Evidence of Insurability Statement

Life and Disability Coverage

Aetna Life Insurance Company

Read This Instruction Page Carefully.

Aetna may contact you directly to request additional information upon receipt of this completed Statement.

Instructions

Plan Sponsor

Please Print

Complete Section A in its entirety. Be sure that:

•All items are completed.

•The Control Number, Suffix and Account numbers are provided (A1).

•The Employee/Member’s Social Security Number is provided (A2).

•Both the Employee/Member’s and your name and address are shown in the spaces provided (A3 and A4).

•The telephone number of your authorized representative (A5), Employee/Member’s date of hire (A6) and Employee/Member’s home and work telephone numbers (A7) are provided.

•Your Employee/Member’s and your E-mail addresses are provided (A8 and A9).

•Employee/Member’s Annual Earnings is completed (A10).

•You check the appropriate box(es) for individual(s) requesting Life coverage. Provide the current (existing) amount of coverage, requested additional (new) amount of coverage, resulting total amount of coverage and Guarantee Issue amount for each individual for whom coverage is being requested (A11).

•You check the reason for requested life coverage (A11).

•You check the appropriate Disability box(es) and provide current and requested amounts or percentage of coverage (A11).

•Section A is signed by your Authorized Representative (A12).

Give the form to your Employee/Member for his/her confidential submission to Aetna.

Aetna will advise you of its coverage decision. Employee/Member will be notified directly if coverage is denied.

Employee/Member

Read the Privacy Notice and Misrepresentation section on “Page 2 of 4” of the Insurability Statement before completing.

Please Print

Verify that your name, address and Social Security Number as shown in Section A are complete and accurate. We may need to direct additional inquiries to your attention.

Complete Section B. Be sure that:

•All items are completed.

•Only the names of individuals requesting coverage at this time are listed (B1).

•Height and Weight must be provided or this form will be returned unprocessed for your completion (B1).

•The appropriate boxes regarding dependent child coverage are checked, if applicable (B2a, B2b, and B2c).

•Complete dates and details are given for all conditions checked in B3g, (B4).

•The form is signed by you. If you are requesting spouse coverage, the spouse’s signature is also required. Read the Certification, Acknowledgment and Authorization prior to signing the form (bottom of Section B).

Make a copy for your records. If a final underwriting decision cannot be made within six months, Aetna reserves the right to request a new Evidence of Insurability Statement.

Please Note: If this form is not completed in its entirety and signed, it will be returned unprocessed for your completion.

EOI |

|

Small Group |

GR-67853-34 (2-18) B |

Make a copy for your records. |

R-POD |

Privacy Notice

In evaluating your insurability, we (Aetna) will rely primarily on the health information you furnish to us in this Evidence of Insurability Statement. In addition, however, we may ask you to take a physical examination, or request additional medical information about you from any of the sources specified in the authorization on Page 4 of 4 of this form.

Disclosure of Information to Others

All of this information will be treated as confidential and will not be disclosed to others without your authorization, except to the extent necessary for the conduct of our business and not contrary to any law. For example, Aetna Life Insurance Company may also release information in its file to its reinsurer(s) and to other life insurance companies to whom you may apply for coverage, or to whom a claim for benefits may be submitted. In addition, information may be furnished to regulators of our business and to others as may be required by law, and to law enforcement authorities when necessary to prevent or prosecute fraud or other illegal activities.

Your Right of Access & Correction

In general, you have a right to learn the nature and substance of any information in our files about you. You also have a right of access to such files (except information which relates to a claim or a civil or criminal proceeding), and to request correction, amendment or deletion of recorded personal information in states which provide such rights and grant immunity to insurers providing such access. We may elect, however, to disclose details of any medical information you request to your (attending) physician. If you wish to exercise this right, or if you wish to have a more detailed explanation of our information practices, please contact:

Aetna Life Insurance Company, Medical Underwriting Department, 151 Farmington Avenue, Hartford, CT 06156-2975

Under New Mexico law, a resident of New Mexico has the right to register as a "protected person" in connection with disclosure of confidential domestic abuse information. If you wish to exercise this right, write to the address shown above.

