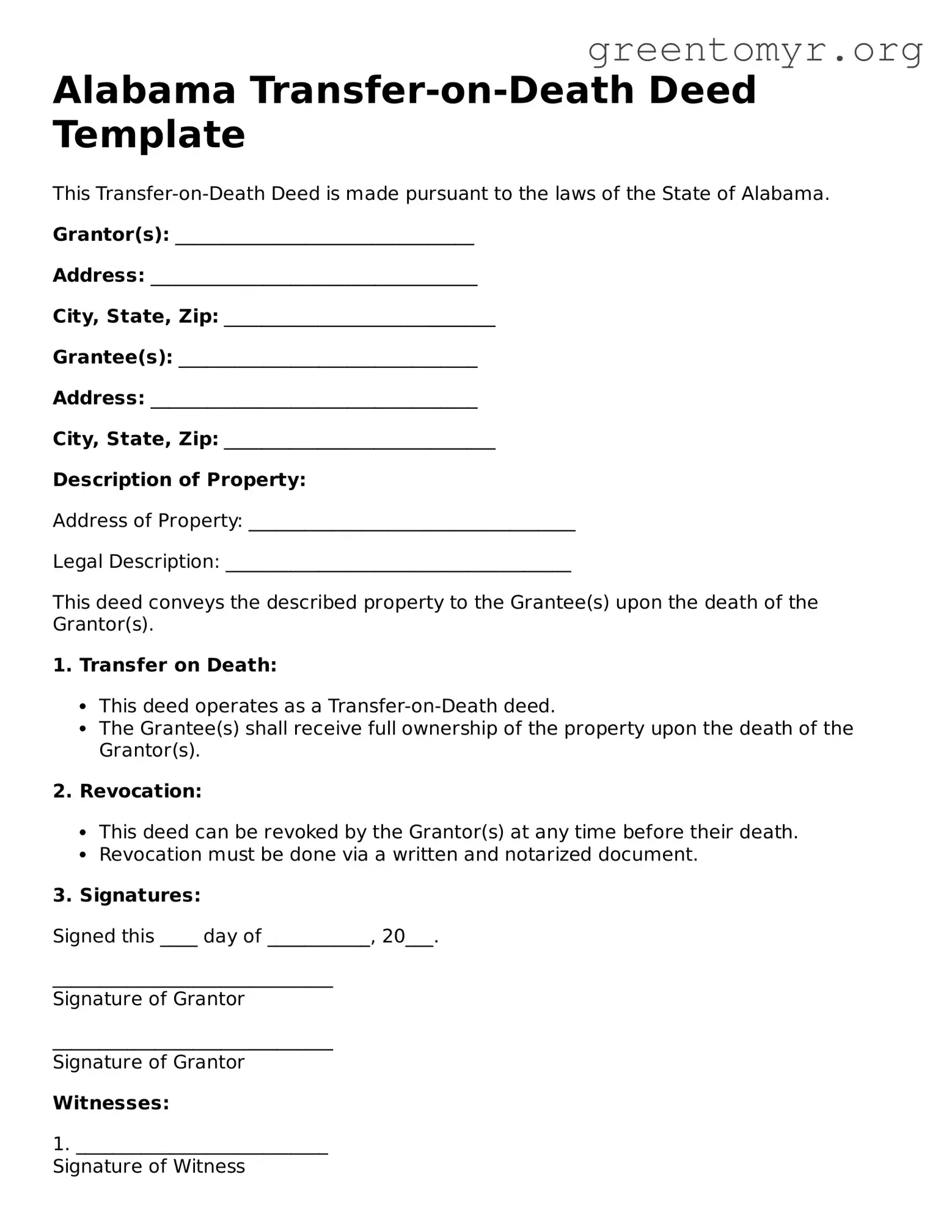

Alabama Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made pursuant to the laws of the State of Alabama.

Grantor(s): ________________________________

Address: ___________________________________

City, State, Zip: _____________________________

Grantee(s): ________________________________

Address: ___________________________________

City, State, Zip: _____________________________

Description of Property:

Address of Property: ___________________________________

Legal Description: _____________________________________

This deed conveys the described property to the Grantee(s) upon the death of the Grantor(s).

1. Transfer on Death:

- This deed operates as a Transfer-on-Death deed.

- The Grantee(s) shall receive full ownership of the property upon the death of the Grantor(s).

2. Revocation:

- This deed can be revoked by the Grantor(s) at any time before their death.

- Revocation must be done via a written and notarized document.

3. Signatures:

Signed this ____ day of ___________, 20___.

______________________________

Signature of Grantor

______________________________

Signature of Grantor

Witnesses:

1. ___________________________

Signature of Witness

2. ___________________________

Signature of Witness

Notary Public:

State of Alabama

County of ____________________

Subscribed and sworn before me this ____ day of ___________, 20___.

______________________________

Notary Public

My Commission Expires: _______________