When filling out the AFCU 435 form for wire transfers, it’s easy to make mistakes. These errors can delay the process or even result in lost funds. Here are **nine common mistakes** people often make.

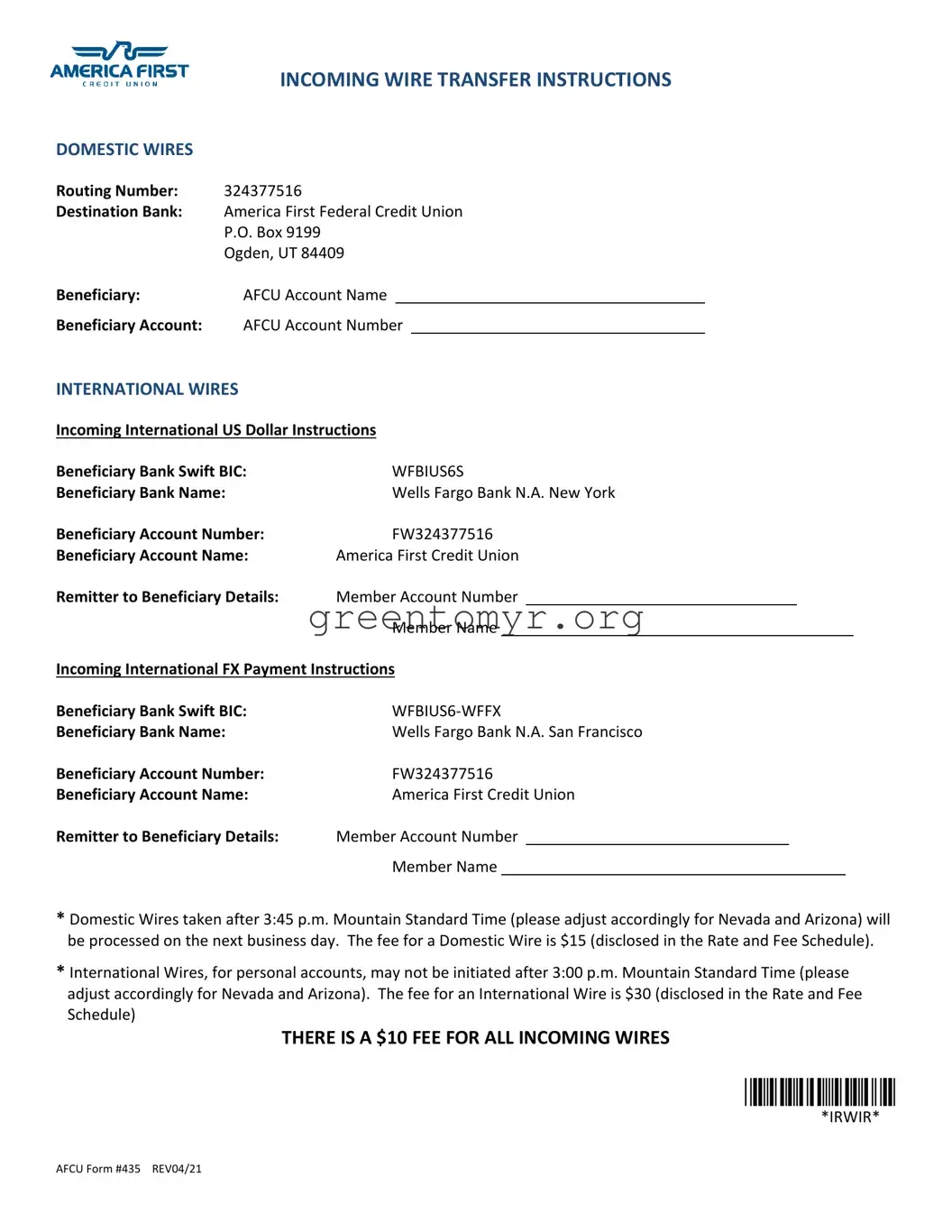

First, many individuals forget to verify the routing number. The correct routing number is 324377516 for domestic wires to America First Federal Credit Union. An incorrect routing number can lead to funds being sent to the wrong bank.

Secondly, not entering the beneficiary account name is a frequent oversight. Be sure to include the AFCU Account Name, as this ensures the funds will be credited correctly to the intended account.

In addition, confusion may arise between domestic and international wire instructions. Always check whether you need to use the domestic routing number or the SWIFT code specific for international wires. Using the wrong instructions can complicate the process.

Another common mistake is neglecting to include the remitter details. Both the member account number and member name are essential for the transfer to be processed smoothly. Omitting this information could delay the transaction.

People often misinterpret the timing requirements for wire transfers. Domestic wires must be initiated before 3:45 p.m. Mountain Standard Time, while international wires have a cutoff of 3:00 p.m. If the request is made after the specified times, it will be processed the next business day.

Many individuals overlook the associated fees. The fees for a domestic wire are $15 and for an international wire, $30. Understanding these costs upfront can help avoid any surprises.

It's also crucial not to ignore the information related to incoming wires. There is a $10 fee for all incoming wires, which is often forgotten. Make sure to account for this to manage expectations regarding any incoming funds.

Lastly, double-check your details for spelling errors or inaccuracies. Small typos can lead to significant issues when transferring money. It’s always wise to review the entire form before submitting.

Taking the time to avoid these common mistakes will help ensure a smoother and more efficient wire transfer process. Clear communication of the necessary information is key to successfully completing the AFCU 435 form.