Misrepresentation

Any person who knowingly and with intent to injure, defraud or deceive any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

Attention Alabama Residents: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or who knowingly presents false information in an application for insurance is guilty of a crime and may be subject to restitution fines or confinement in prison, or any combination thereof. Attention Arkansas, District of Columbia, Rhode Island and West Virginia Residents: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison. Attention California Residents: For your protection, California law requires notice of the following to appear on this form: Any person who knowingly presents a false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison. Attention Colorado Residents: It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado division of insurance within the department of regulatory agencies. Attention Florida Residents: Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete or misleading information is guilty of a felony of the third degree. Attention Kansas and Missouri Residents: Any person who knowingly and with intent to injure, defraud or deceive any insurance company or other person submits an enrollment form for insurance or statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto may have violated state law. Attention Kentucky Residents: Any person who knowingly and with intent to defraud any insurance company or other person files a statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and may subject such person to criminal and civil penalties. Attention Louisiana Residents: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application is guilty of a crime and may be subject to fines and confinement in prison. Attention Maine and Tennessee Residents: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties may include imprisonment, fines or denial of insurance benefits. Attention Maryland Residents: Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly or willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison. Attention New Jersey Residents: Any person who includes any false or misleading information on an application for an insurance policy is subject to criminal and civil penalties. Attention North Carolina Residents: Any person who knowingly and with intent to injure, defraud or deceive any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which may be a crime and subjects such person to criminal and civil penalties. Attention Ohio Residents: Any person who, with intent to defraud or knowing he is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement is guilty of insurance fraud. Attention Oklahoma Residents: WARNING: Any person who knowingly, and with intent to injure, defraud or deceive any insurer, makes any claim for the proceeds of an insurance policy containing any false, incomplete or misleading information is guilty of a felony. Attention Oregon Residents: Any person who with intent to injure, defraud or deceive any insurance company or other person submits an enrollment form for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto may have violated state law. Attention Pennsylvania Residents: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties. Attention Puerto Rico Residents: Any person who knowingly and with the intention to defraud includes false information in an application for insurance or file, assist or abet in the filing of a fraudulent claim to obtain payment of a loss or other benefit, or files more than one claim for the same loss or damage, commits a felony and if found guilty shall be punished for each violation with a fine of no less than five thousand dollars ($5,000), not to exceed ten thousand dollars ($10,000); or imprisoned for a fixed term of three (3) years, or both. If aggravating circumstances exist, the fixed jail term may be increased to a maximum of five (5) years; and if mitigating circumstances are present, the jail term may be reduced to a minimum of two (2) years. Attention Texas Residents: Any person who knowingly and with intent to injure, defraud or deceive any insurance company or other person files an application for insurance or statement of claim containing any intentional misrepresentation of material fact or conceals, for the purpose of misleading, information concerning any fact material thereto may commit a fraudulent insurance act, which may be a crime and may subject such person to criminal and civil penalties. Attention Vermont Residents: Any person who knowingly and with intent to injure, defraud or deceive any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which may be a crime and may subject such person to criminal and civil penalties. Attention Virginia Residents: Any person who knowingly and with intent to injure, defraud or deceive any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent act, which is a crime and subjects such person to criminal and civil penalties. Attention Washington Residents: It is a crime to knowingly provide false, incomplete, or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines, and denial of insurance benefits. Attention New York Residents, the following statement applies only to your AD&D and Disability coverage: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and shall be subject to a civil penalty not to exceed five thousand dollars and the stated value of the claim for each violation.

Employee/Member’s or Authorized Person’s Signature: |

Date: |

|

|

Submission and Approval

The requested coverage will not be in effect unless and until evidence of insurability is submitted as required and is approved by Aetna.

