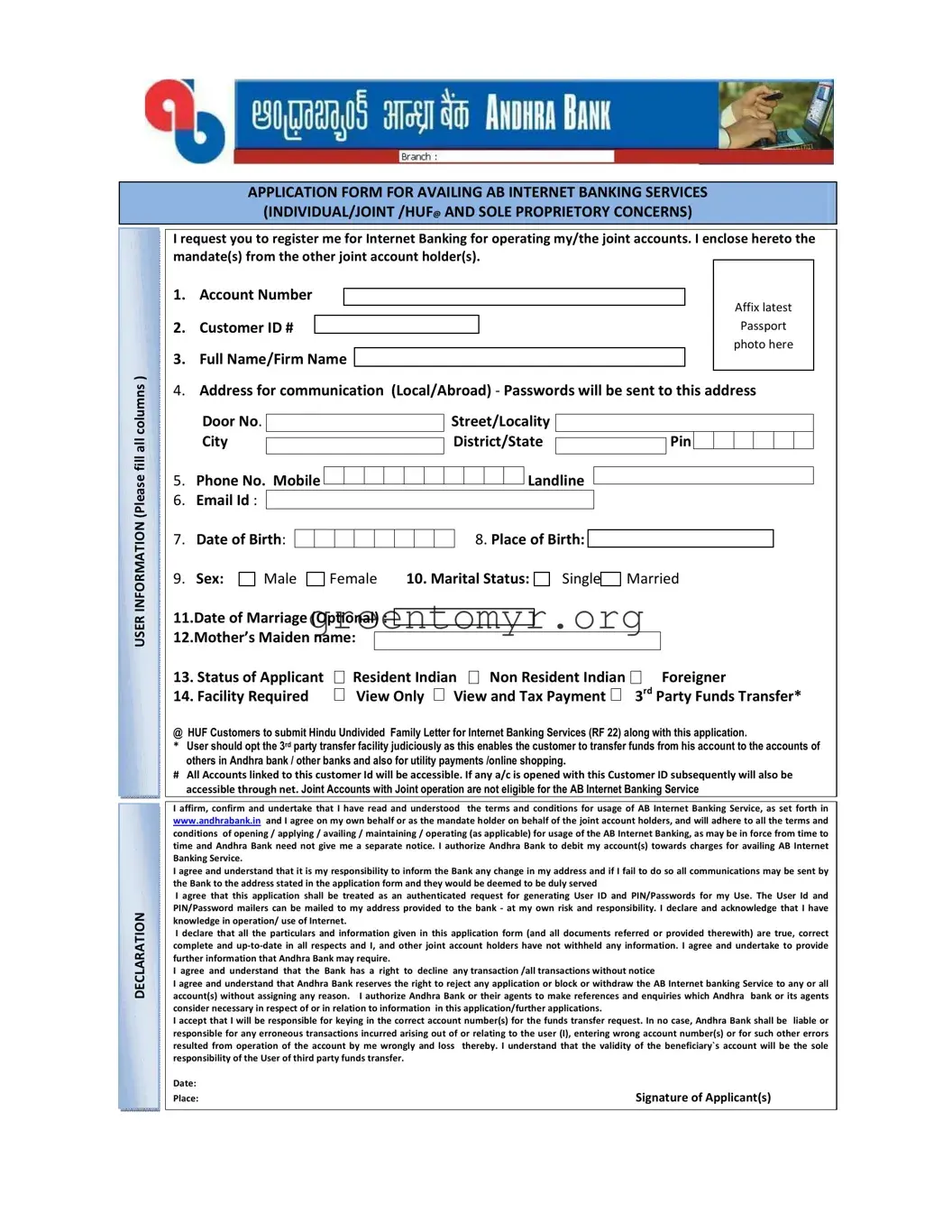

I/we hereby declare that I/we am/are a non-resident Indian of Indian Nationality/origin. I/we confirm that all debits to my/our accounts for the purpose of investment in India and credits representing sale proceeds of investments in India are covered either by general or special permission of Reserve Bank of India. I/we further undertake and declare that any request made by me/us through AB Internet Banking Service for transfer of funds shall be for the approved bonafide transactions of domestic nature only and in any event such request will not be in contravention to the various regulations framed under Foreign Exchange Management Act 1999, Foreign Exchange Management (Deposit) Regulations 2000 and other rules and regulations laid down by Reserve Bank of India including Exchange Control Regulations.

Date:

Place: |

Signature of Applicants(s) |

I/we undersigned declare that the said First Joint holder has submitted an application for availing AB Internet Banking Service from your bank in respect of the account(s) applied in the application. I/we hereby authorize the said First Joint holder to view/access and conduct operations in the said accounts(s) for and on my/our behalf.

I/ we confirm/affirm and undertake that I/We have read and understood the terms and conditions for usage of the AB Internet Banking Services, as displayed on the website www.andhrabank.in and that I/we agree to abide by them.

Names of Joint Account Holder(s)Signatures of Joint Account holder(s) 1.

2._______________________________________________________________________________________

Note:For every addition of new Jt account, a separate annexure-II specified in Cir No.304 dt.15.12.09 is to be obtained.

I have verified the application and the records and confirm that the applicant is

An Individual and sole holder of the account

An Individual and a First Joint holder of the joint account – operated not jointly but as:

Either or Survivor |

Former or Survivor |

Anyone Singly or Survivor |

Applicant is the Sole Proprietor and holder of the account

Karta of HUF Account

I have also verified and I hereby confirm that KYC Norms are fulfilled completely for the account(s) linked to this customer Id mentioned in the application form. I have also verified the signature of the applicant with his specimen signature available on

records and found in order. |

|

Date: |

Signature of Verifying Officer |

____________________________________________________________________________________________________________

Permitted to Register the Application Form for availing the AB Infi-Net Internet banking Services.

Date:Signature of Branch Head

Receipt of Acknowledgement from the applicant

Acknowledgement-cum-User ID Intimation Slip (Individual Internet Account) received on ______________

Date: _______________ |

Signature of the applicant |

Landline

Landline

Male

Male

Female

Female

Single

Single

(Please fill 8 digit customer Id of the account applied by the customer for net facility)

(Please fill 8 digit customer Id of the account applied by the customer for net facility)