Filling out a Durable Power of Attorney (DPOA) form in Alabama can be an important step in planning for the future. However, several common mistakes can occur throughout the process. Understanding these pitfalls can help ensure that your DPOA accurately reflects your intentions and fulfills your needs.

One of the frequent errors is failing to specify the powers granted. The DPOA allows you to designate someone to act on your behalf, but not detailing the extent of these powers can lead to confusion later. For instance, you might intend for your agent to manage your financial affairs but fail to expressly mention it. Leaving such details vague can create unnecessary complications when that person needs to act.

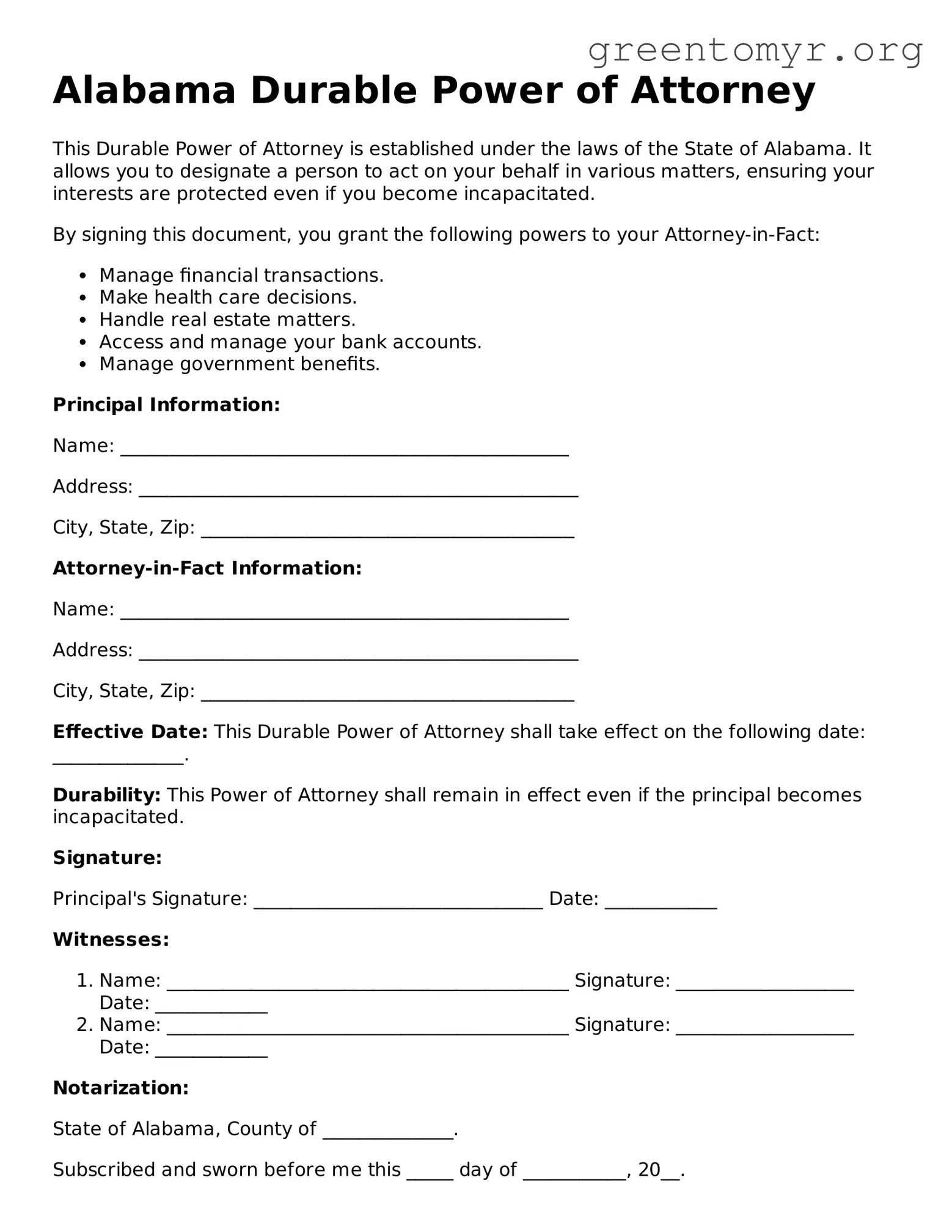

Many individuals neglect to ensure that the form is properly signed and witnessed. In Alabama, specific signing requirements exist to make the DPOA valid. If you skip this step or have unwitnessed signatures, your document may be deemed not legally binding, leaving your plans unprotected. Always check that your form complies with these requirements.

Another common mistake revolves around not naming a successor agent. Life can be unpredictable, and if your primary agent is unable to act for any reason—such as illness or unavailability—a successor ensures your wishes still can be executed. Failing to name an alternative can leave you vulnerable if an emergency arises.

Additionally, people often forget to update their DPOA. Major life events—like marriage, divorce, or the passing of an agent—can significantly affect the document's relevance. Regularly reviewing and updating your DPOA keeps it aligned with your current circumstances and relationships.

Some individuals may assume they can create a DIY DPOA from the internet without understanding the legal nuances involved. While template resources can be helpful, they may not meet Alabama’s specific legal standards. Consulting with a legal professional ensures that your form is effectively constructed and legally sound.

Another mistake involves not properly communicating the existence of the DPOA. Even if you’ve filled it out correctly, if your loved ones or the appointed agent aren’t aware of it, they might struggle in times of need. Sharing the location of the document and informing those involved can make a considerable difference in an emergency.

A less obvious mistake is neglecting to consider who should be appointed as the agent. It’s crucial to select someone who is trustworthy, responsible, and capable of handling the responsibilities they will assume. Relying on family dynamics alone may not lead to the best choice, so thoughtful consideration is necessary.

Additionally, people sometimes underestimate the importance of clarity in their instructions. Generic instructions can lead to confusion and disagreement among family members, especially during emotionally charged situations. Clear, specific guidance will help ensure your wishes are honored as intended.

Lastly, failing to keep a signed copy of the DPOA is a critical oversight. If only you hold the original, it could get lost or damaged, rendering your wishes difficult to enforce. Providing copies to your agent and any relevant financial institutions protects your intentions and facilitates smoother execution.

Taking the time to avoid these mistakes will contribute to creating a well-thought-out Durable Power of Attorney. By ensuring accuracy and clarity, you can have peace of mind knowing that your future wishes are set in motion.