When completing the Anz Telegraphic Transfer form, individuals often make several common mistakes that can lead to delays or complications. Understanding these errors can help ensure a smoother transaction process.

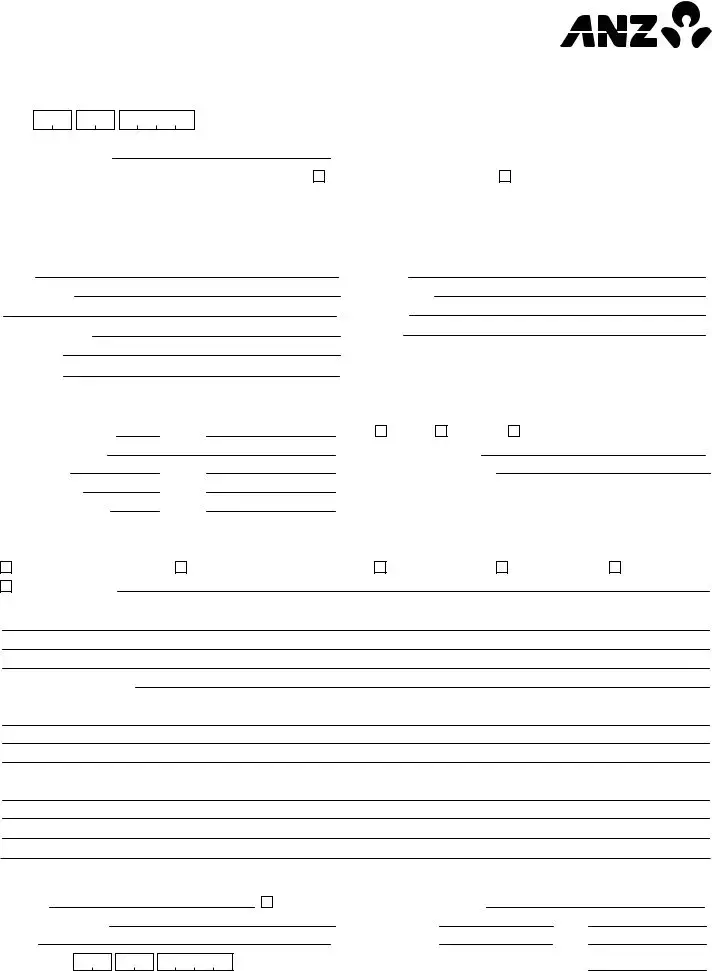

One frequent mistake is failing to provide all necessary contact details. Applicants should list both phone numbers, as the form specifies. Omitting a phone number can lead to difficulties in communication if further information is required.

Another common error involves incorrect beneficiary details. Applicants may write the beneficiary’s name or address incorrectly. This can cause the funds to be directed to the wrong person or location, complicating the transfer process.

Many individuals misuse the currency and amount sections. They fail to clearly indicate the currency type or miscalculate the total payment. This mistake can result in the wrong amount being transferred or confusion about fees.

Moreover, applicants sometimes do not provide the purpose of payment. This section is marked as mandatory, and failing to complete it could slow down the processing of the transfer.

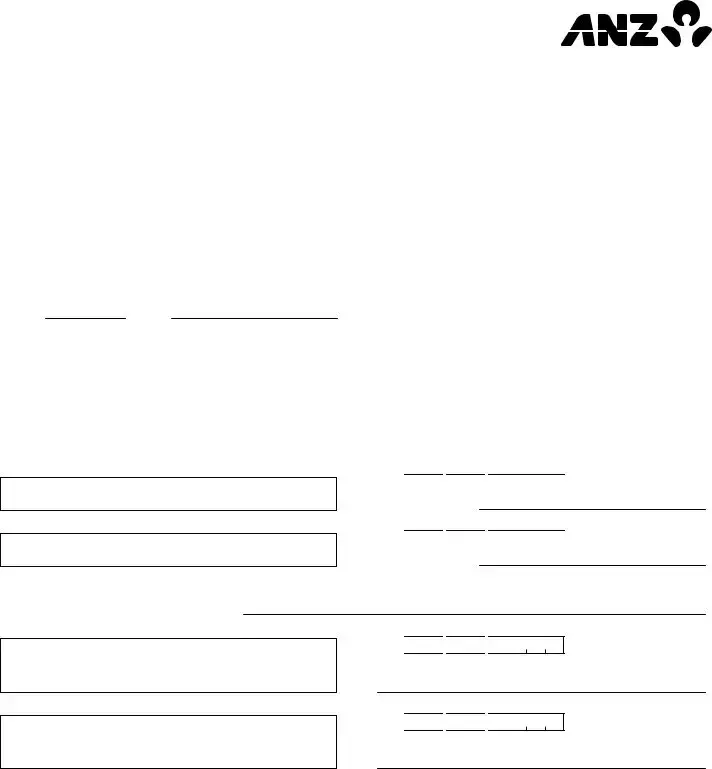

Some applicants neglect to sign where required. The application must be signed in accordance with the mandate instructions; missing signatures are a frequent issue. Without the correct signatures, the bank may not process the transfer.

In addition, applicants often overlook the need to specify whether the transfer is being made on their behalf or for someone else. This information must be clearly stated to ensure proper processing.

Another issue arises with the bank details section. Applicants may forget to include the BSB or SWIFT BIC codes. These codes are critical for international transfers, and lacking them can hinder the completion of the transaction.

Misunderstanding the applicant verification requirements can also lead to errors. Individuals sometimes fail to provide accurate identification information, which can result in a delay in processing the transfer.

Additionally, improper use of names can occur. The form instructs applicants to write names with the family name first. Ignoring this guideline can create confusion and might delay the transfer.

Lastly, some applicants do not retain a copy of the completed form. This can be problematic if any discrepancies arise after submission. Keeping a record ensures that applicants have a reference if questions or issues occur later.

International Telegraphic Transfer

International Telegraphic Transfer

International Telegraphic Transfer

International Telegraphic Transfer

Full Name of Applicant

Full Name of Applicant

Full Name of Applicant

Full Name of Applicant

Full name (family name first)

Full name (family name first)

Full name (family name first)

Full name (family name first)