GR-67853-34 (2-18) B |

Small Group Page 2 of 8 |

Evidence of Insurability Statement

Life and Disability Coverage

Aetna Life Insurance Company

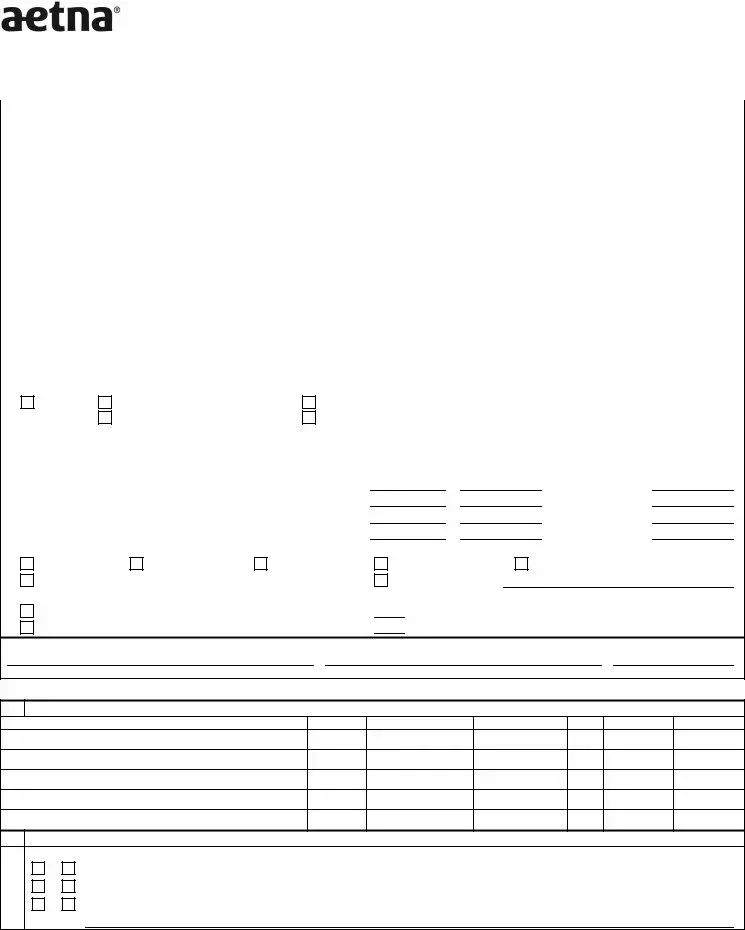

A. Plan Sponsor: Complete this Section - Please print.

Make a copy for your records. Mail the original to:

Aetna Small Group

Underwriting

1. |

|

Control Number |

Suffix |

|

|

Account |

|

2. Employee/Member Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Plan Sponsor Name & Address |

|

|

|

|

|

4. Employee/Member Name & Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ATTN: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street |

|

|

|

|

|

|

Street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

ZIP Code |

|

|

City |

|

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

5. |

Plan Sponsor - Authorized Rep. Telephone Number |

|

6. Employee/Member Date of Hire |

|

7. Employee/Member Telephone Numbers (Including Area Code) |

|

|

|

|

( |

) |

|

|

(MM/DD/YYYY) |

|

|

Work |

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Home |

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

Plan Sponsor E-mail address |

|

|

|

|

|

9. Employee/Member E-mail Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

Employee/Member’s Annual Earnings $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. |

Coverage(s) Applied for: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee/Member Basic Life Spouse

Employee/Member Supplemental, Optional or Voluntary Life Child(ren)

|

Employee/Member |

|

|

|

Supplemental, |

|

|

Employee/Member |

Optional or |

Spouse |

Child(ren) |

Basic Life |

Voluntary Life |

Life |

Life |

a. Current (Existing) Amount of Life Insurance Coverage? |

$ |

b. Additional (New) Amount of Life Insurance Coverage requested? $ |

c. Resulting Total Life Insurance Amount if Approved (a + b)? |

$ |

d. Guarantee Issue Amount of Life Insurance? |

|

$ |

*Reason for Requested Coverage (indicate all that apply). |

|

Salary Increase |

Change in Multiple |

Late Applicant |

|

Requesting an Amount in Excess of Plan’s Guaranteed Issue Limit |

|

Disability Coverages (Employee/Member Only): |

|

|

$

$

$

$

Change in Increments Other (Please explain)

Short Term Disability: |

Current Amount $ |

|

or |

Long Term Disability: |

Current Amount $ |

|

or |

% |

Requested Amount $ |

|

or |

|

% |

% |

Requested Amount $ |

|

or |

|

% |

12. I certify the above information is correct.

Plan Sponsor - Authorized Representative Signature |

Plan Sponsor - Authorized Representative Name (Please print) |

Date Signed (MM/DD/YYYY) |

B.Employee/Member: Complete this Section - Please print. All questions must be answered. Incomplete forms cannot be processed.

