Filling out the ADP Flexible Spending Account (FSA) Claim Form can be straightforward, but common mistakes can lead to delays or denials of reimbursement. Here are nine frequent errors made by individuals when completing this important document.

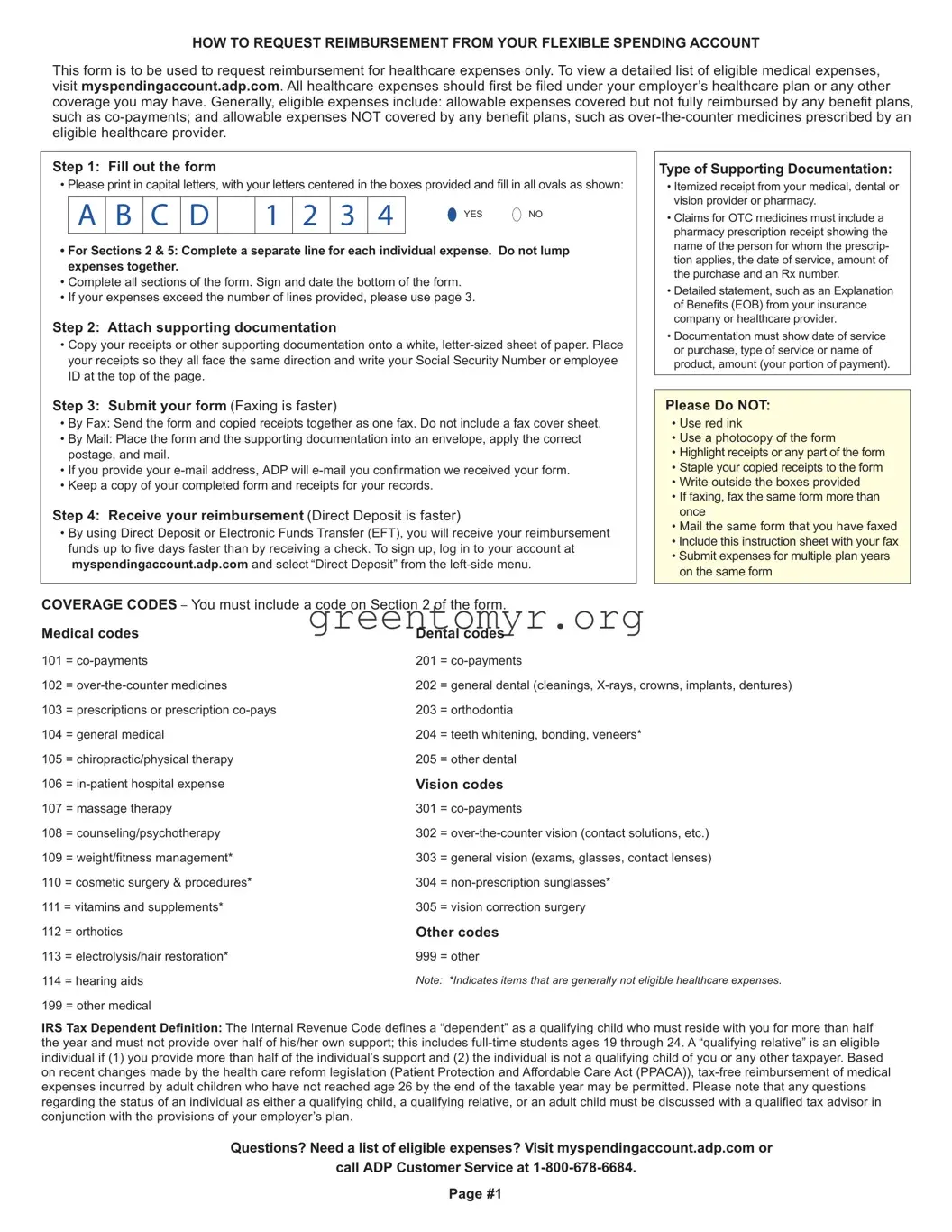

One common mistake is failing to complete all required sections of the form. Each section serves a specific purpose, and leaving any part blank can result in processing issues. Ensure that you have filled in every section, especially your personal information and healthcare expenses.

Another frequent error is not filing correctly under your employer’s healthcare plan first. Before submitting an FSA claim, you must first seek reimbursement from any applicable insurance. Failing to do so can lead to complications down the line.

People often lump multiple expenses together on a single line. This is a significant mistake. Each healthcare expense should be documented separately, with distinct entries in the designated sections of the form. Combining expenses could confuse the claims process and result in rejected claims.

Many submit receipts without proper documentation. When attaching supporting documents, be sure to include copies of itemized receipts on a white letter-sized sheet of paper, facing the same direction. Always include your Social Security number or employee ID on this sheet to ensure proper identification of your claims.

Using red ink is another common pitfall. This can lead to scanning issues that might prevent your claim from being processed accurately. Stick to black or blue ink when filling out the form to avoid complications.

Some individuals forget to sign and date the bottom of the form. This is a critical step that is often overlooked. Without your signature and the date, the claims processing may be halted or returned for correction.

An additional error is submitting the same form multiple times, either by faxing and mailing the same claim simultaneously or faxing the form more than once. This practice can confuse claims processors and delay reimbursements.

It is also important not to include the instruction sheet when submitting. This document is only meant for your reference, and including it can complicate processing and may lead to delays in receiving your funds.

Lastly, many people do not use the correct coverage codes for their expenses. Each type of healthcare expense requires a specific code. Missing or incorrect codes can lead to denial of claims or incomplete reimbursement amounts. Make sure to verify your coverage before submitting the form.