An Affidavit of Gift form is a legal document that serves as a declaration of a gift given from one person to another. It outlines the details of the gift, including the identities of both the giver and the recipient, the nature of the gift, and the intent of the giver to make the gift without expecting anything in return. This document is often used for significant gifts, such as real estate or large sums of money, and can be helpful in proving that the transfer was indeed a gift, especially in case of tax implications or legal questions.

When should I use an Affidavit of Gift?

You should consider using an Affidavit of Gift in situations where you are giving a substantial gift. Common instances include:

-

Transferring ownership of property

-

Donating large amounts of cash

-

Gifting valuable personal items such as artworks or vehicles

By using this form, you establish clear documentation that the transfer is a gift, which can protect both parties legally in the future.

Who needs to sign the Affidavit of Gift?

Typically, the Affidavit requires signatures from both the donor (the person giving the gift) and the recipient (the person receiving the gift). Depending on jurisdiction, it may also need a witness or notary public to validate the signatures and ensure the legitimacy of the document.

Are there tax implications for gifts documented by an Affidavit of Gift?

Yes, there can be tax implications associated with gifts. In the United States, the IRS has annual gift tax exclusions, which means you can give up to a certain amount each year without having to report it. For gifts that exceed this amount, the donor may need to file a gift tax return. It is advisable to consult with a tax professional to understand these implications fully and ensure compliance with IRS regulations.

Is an Affidavit of Gift legally binding?

Yes, an Affidavit of Gift is a legally binding document once it is signed and acknowledged. It serves as evidence of the donor's intent and the circumstances of the gift. However, if the terms of the gift are not clear or are disputed later, the enforceability may depend on the specific details and local laws. Thus, it's wise to be thorough and precise when completing this form.

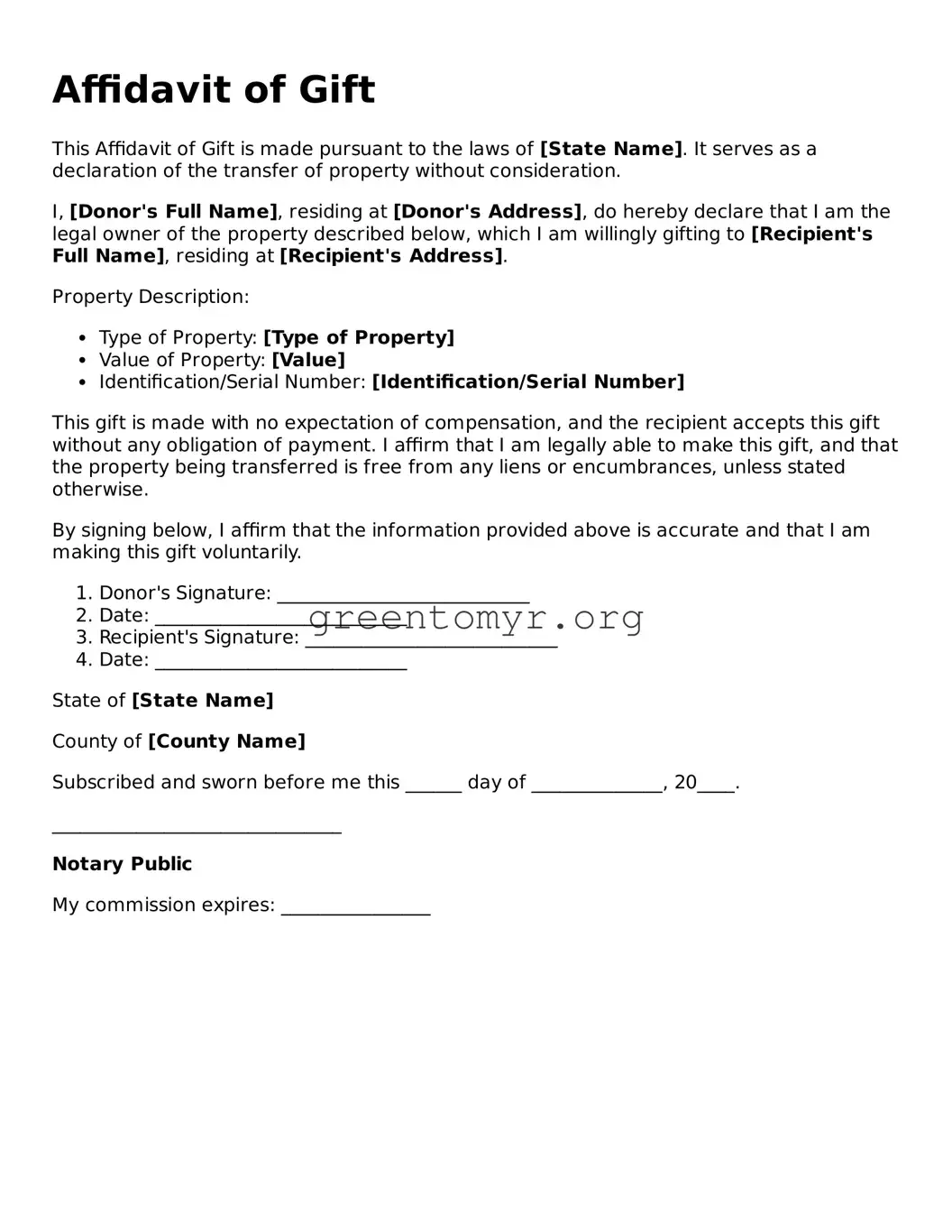

To complete an Affidavit of Gift form, follow these general steps:

-

Provide the legal names and addresses of both the donor and the recipient.

-

Clearly describe the gift, including its value and any identifying details.

-

State the intent, affirming that the gift is made without compensation.

-

Sign the document in the presence of a witness or notary, if required.

Forms can often be obtained from legal resources online or local government offices, but ensure you use a format that meets your state’s requirements.

You can obtain an Affidavit of Gift form from several sources, including:

-

Your local government office, particularly if it's related to property transfers.

-

Online legal document providers that offer customizable templates.

-

Consulting with an attorney who specializes in estate planning or gifts.

It's important to use a form that complies with the laws in your state to ensure validity.