What is the Annual Credit Report and why should I request it?

The Annual Credit Report is a document that summarizes your credit history, providing insights into your borrowing behavior, payment history, and outstanding debts. By law, you are entitled to receive one free credit report each year from each of the three major credit reporting companies: Equifax, Experian, and TransUnion. Regularly reviewing your credit report helps you ensure its accuracy and identify any discrepancies or potential fraudulent activities.

How can I obtain my Annual Credit Report?

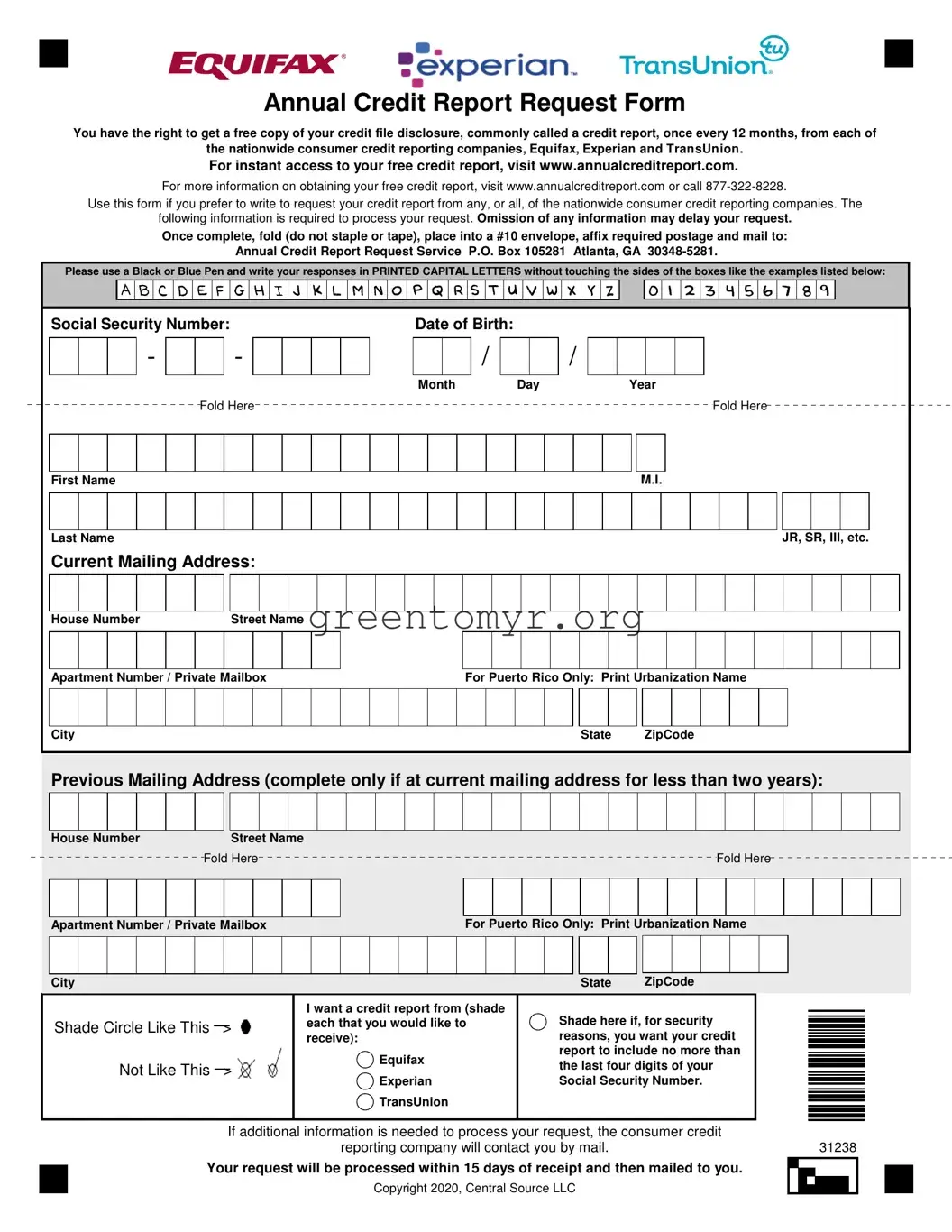

You can obtain your Annual Credit Report easily in several ways. The most streamlined method is to visit

www.annualcreditreport.com

, where you can access your reports instantly. Alternatively, if you prefer a more traditional approach, you can use a written request form. Fill out the Annual Credit Report Request Form with the required information, and mail it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

Be sure to use a black or blue pen and print clearly so that your request is processed without any delays.

To process your request efficiently, you need to provide specific personal information. This includes:

-

Your Social Security Number

-

Your date of birth

-

Your full name, including any suffixes (like Jr. or Sr.)

-

Your current mailing address

-

Your previous mailing address if you have lived at your current address for less than two years

It is vital to provide accurate information because missing details may result in delays.

What if I want to request reports from all three credit reporting companies?

If you want to receive a credit report from Equifax, Experian, and TransUnion simultaneously, simply shade the corresponding boxes on the request form. This ensures that your request covers reports from all three companies without needing to submit separate requests.

How long does it take to receive my credit report?

Your request will be processed within 15 days from the day it is received. After processing, your credit report will be mailed directly to your address as specified in your request. If there are any issues or additional information is needed, the credit reporting company will reach out to you by mail.

What if I find an error on my credit report?

If you discover any inaccuracies in your credit report, it is important to act quickly. You should contact the credit reporting company directly to dispute the information. Provide any necessary documentation to support your case. The company is obliged to investigate your claim and will inform you of the results, typically within 30 days.

Can I request my credit report by phone?

Yes, you can request your credit report by calling toll-free at 877-322-8228. However, using the online method or the written request form may be more convenient and ensure that you can easily verify the information you provide. Always ensure that you have your personal information ready before making your call.