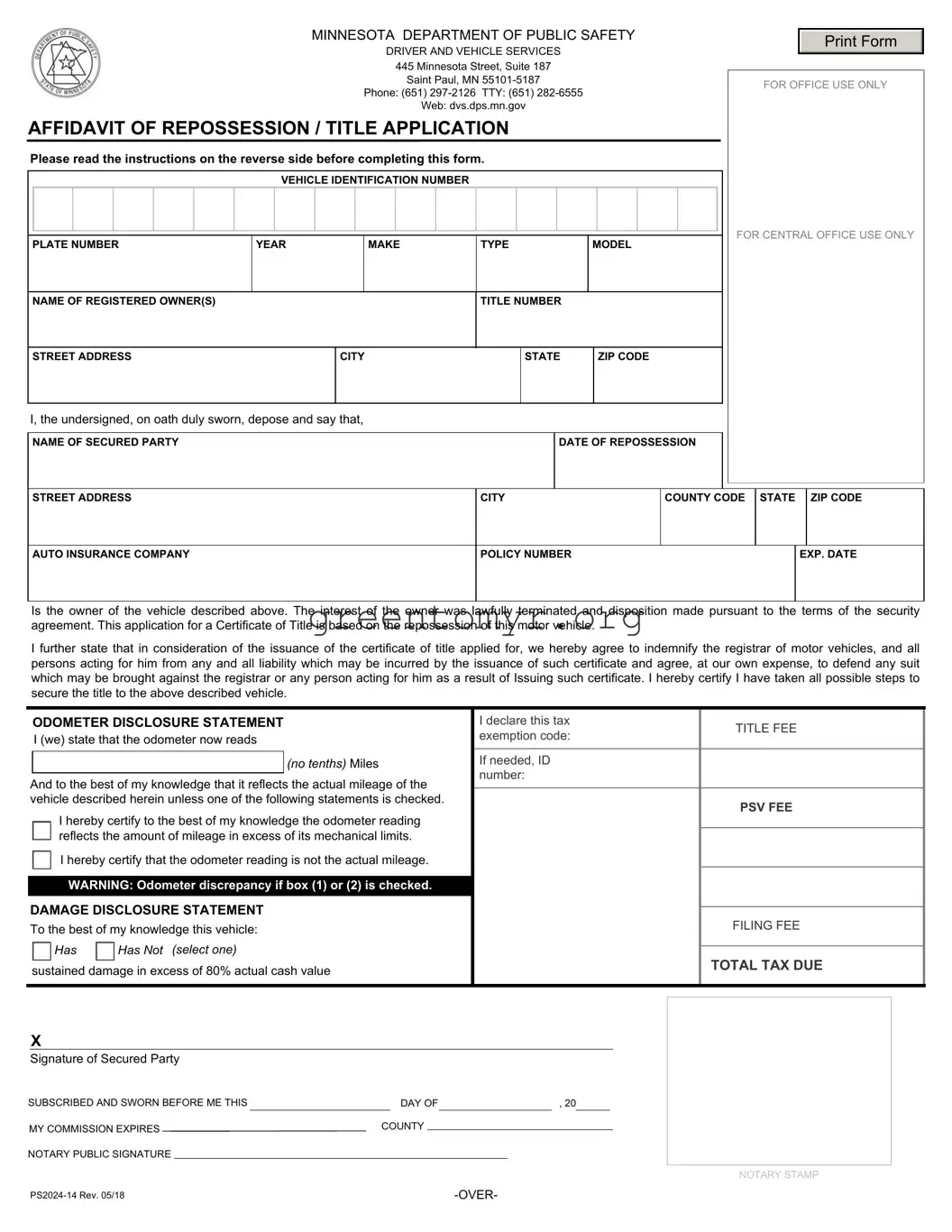

Filling out the Affidavit of Repossession in Minnesota can be straightforward, but people often make mistakes that may delay the process. Understanding these common pitfalls can save time and frustration.

One significant error is failing to include the correct Vehicle Identification Number (VIN). Without a valid VIN, your application may be rejected outright. Double-check that this number matches the one on the vehicle’s title.

Another mistake is incomplete owner information. Ensure that you have the correct names of all registered owners. Leaving any owner's name off the form could complicate the repossession process.

Many people forget to sign the document. The signature of the secured party is crucial for validation. Without it, the application may be considered invalid.

Do not overlook odometer disclosure. Accurately reporting the odometer reading is vital. Failing to provide this information or lying about it can lead to severe legal consequences.

Another common error is not indicating whether the vehicle has sustained damage. The damage disclosure statement must be correctly filled out to avoid misunderstandings and allegations of fraud.

Omitting the necessary fees can lead to delays. Make sure all applicable fees are included with the application. Consult the website or call for guidance if you're unsure of the amounts.

Moreover, people sometimes submit their applications to the wrong office. Ensure you send your form to the designated address for faster processing. Check the instructions to confirm the correct location.

In some cases, individuals forget to provide insurance information. This is critical as it demonstrates that the vehicle is insurable post-repossession. Without this, your application may face scrutiny.

Do not neglect to certify the form properly. Misstatements in your declaration can lead to complications later on. Be truthful and thorough in your disclosures.

Lastly, failing to attach a notary’s signature can cause your application to be rejected. The document must be notarized for it to be legally binding.

Stay vigilant and double-check your form before submission. By avoiding these mistakes, you can ensure a smoother repossession process.

Has

Has  Has Not (select one)

Has Not (select one)