What is an ADP Pay Stub?

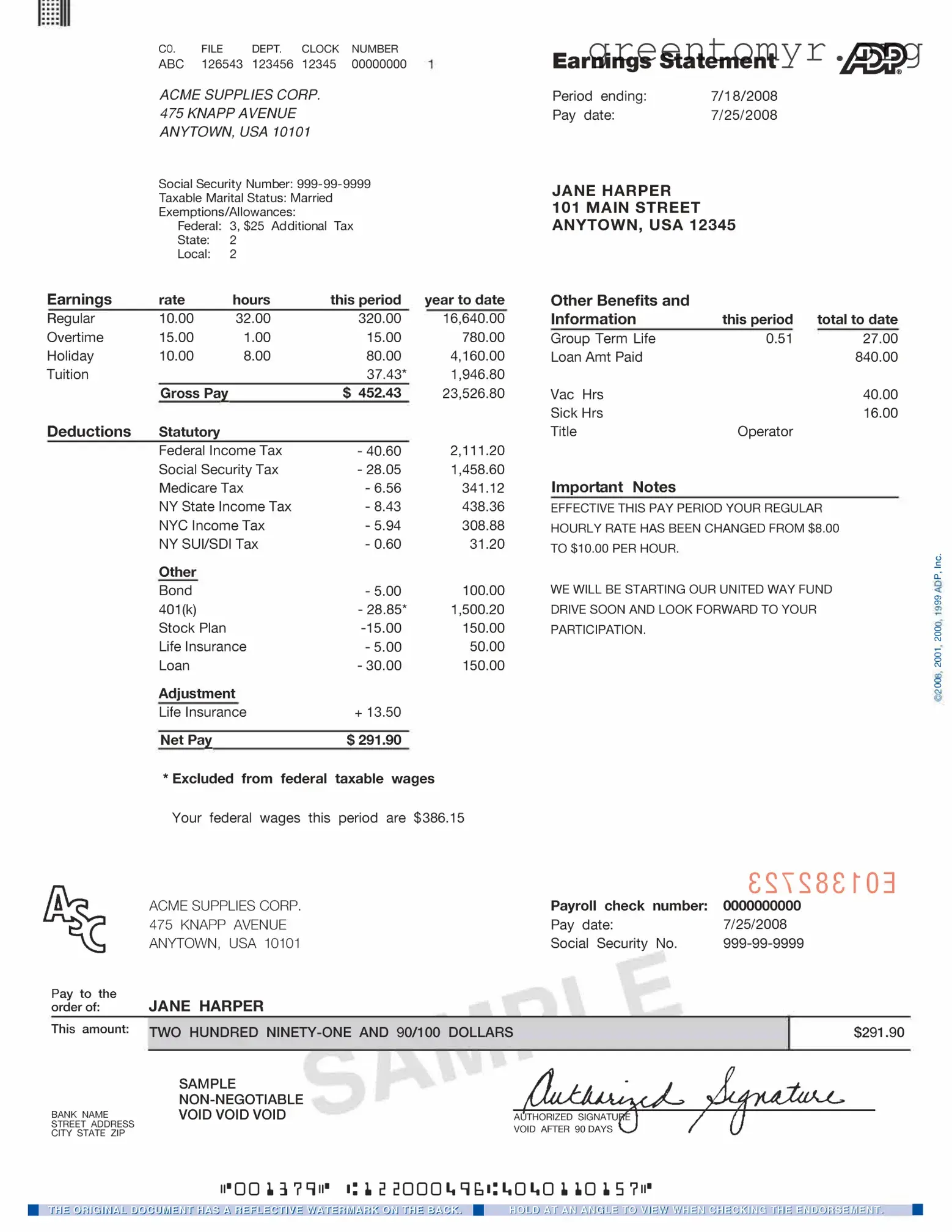

An ADP Pay Stub is a document that provides a detailed breakdown of an employee's earnings for a specific pay period. This document typically includes information such as gross wages, deductions, taxes withheld, and net pay. Employees receive this stub as part of their payroll process, either physically or electronically, and it serves as an important record for personal finance and tax preparation purposes.

How do I access my ADP Pay Stub?

You can access your ADP Pay Stub through the ADP employee portal. Once logged in, navigate to the "Pay" section. Here, you will find your pay stubs listed by date. If you are accessing it for the first time, you may need to register using your employee information. For assistance, your HR department can provide guidance or troubleshoot access issues.

An ADP Pay Stub typically contains several key pieces of information, including:

-

Employee Information:

Name, identification number, and departmental details.

-

Pay Period:

The start and end dates of the pay period.

-

Gross Earnings:

Total wages earned before deductions.

-

Deductions:

Items such as taxes, retirement contributions, and health insurance premiums.

-

Net Pay:

The amount received after all deductions.

Can I get a copy of a previous pay stub?

Yes, you can obtain copies of previous pay stubs through your ADP account. After logging in, you will have the option to view your pay history, from which you can select and download past stubs. For those who need further assistance, reaching out to your employer's HR department can be a helpful step.

What should I do if I believe there is an error on my pay stub?

If you suspect there is an error on your pay stub, promptly contact your HR department or payroll administrator. Prepare to provide specific details about the discrepancy to facilitate a thorough investigation. It's essential to communicate any issues as soon as possible to ensure corrections can be made timely.

Is my ADP Pay Stub secure?

ADP takes security seriously and employs various methods to protect your personal and financial information. Accessing your pay stub requires secure log-in credentials, and sensitive data is encrypted. Always be sure to use strong, unique passwords and log out after each session, especially when using shared devices.