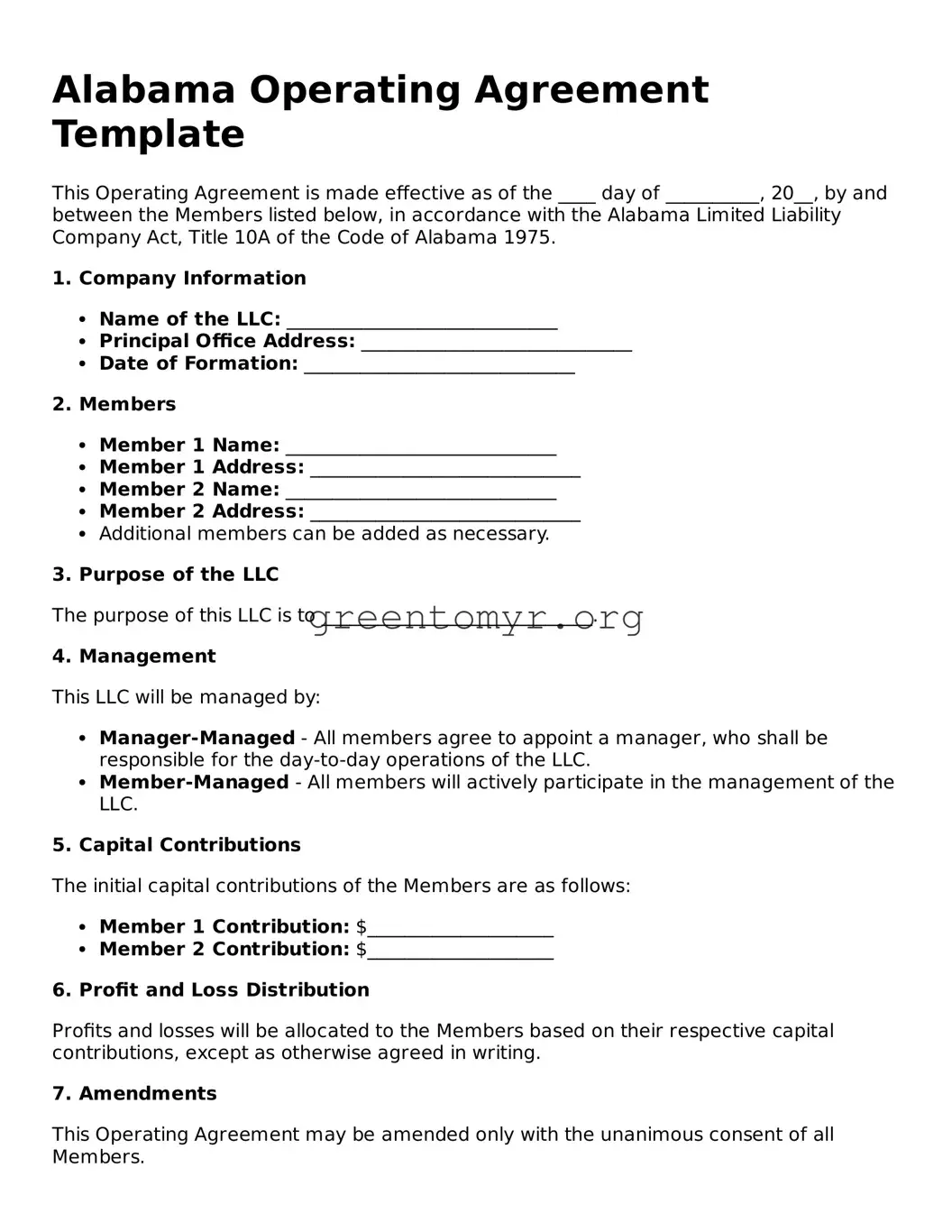

Alabama Operating Agreement Template

This Operating Agreement is made effective as of the ____ day of __________, 20__, by and between the Members listed below, in accordance with the Alabama Limited Liability Company Act, Title 10A of the Code of Alabama 1975.

1. Company Information

- Name of the LLC: _____________________________

- Principal Office Address: _____________________________

- Date of Formation: _____________________________

2. Members

- Member 1 Name: _____________________________

- Member 1 Address: _____________________________

- Member 2 Name: _____________________________

- Member 2 Address: _____________________________

- Additional members can be added as necessary.

3. Purpose of the LLC

The purpose of this LLC is to _____________________________.

4. Management

This LLC will be managed by:

- Manager-Managed - All members agree to appoint a manager, who shall be responsible for the day-to-day operations of the LLC.

- Member-Managed - All members will actively participate in the management of the LLC.

5. Capital Contributions

The initial capital contributions of the Members are as follows:

- Member 1 Contribution: $____________________

- Member 2 Contribution: $____________________

6. Profit and Loss Distribution

Profits and losses will be allocated to the Members based on their respective capital contributions, except as otherwise agreed in writing.

7. Amendments

This Operating Agreement may be amended only with the unanimous consent of all Members.

8. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Alabama.

9. Signatures

By signing below, the Members agree to the terms of this Operating Agreement:

- _________________________ (Member 1 Signature) Date: _______________

- _________________________ (Member 2 Signature) Date: _______________

- _________________________ (Additional Member Signature) Date: _______________

End of Agreement