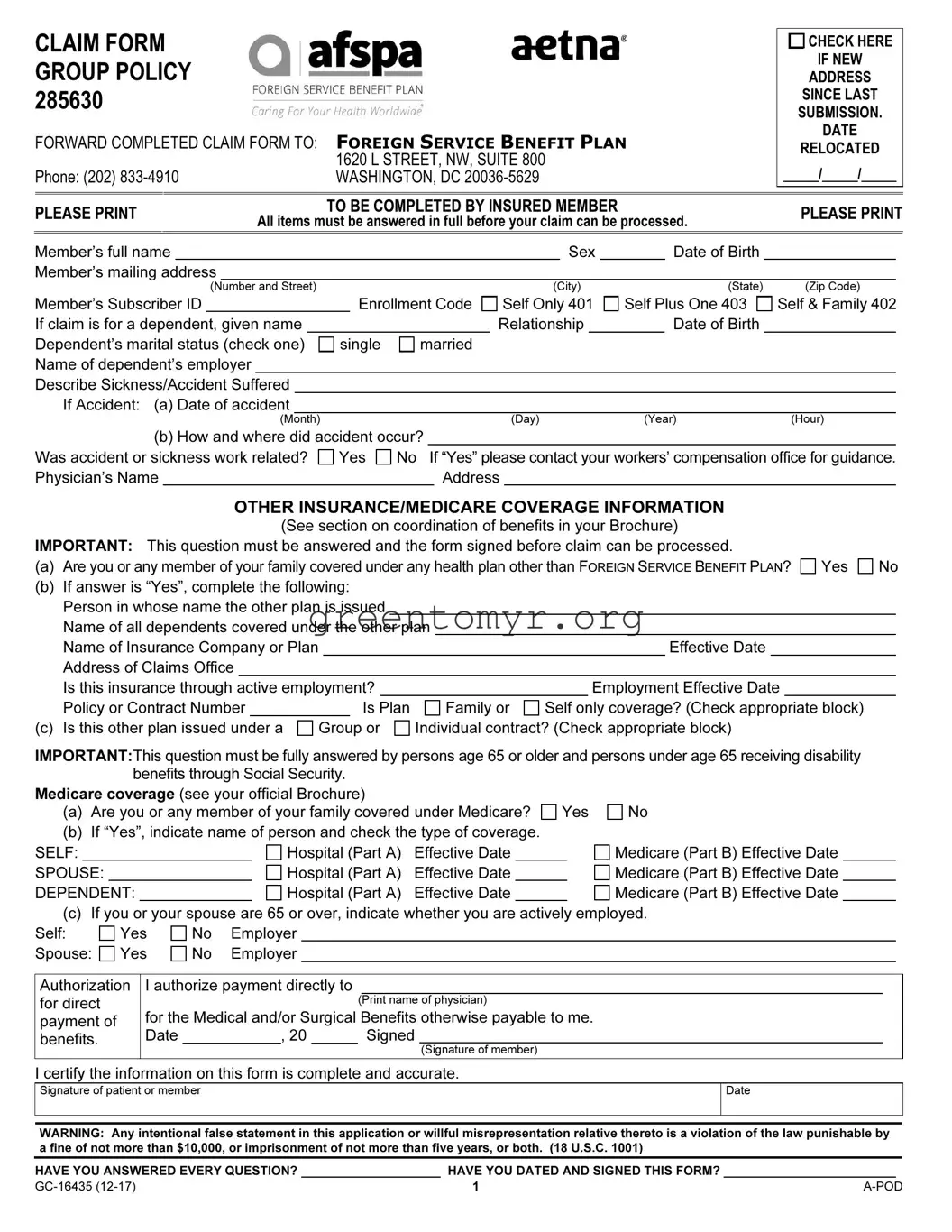

When navigating the intricacies of healthcare claims, the Afspa Claim Form plays a vital role in ensuring that insured members can receive the appropriate medical benefits to which they are entitled. This comprehensive document requires that all necessary details be carefully filled out to facilitate accurate processing of each claim. Key components include personal information about the member, such as their full name, date of birth, and mailing address, alongside specific coverage selections that indicate whether the claim pertains to an individual or their family. Details regarding the sickness or accident, including date and circumstances, must also be documented clearly. Additionally, the form integrates important inquiries related to other insurance coverage, ensuring that any duplicate coverage is accounted for and properly coordinated. Another essential area of focus on the form is Medicare information, particularly for those aged 65 or over, prompting clear disclosure to streamline benefit payments. Finally, an authorization for direct payment to healthcare providers strengthens the processing of claims, while a warning against false statements underscores the importance of accuracy and honesty in completing the documentation. By carefully reviewing and fulfilling each section, members can ensure a smoother claims experience.

Yes

Yes

No Physician’s Name

No Physician’s Name

Y

Y

N

N