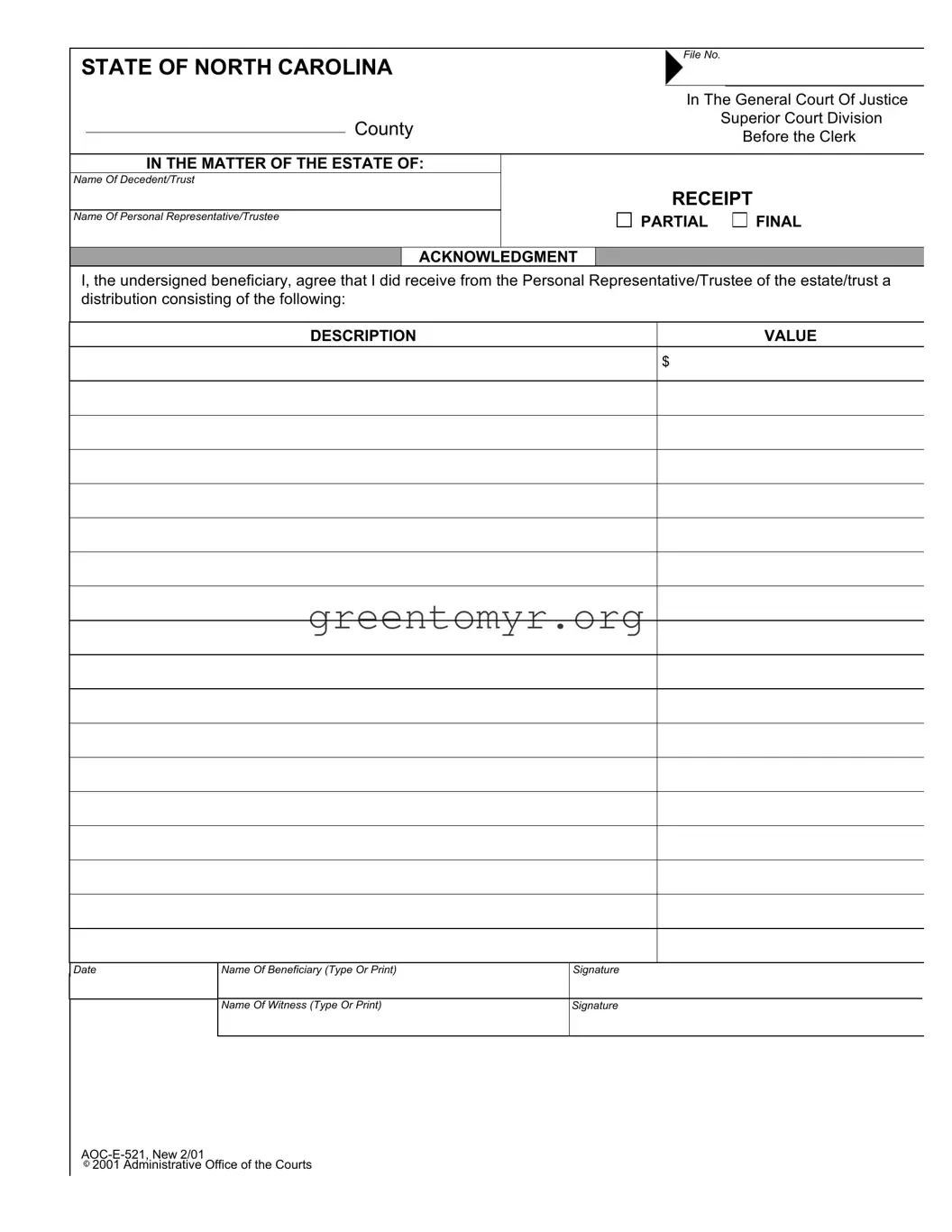

When filling out the AOC E 521 form, many people tend to overlook key details that can lead to complications later. One common mistake is neglecting to provide accurate information about the decedent’s name. This sounds obvious, but errors can easily happen. Even a small typo can create confusion and delay the process.

Another frequent error is failing to include the correct file number. This number is crucial for the court to locate the estate file. Leaving it blank or entering the wrong number can cause unnecessary delays in processing your form.

Many people forget to clearly describe the distribution they received. Simply stating “cash” isn't enough. Instead, one should specify amounts and types of assets. This ensures everyone understands what has been received.

Additionally, omitting dates can create issues. Beneficiaries should carefully date their signatures. This helps establish a clear timeline of when distributions were made, which is important for legal purposes.

Sometimes, the signatures required are done incorrectly. Both the beneficiary and the witness must sign the form. If either signature is missing or done in an incorrect format, the form may be rejected and require resubmission.

Moreover, typing or printing names instead of writing them can be a mistake. The form asks for the names of the beneficiary and witness to be either typed or printed. Ensure to follow the directions as closely as possible.

Beneficiaries sometimes misunderstand their role. The AOC E 521 form is intended for beneficiaries who have received a distribution. Failing to recognize this can lead to filling out the form incorrectly. Understanding your position helps avoid errors.

Status of the estate is another detail that can be misrepresented. It’s important to indicate whether the acknowledgment is for a partial or final distribution accurately. Mislabeling this can create confusion regarding the status of the estate.

Some might also overlook adding any additional necessary documentation. If there are accompanying documents required by the court, not submitting them could result in delays. Always check what might be needed beyond the AOC E 521 form.

Finally, not keeping a copy of the completed form is a common oversight. Beneficiaries should always make a copy of all submitted documents for their records. This can be invaluable if any questions arise about the transaction in the future.

PARTIAL

PARTIAL  FINAL

FINAL 2001 Administrative Office of the Courts

2001 Administrative Office of the Courts