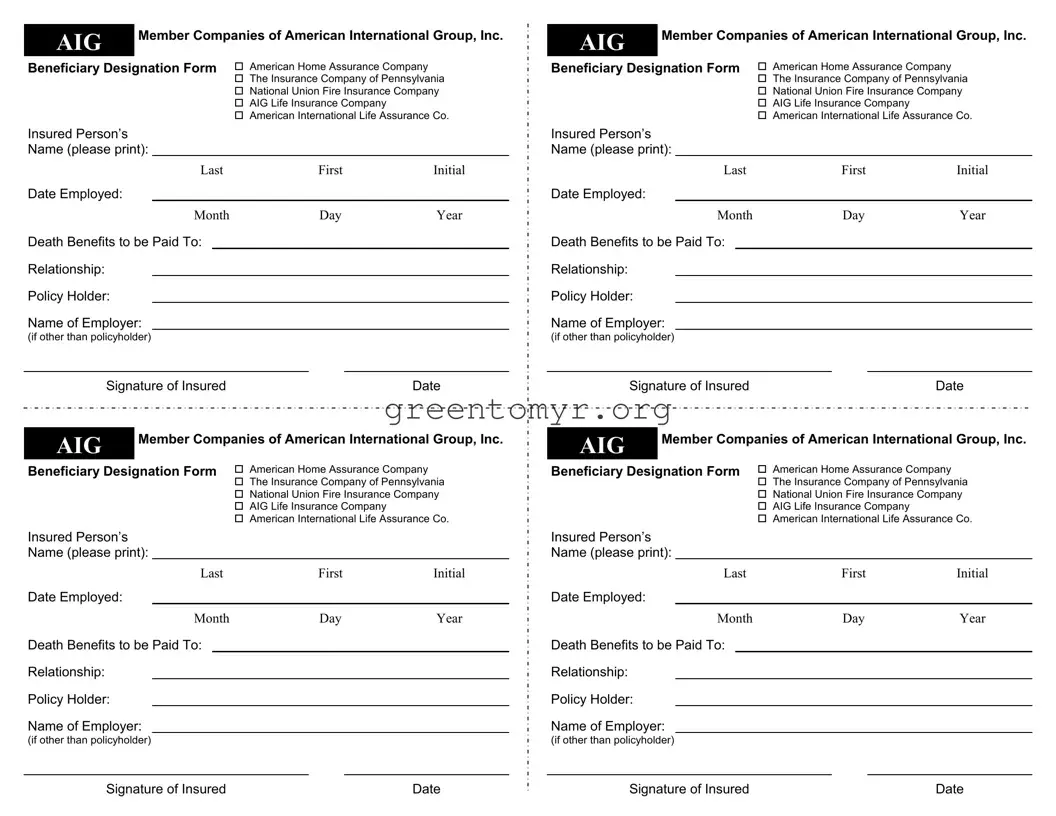

Filling out the AIG Beneficiary Designation form can seem straightforward, but many people make common mistakes that can complicate matters later on. One frequent error is not clearly printing the name of the insured person. When names are unclear or illegible, it creates confusion that may delay the processing of claims. Always take time to print each letter carefully to avoid misunderstandings.

Another mistake people often make is failing to update the form following significant life events. Marriages, divorces, and births can change who should receive benefits. Forgetting to update this information may lead to unintended beneficiaries receiving funds, which can cause family disputes and legal complications.

Additionally, individuals may inadvertently list the wrong relationship to the insured. It is important to specify the correct relationship clearly. This clarity ensures that the insurance company understands the intent, and it helps avoid confusion during the claims process.

Leaving sections of the form incomplete is another common mistake. Each blank serves a purpose, and skipping information could cause the form to be rejected or delayed. Ensure that all required fields are filled in before submitting the form.

Moreover, some may not sign the form correctly. A signature is a critical part of the process. It affirms that the insured agrees to the listed beneficiaries. Neglecting to sign, or signing in a different name than what is printed, can render the form invalid.

People also often overlook providing information about their employer. If the policy is through an employer, failing to mention the correct employer's name may lead to complications when processing claims. Providing accurate information helps in the timely distribution of benefits.

Misunderstanding the beneficiary designation types is yet another common issue. Some individuals may not realize they can designate more than one beneficiary or that they can specify percentages for each. This misunderstanding can lead to conflicts or incorrect distributions of benefits, which are best avoided with clear instructions on the form.

Finally, procrastinating in filling out and submitting the form can be detrimental. People often believe they can complete this task later, but delays can result in missed opportunities to update beneficiaries when necessary. It is prudent to handle this matter as soon as possible to ensure peace of mind and clear intentions in the event of unforeseen circumstances.