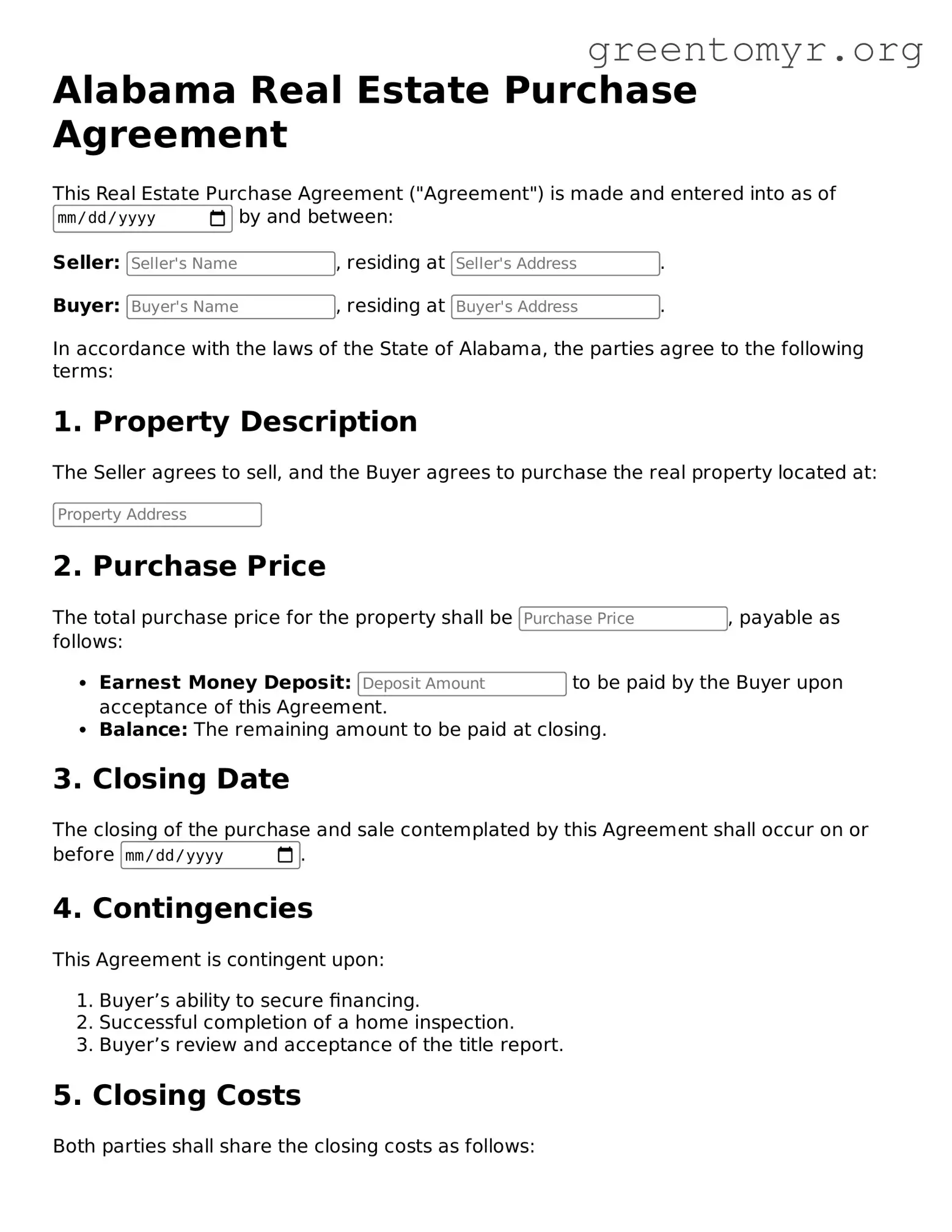

Real Estate Purchase Agreement Form for the State of Alabama

The Alabama Real Estate Purchase Agreement is a crucial document used in property transactions, outlining the terms and conditions between a buyer and seller. This form ensures that both parties have a clear understanding of the purchase details, including price, contingencies, and closing dates. Ready to get started? Fill out the form by clicking the button below.