1.Only the Names of Individual(s) Requesting Coverage at this Time Should be Listed

Name

Employee:

Spouse:

Child(ren):

Relationship Birthdate (MM/DD/YYYY) Birthplace (City/State) Gender Height (ft., in.) Weight (lbs.)

Self

2.Complete these questions if dependent children are listed above. Use Number 4 if additional space is needed.

|

|

|

|

Yes |

No |

a. |

Do all dependent children live in your household? If No, please explain: |

|

b. |

Do all dependent children depend solely on you for support? If No, please explain: |

|

c. |

If any dependent child is age 19 or older, is/are they regularly attending school? If No, please explain: |

continued

EOI

GR-67853-34 (2-18) B |

Small Group Page 3 of 8 |

Employee/Member Social Security Number

B.Employee/Member: Complete this Section - Please print. (Continued)

3.Statement of Health for Individual(s) Listed Above. Please answer the following questions to the best of your knowledge and belief.

If any of the following questions are checked “Yes”, you must provide details in Number 4 below.

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. |

Is any individual pregnant? If Yes, |

Who: |

|

|

|

|

|

|

|

Date Due: |

|

|

|

|

|

Any complications or problems? If Yes, explain: |

|

|

|

|

|

|

|

b. |

Has any individual used tobacco products in the last 12 months (cigarettes, cigar, pipe, chewing tobacco)? |

|

|

If Yes, Who: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c. |

Are any inpatient or outpatient medical, surgical or diagnostic procedures recommended or contemplated: If Yes, When: |

|

|

|

Individual: |

|

|

|

|

|

|

|

|

|

|

|

Name of procedure: |

|

|

|

Reason for procedure: |

|

|

|

|

|

|

|

|

|

|

|

|

|

d. |

In the past 7 years, has any individual been confined to a hospital, clinic, sanatorium, rehabilitation or other treatment facility? |

|

|

If Yes, Who: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Why: |

|

|

|

|

|

|

|

|

|

|

|

When: |

|

e. |

In the past 7 years, has any individual been examined, monitored or received medical treatment from any doctor, practitioner or |

|

|

counselor for any condition other than minor illnesses (cold, flu, etc.)? |

|

|

|

|

|

|

|

|

If Yes, Who: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Why: |

|

|

|

|

|

|

|

|

|

|

|

When: |

|

f. |

Is any individual(s) currently taking medication(s)? If Yes, complete the following information: |

|

|

|

|

|

|

|

Name of Individual |

|

Medication |

|

|

|

Dosage/Frequency |

Diagnosis |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

g.Within the past 10 years have you, your spouse or child(ren) had any disease, impairment of or treatment (other than minor illnesses) for any of the following? If Yes, check the appropriate box(es) and describe in Number 4.

AIDS* |

Cancer |

Immune System Disorder |

Nervous System |

Arthritis Type: |

|

|

Carpal Tunnel Syndrome |

Intestine/Stomach/Ulcer |

Paralysis/Paresis |

Asthma/Emphysema/COPD |

Chest Pain |

Kidney/Bladder |

Reproductive System |

Back/Spine/Neck |

Chronic Fatigue/Fibromyalgia |

Liver/Spleen/Pancreas |

Skin Disorder |

Blood Disorder/Bleeding/Blood Clot |

Diabetes/Metabolic |

Lungs/Breathing |

Stroke |

Blood Pressure/Hypertension |

Ears/Eyes |

Lupus Type: |

|

|

Substance Abuse (Alcohol/Drug) |

Blood Vessels/Circulation |

Epilepsy/Seizure |

Mental/Emotional Condition |

Throat/Tonsils/Swallowing |

Bones/Joints |

Esophagus/Digestion/GERD |

Multiple Sclerosis |

Thyroid/Pituitary/Adrenal |

Brain |

Heart |

Muscular Condition |

Tumor/Growth |

Other

*AIDS (Acquired Immune Deficiency Syndrome) is a serious disease. It is caused by a virus called HIV (Human Immunodeficiency Virus). The virus is found in some human body fluids of infected people, most notably in semen and blood. If the AIDS virus finds its way into the bloodstream, it can damage the body’s defenses against disease, resulting in life- threatening diseases. There is no known cure.

4.In the space below, describe all conditions checked in 3g above and provide additional information for questions 2a-c and 3a-f, if needed.

