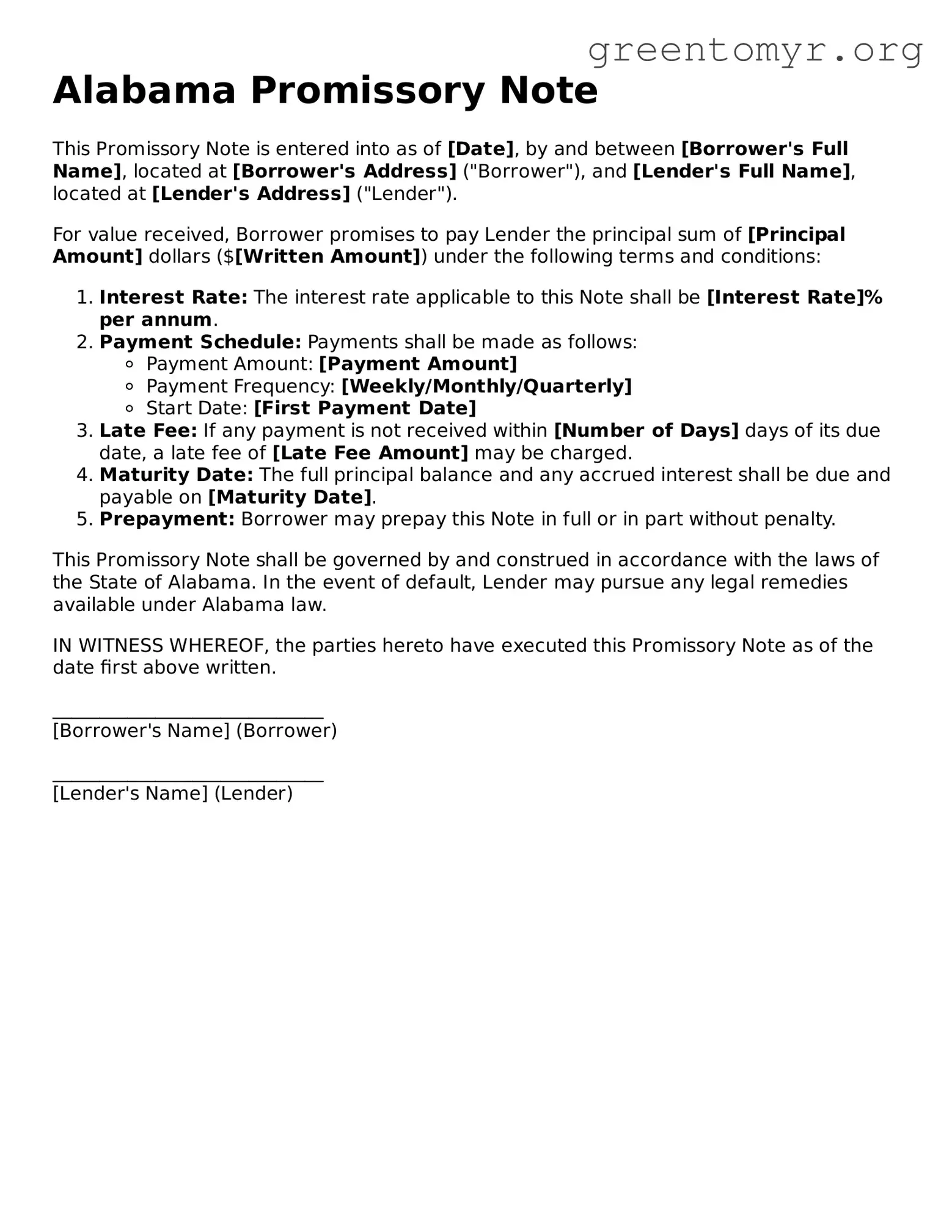

Alabama Promissory Note

This Promissory Note is entered into as of [Date], by and between [Borrower's Full Name], located at [Borrower's Address] ("Borrower"), and [Lender's Full Name], located at [Lender's Address] ("Lender").

For value received, Borrower promises to pay Lender the principal sum of [Principal Amount] dollars ($[Written Amount]) under the following terms and conditions:

- Interest Rate: The interest rate applicable to this Note shall be [Interest Rate]% per annum.

- Payment Schedule: Payments shall be made as follows:

- Payment Amount: [Payment Amount]

- Payment Frequency: [Weekly/Monthly/Quarterly]

- Start Date: [First Payment Date]

- Late Fee: If any payment is not received within [Number of Days] days of its due date, a late fee of [Late Fee Amount] may be charged.

- Maturity Date: The full principal balance and any accrued interest shall be due and payable on [Maturity Date].

- Prepayment: Borrower may prepay this Note in full or in part without penalty.

This Promissory Note shall be governed by and construed in accordance with the laws of the State of Alabama. In the event of default, Lender may pursue any legal remedies available under Alabama law.

IN WITNESS WHEREOF, the parties hereto have executed this Promissory Note as of the date first above written.

_____________________________

[Borrower's Name] (Borrower)

_____________________________

[Lender's Name] (Lender)