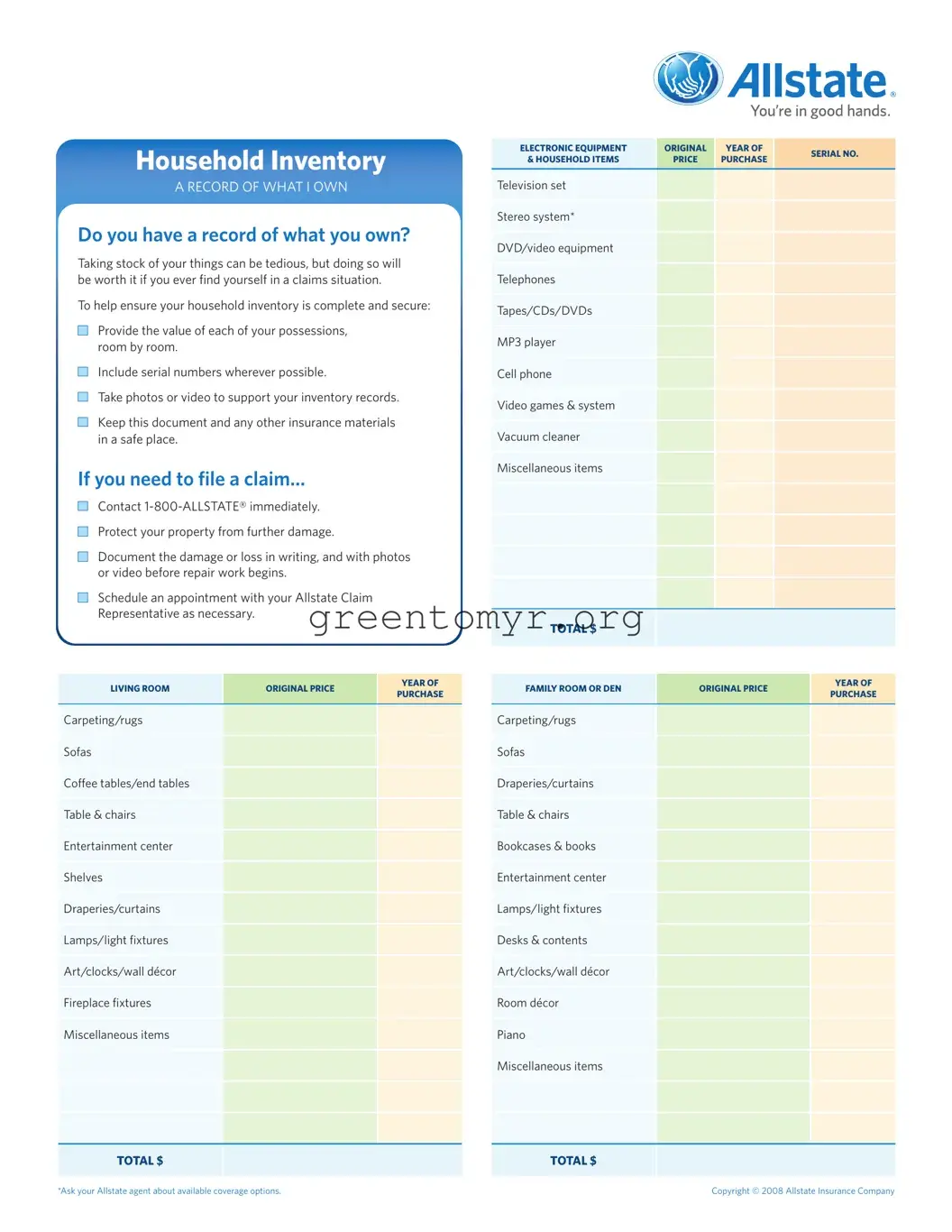

When completing the Allstate Inventory form, it's easy to make mistakes that could affect your insurance claims in the future. One common error is failing to include serial numbers for electronic items. Without these numbers, it becomes challenging to verify ownership, which can complicate the claims process.

Another frequent mistake involves underestimating the value of possessions. Many people might forget that their items appreciate or depreciate over time. Providing the original purchase price without considering current value could lead to inadequate coverage.

Some individuals neglect to photograph or video record their belongings. Visual documentation is crucial, especially during claims. If a loss occurs, having a visual record of your possessions can help expedite the claims process and substantiate your inventory.

A significant oversight occurs when individuals don't complete the inventory room by room. Treating the inventory as a single, large list can lead to missed items or overlapping information. A structured approach ensures that nothing is overlooked.

Additionally, people sometimes forget to keep the inventory document secure. It's essential to store this information in a safe place, preferably both digitally and physically, to ensure easy access when necessary.

Some individuals might rush through the inventory, not taking the time to double-check or verify their information. This haste can lead to inaccuracies, making it harder to file a claim later. It's vital to review the completed form carefully. Ensure all details are accurate before finalizing the inventory.

Another mistake is failing to update the inventory regularly. Over time, possessions can change, and new items can be acquired. Not updating the inventory can result in significant gaps in coverage, especially for high-value items.

In some cases, people mistakenly think they do not need to include miscellaneous items. Every item counts, no matter how small. These items can add up in value, so don't overlook them.

Lastly, individuals often forget to note additional coverage options available for certain items. Consulting with your Allstate agent can provide insight on how to best protect valuable possessions that require special consideration. Investing time in understanding these options can make a significant difference in your coverage.