Misconception 1: The Alabama Child Support Sheet form is only for cases involving custody disputes.

This form applies to any situation where child support needs to be determined, regardless of whether custody is contested.

Misconception 2: Only the primary custodial parent fills out the Alabama Child Support Sheet form.

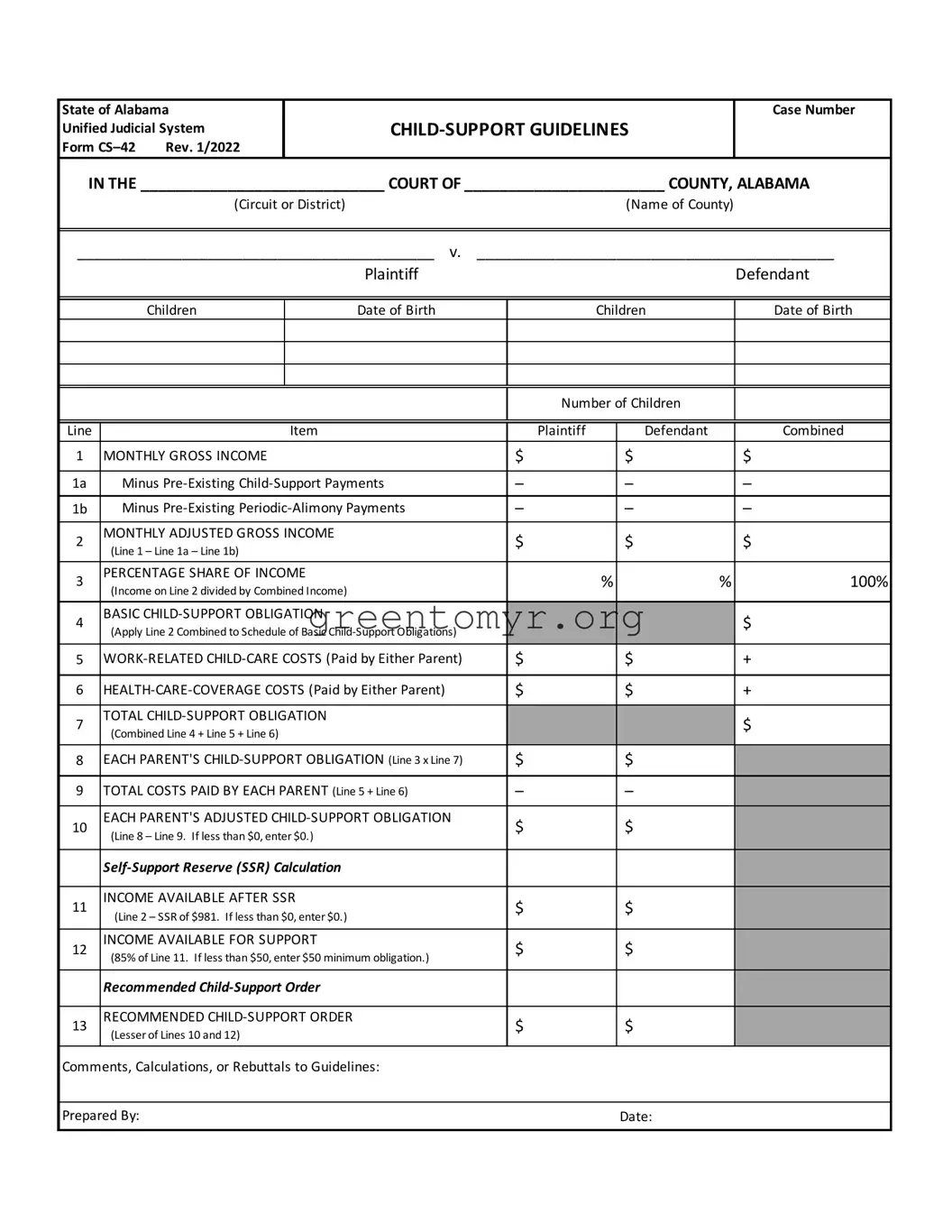

Both parents are required to provide their financial information to accurately calculate child support obligations.

Misconception 3: All forms of income must be reported in the same way.

Different types of income can be reported differently. It’s important to follow the guidelines for how each type should be documented.

Misconception 4: Pre-existing child support payments are not considered in the calculation.

Pre-existing child support payments must be accounted for, as they will affect the calculated adjusted gross income.

Misconception 5: Only the highest-earning parent pays child support.

Child support obligations are based on both parents’ incomes, so the non-custodial parent might not be the only one who has financial responsibilities.

Misconception 6: The form automatically determines child support without any parental input.

The form requires detailed information from both parents. Accurate input is critical to getting a fair calculation.

Misconception 7: Once completed, the Child Support Sheet is unchangeable.

Parties can revisit and adjust the sheet if there are significant changes in income or circumstances after the initial filing.

Misconception 8: The Child Support Order is final and cannot be modified.

Child support orders can be modified if there has been a substantial change in circumstances affecting either parent’s financial situation.

Misconception 9: The Child Support Sheet is only required for divorcing couples.

This form is necessary in various scenarios, including paternity cases and separations, regardless of marital status.