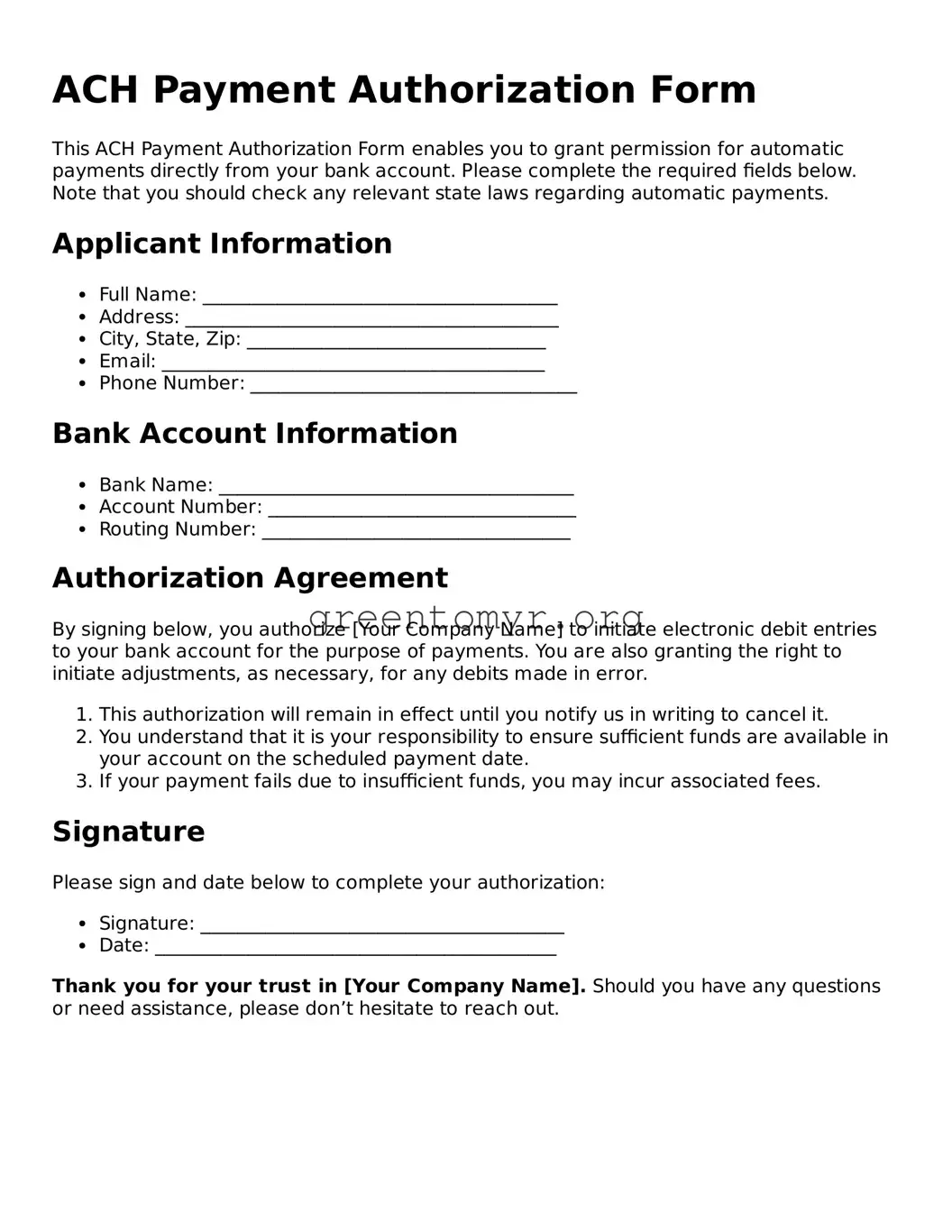

Filling out the form is straightforward. You typically need to provide:

-

Your name and contact information

-

Your bank account details, including account number and routing number

-

The amount to be withdrawn, if applicable

-

The frequency of the payment (weekly, monthly, etc.)

-

Your signature to authorize the transactions

Make sure to double-check your information for accuracy before submitting the form.

Can I cancel my payment authorization at any time?

Yes, you can cancel your authorization. However, it's important to notify the company receiving the payments before the next scheduled withdrawal. Check their policy for cancellations, as some may require written confirmation.

Reputable companies that use ACH Payment Authorization Forms prioritize the security of your personal and banking information. They typically use encryption and other security measures to protect your data. Always verify the company's security practices before submitting sensitive information.

What happens if I don’t have enough funds in my account?

If there are insufficient funds in your account on the scheduled withdrawal date, the transaction may bounce. This could lead to overdraft fees from your bank and potential fees from the company. It's wise to keep track of your account balance, especially around payment dates.

How long does it take to set up the ACH payment?

The setup time can vary depending on the company processing the ACH payments. Generally, it can take anywhere from a few days to about a week for the authorization to be fully processed. Always check with the company for their specific timeline.

What do I do if I see an unauthorized charge?

If you notice an unauthorized charge, act quickly. Contact your bank immediately to report the charge and dispute the transaction. Additionally, reach out to the company that initiated the transaction to resolve the issue. Most banks have processes in place to investigate unauthorized charges.

Typically, the ACH system is designed for domestic transactions within the United States. For international transactions, other payment methods may be required. Always inquire with the receiving party about their accepted payment methods before attempting to set up an ACH for international purposes.