Ques. |

Name of |

|

|

Date of |

Details/ |

Treatments |

Full Recovery Date |

No. |

Individual |

Diagnosis |

Onset |

Symptoms |

Received |

or is condition ongoing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here if you are providing additional information on a separate attachment.

Certification: I certify these answers and statements are complete and true to the best of my knowledge and belief. I will inform Aetna of any material changes to the information provided which take place between the time the form is completed and the time coverage becomes effective. I agree that this document shall become a part of my request for group coverage and I acknowledge that I have retained a copy of this document as completed by me.

Acknowledgment: I understand that, to the extent permitted by state law, false statements may result in the denial of claims or in my insurance coverage being void as of its effective date with no benefits payable. I understand that conditions which are disclosed on this form may be subject to all conditions of my Plan Sponsor’s Plan including any preexisting condition limitations, fraud provisions and employee actively at work and dependent health condition requirements. My signature indicates that I have reviewed all information and statements on this form for completeness and accuracy.

Authorization: To all physicians and other health professionals, hospitals and other health care institutions, insurers, medical or hospital service and prepaid health plans, employers and

the Medical Information Bureau: You are authorized to provide Aetna Life Insurance Company (Aetna) information concerning healthcare, advice, treatment or supplies (including those related to mental illness and/or AIDS/ARC/HIV) provided me or any members of my family for whom coverage has been requested. (Minnesota residents are not required to provide information concerning results of AIDS/ARC/HIV tests performed on a criminal offender or a crime victim.) I acknowledge that information obtained from any or all of the above may result in further underwriting investigation. This information will be used for the purpose of determining eligibility for coverage. This authorization will be valid for twelve (12) months from the date signed. I acknowledge that I have read the Privacy Notice and Misrepresentation section shown on “Page 2 of 4” of this form and know that I have a right to receive a copy of this authorization upon request. I agree that a photographic copy of this authorization is as valid as the original.

Employee/Member’s or Authorized Person’s Signature (Required at all |

Date |

Spouse’s or Authorized Person’s Signature (Required if spouse |

Date |

times) |

|

coverage is requested) |

|

|

|

|

|

GR-67853-34 (2-18) B |

Small Group Page 4 of 8 |

Aetna complies with applicable Federal civil rights laws and does not discriminate, exclude or treat people differently based on their race, color, national origin, sex, age, or disability.

Aetna provides free aids / services to people with disabilities and to people who need language assistance.

If you are an existing Aetna member and need a qualified interpreter, written information in other formats, translation or other services, please call the number on your member ID card. If you are a prospective Aetna member, please call 1-888-238-6201.

If you believe we have failed to provide these services or otherwise discriminated based on a protected class noted above, you can also file a grievance with the Civil Rights Coordinator by contacting:

Civil Rights Coordinator,

PO Box 14462, Lexington, KY 40512 (CA HMO customers: PO Box 24030 Fresno, CA 93779),

1-800-648-7817, TTY: 711,

Fax: 859-425-3379 (CA HMO customers: 860-262-7705), [email protected].

You can also file a civil rights complaint with the U.S. Department of Health and Human Services, Office for Civil Rights Complaint Portal, available at https://ocrportal.hhs.gov/ocr/portal/lobby.jsf,

or at: U.S. Department of Health and Human Services, 200 Independence Avenue SW, Room 509F, HHH Building, Washington, DC 20201, or at 1-800-368-1019, 800-537-7697 (TDD).

Aetna is the brand name used for products and services provided by one or more of the Aetna group of subsidiary companies, including Aetna Life Insurance Company, Coventry Health Care plans and their affiliates (Aetna).

GR-67853-34 (2-18) B |

Small Group Page 5 of 8 |

TTY: 711

To access language services at no cost to you, call 1-888-238-6201.

