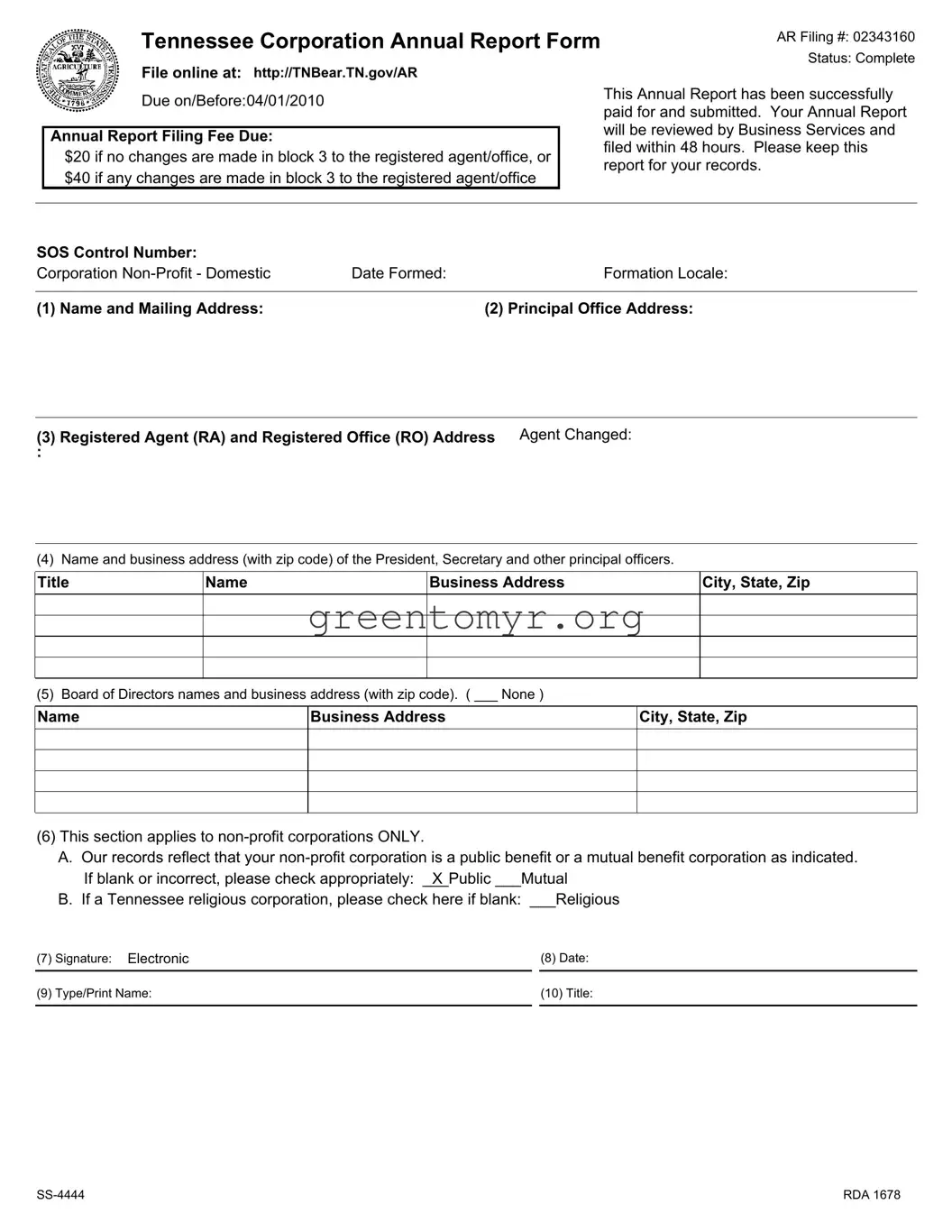

The Annual Report form is a crucial document for corporations operating in Tennessee. Filed annually, it ensures compliance with state requirements and maintains the corporation's good standing. Completing this form involves several key components: the filing number, status, and due date, which in this case is April 1, 2010. A standard fee of $20 applies if no changes are made regarding the registered agent or office. Any adjustments will increase this fee to $40. Additionally, after submission, the report undergoes a review by Business Services and should be processed within 48 hours. It's essential to retain a copy for your records. The form requests detailed information, including the corporation's name and mailing address, the principal office address, and the registered agent and office information. Identifying the corporation's key personnel is also necessary, with sections for the president, secretary, and other principal officers. If applicable, information about the board of directors must be provided as well. Non-profit corporations must declare their classification as either public benefit or mutual benefit and may indicate their religious status if pertinent. Lastly, the form requires an electronic signature, date, printed name, and title of the signer, completing the essential requirements for filing the Annual Report.