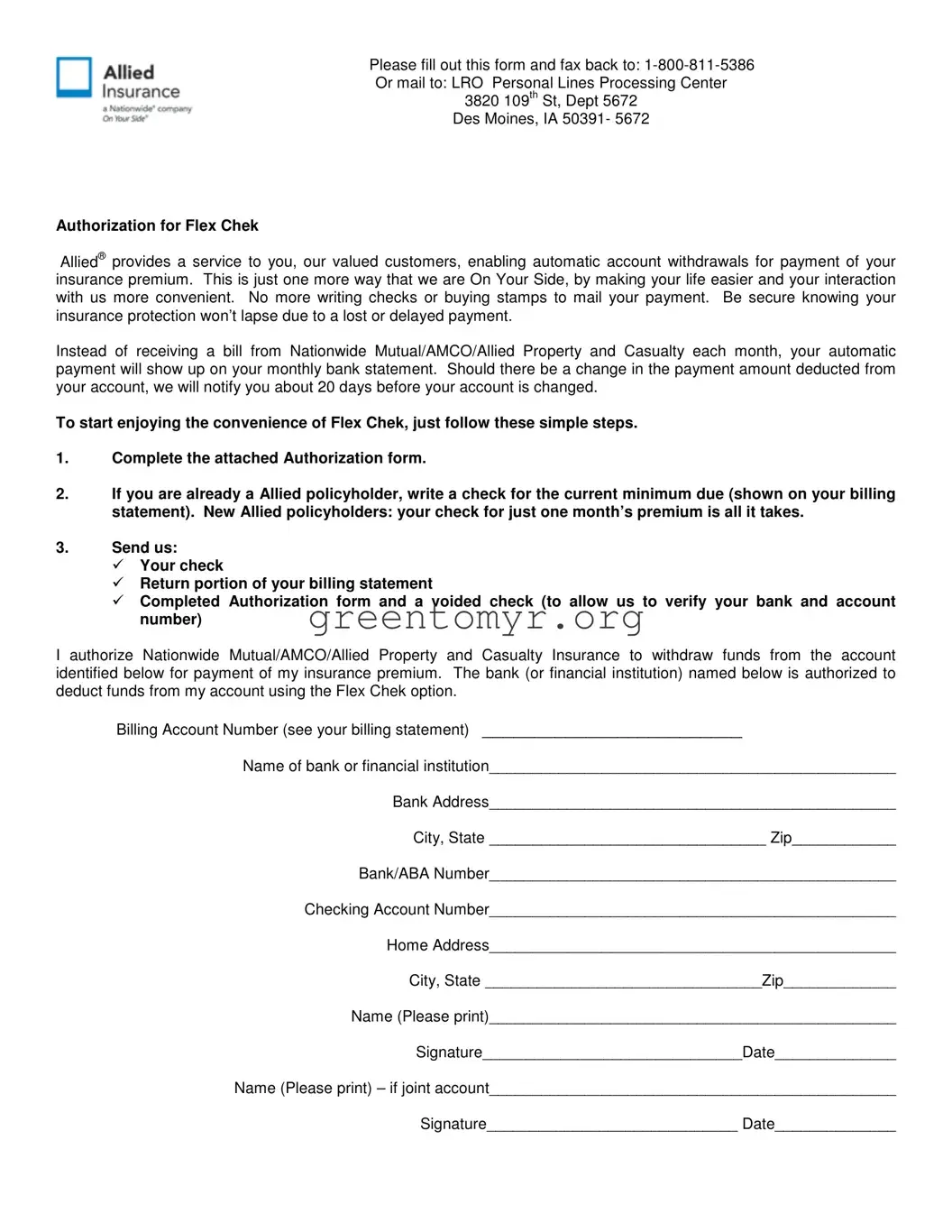

Please fill out this form and fax back to: 1-800-811-5386 Or mail to: LRO Personal Lines Processing Center

3820 109th St, Dept 5672

Des Moines, IA 50391- 5672

Authorization for Flex Chek

Allied® provides a service to you, our valued customers, enabling automatic account withdrawals for payment of your insurance premium. This is just one more way that we are On Your Side, by making your life easier and your interaction with us more convenient. No more writing checks or buying stamps to mail your payment. Be secure knowing your insurance protection won’t lapse due to a lost or delayed payment.

Instead of receiving a bill from Nationwide Mutual/AMCO/Allied Property and Casualty each month, your automatic payment will show up on your monthly bank statement. Should there be a change in the payment amount deducted from your account, we will notify you about 20 days before your account is changed.

To start enjoying the convenience of Flex Chek, just follow these simple steps.

1.Complete the attached Authorization form.

2.If you are already a Allied policyholder, write a check for the current minimum due (shown on your billing statement). New Allied policyholders: your check for just one month’s premium is all it takes.

3.Send us:

Your check

Return portion of your billing statement

Completed Authorization form and a voided check (to allow us to verify your bank and account number)

I authorize Nationwide Mutual/AMCO/Allied Property and Casualty Insurance to withdraw funds from the account identified below for payment of my insurance premium. The bank (or financial institution) named below is authorized to deduct funds from my account using the Flex Chek option.

Billing Account Number (see your billing statement) _________________________

Name of bank or financial institution_______________________________________________

Bank Address_______________________________________________

City, State ________________________________ Zip____________

Bank/ABA Number_______________________________________________

Checking Account Number_______________________________________________

Home Address_______________________________________________

City, State ________________________________Zip_____________

Name (Please print)_______________________________________________

Signature______________________________Date______________

Name (Please print) – if joint account_______________________________________________

Signature_____________________________ Date______________