Para acceder a los servicios de idiomas sin costo, llame al 1-888-238-6201. (Spanish) 如欲使用免費語言服務,請致電 1-888-238-6201。(Chinese)

Afin d'accéder aux services langagiers sans frais, composez le 1-888-238-6201. (French)

Para ma-access ang mga serbisyo sa wika nang wala kayong babayaran, tumawag sa 1-888-238-6201. (Tagalog)

Um auf für Sie kostenlose Sprachdienstleistungen zuzugreifen, rufen Sie 1-888-238-6201 an. (German) Për shërbime përkthimi falas për ju, telefononi 1-888-238-6201. (Albanian)

የቋንቋ አገልግሎቶችን ያለክፍያ ለማግኘት፣ በ 1-888-238-6201 ይደውሉ፡፡ (Amharic)

(Arabic) .1-888-238-6201 مقرلا ىلع لاصتلاا ءاجرلا ،ةفلكت يأ نود ةيوغللا تامدخلا ىلع لوصحلل

Անվճար լեզվական ծառայություններից օգտվելու համար զանգահարեք 1-888-238-6201 հեռախոհամարով: (Armenian)

Kugira uronke serivisi z’indimi atakiguzi, hamagara 1-888-238-6201 (Bantu)

Ngadto maakses ang mga serbisyo sa pinulongan alang libre, tawagan sa 1-888-238-6201. (Bisayan-Visayan)

Per accedir a serveis lingüístics sense cap cost per vostè, telefoni al 1-888-238-6201. (Catalan)

Para un hago' i setbision lengguåhi ni dibåtde para hågu, ågang 1-888-238-6201. (Chamorro)

ᏩᎩᏍᏗ ᏚᏬᏂᎯᏍᏗ ᎤᏳᎾᏓᏛᏁᏗ Ꮭ ᎪᎱᏍᏗ ᏗᏣᎬᏩᎳᏁᏗ ᏱᎩ, ᏫᎨᎯᏏᎳᏛᏏ 1-888-238-6201. (Cherokee) Anumpa tohsholi I toksvli ya peh pilla ho ish I paya hinla, I paya 1-888-238-6201. (Choctaw)

Tajaajiiloota afaanii garuu bilisaa ati argaachuuf,bilbili 1-888-238-6201. (Cushite-Oromo)

Voor gratis toegang tot taaldiensten, bell 1-888-238-6201. (Dutch)

Pou jwenn sèvis lang gratis, rele 1-888-238-6201. (French Creole-Haitian)

GR-67853-34 (2-18) B |

Small Group Page 6 of 8 |

Για να επικοινωνήσετε χωρίς χρέωση με το κέντρο υποστήριξης πελατών στη γλώσσα σας, τηλεφωνήστε στον αριθμό 1-888-238-6201. (Greek)

No ka walaʻau ʻana me ka lawelawe ʻōlelo e kahea aku i kēia helu kelepona 1-888-238-6201. Kāki ʻole ʻia kēia kōkua nei. (Hawaiian)

Xav tau kev pab txhais lus tsis muaj nqi them rau koj, hu 1-888-238-6201. (Hmong)

Iji nwetaòhèrè na ọrụ gasị asụsụ n'efu, kpọọ 1-888-238-6201. (Ibo)

Tapno maaksesyo dagiti serbisio maipapan iti pagsasao nga awan ti bayadanyo, tawagan ti 1-888-238-6201. (Ilocano)

Untuk mengakses layanan bahasa tanpa dikenakan biaya, hubungi 1-888-238-6201. (Indonesian) Per accedere ai servizi linguistici, senza alcun costo per lei, chiami il numero 1-888-238-6201 (Italian) 言語サービスを無料でご利用いただくには、1-888-238-6201 までお電話ください。(Japanese)

무료 언어 서비스를 이용하려면 1-888-238-6201 번으로 전화해 주십시오. (Korean)

|

|

|

(Kurdish) .1-888-238-6201 یەرامژ هب هکب یدنەويهپ ،ۆت ۆب نووچێت ێبهب نامز یرازوگتهمزخ هب نتشيهگاڕێپسەد ۆب |

່ |

້ |

|

|

່ |

່ |

|

|

ເພອເຂາໃຊການບລການພາສາໂດຍບເສຍຄາຕກບທານ, ໃຫໂທຫາເບ 1-888-238-6201. (Laotian) |

ື |

ົ |

້ |

ໍິ |

ໍ |

່ ໍັ ່ |

້ |

ີ |

Nan etal nan jikin jiban ikijen Kajin ilo an ejelok onen nan kwe, kirlok 1-888-238-6201. (Marshallese) Pwehn alehdi sawas en lokaia kan ni sohte pweipwei, koahlih 1-888-238-6201. (Micronesian-Pohnpeian)

េដមបទទលបានេសវាកមភាសាែដលឥតគតៃថសរមាបេលាកអកើីួិ សមេហៅទរសពេទៅកាន់ូន័ូេលខ់ 1-888-238-6201 (Mon-Khmer, Cambodian)

Të kɔɔr yïn wɛɛr̈ ̈de thokic ke cïn wëu kɔr keek tënɔŋ yïn. Ke cɔl kɔc ye kɔc kuɔny ne nɔmba 1-888-238-6201. (Nilotic-Dinka)

For tilgang til kostnadsfri språktjenester, ring 1-888-238-6201. (Norwegian)

Um Schprooch Services zu griege mitaus Koscht, ruff 1-888-238-6201. (Pennsylvania Dutch)

GR-67853-34 (2-18) B |

Small Group Page 7 of 8 |

(Persian-Farsi) .ديريگب امت 1-888-238-6201 هرامش اب ،ناگيار روط هب نابز تامدخ هب یسرتسد یارب Aby uzyskać dostęp do bezpłatnych usług językowych proszę zadzwonoć 1-888-238-6201 (Polish)

Para acessar os serviços de idiomas sem custo para você, ligue para 1-888-238-6201. (Portuguese)

Pentru a accesa gratuit serviciile de limbă, apelați 1-888-238-6201. (Romanian)

Для того чтобы бесплатно получить помощь переводчика, позвоните по телефону 1-888-238-6201. (Russian) Mo le mauaina o auaunaga tau gagana e aunoa ma se totogi, vala’au le 1-888-238-6201. (Samoan)

Za besplatne prevodilačke usluge pozovite 1-888-238-6201. (Serbo-Croatian)

Heeba a nasta jangirde djey wolde wola chede bo apelou lamba 1-888-238-6201. (Sudanic-Fulfulde) Kupata huduma za lugha bila malipo kwako, piga 1-888-238-6201. (Swahili)

ܿ |

|

|

ܵ |

ܵܿ |

ܵ |

|

ܵ |

ܿܿ |

ܿ |

ܿ |

|

ܵ |

|

:ܢܘܡܝܪ |

|

|

ܵ |

|

|

|

ܬܝܐܢܓܡ ܐܢܫܠܒ ܐܬܪܝܗܕ ܐ̈ܬܡܠܚ ܠܥ |

ܢܘܬܝ̄ ܐܩܝܢܣ ܢܐ |

|

ܼ |

ܼ |

|

ܼ |

|

ܸ |

|

ܼܼ |

ܹ ܼ ܸ ܼ |

ܼ |

ܼ |

ܸ |

(Syriac-Assyrian) 1-888-238-6201

หากทานตองการเขาถงการบรการทางดานภาษาโดยไมมคาใชจาย่้ ้ ึ ิ ้่ ีโปรดโทร่ ้ 1่-888-238-6201 (Thai)

Kapau ‘oku ke fiema’u ta’etōtōngi ‘a e ngaahi sēvesi kotoa pē he ngaahi lea kotoa, telefoni ki he 1-888-238-6201. (Tongan)

Ren omw kopwe angei aninisin eman chon awewei (ese kamo), kopwe kori 1-888-238-6201. (Trukese) Sizin için ücretsiz dil hizmetlerine erişebilmek için, 1-888-238-6201 numarayı arayın. (Turkish)

Щоб отримати безкоштовний доступ до мовних послуг, задзвоніть за номером 1-888-238-6201. (Ukrainian) (URDU) ۔ںيرک تاب ر .1-888-238-6201 ، ےيل ےک ےنرک لصاح تامدخ ہقلعتم ےس نابز تميقلاب

Nếu quý vị muốn sử dụng miễn phí các dịch vụ ngôn ngữ, hãy gọi tới số 1-888-238-6201. (Vietnamese)

(Yiddish) .1-888-238-6201 ןפור ,ריא וצ זיירפַּ ןייק ןיא ןעגנונידאַב ךאַרפּש ירוצ וצ Lati wọnú awọn isẹ èdè l’ọfẹ fun ọ, pe 1-888-238-6201. (Yoruba)

GR-67853-34 (2-18) B |

Small Group Page 8 of 8 |