Organization name: __________________________ |

Corp number/CA SOS file number: |

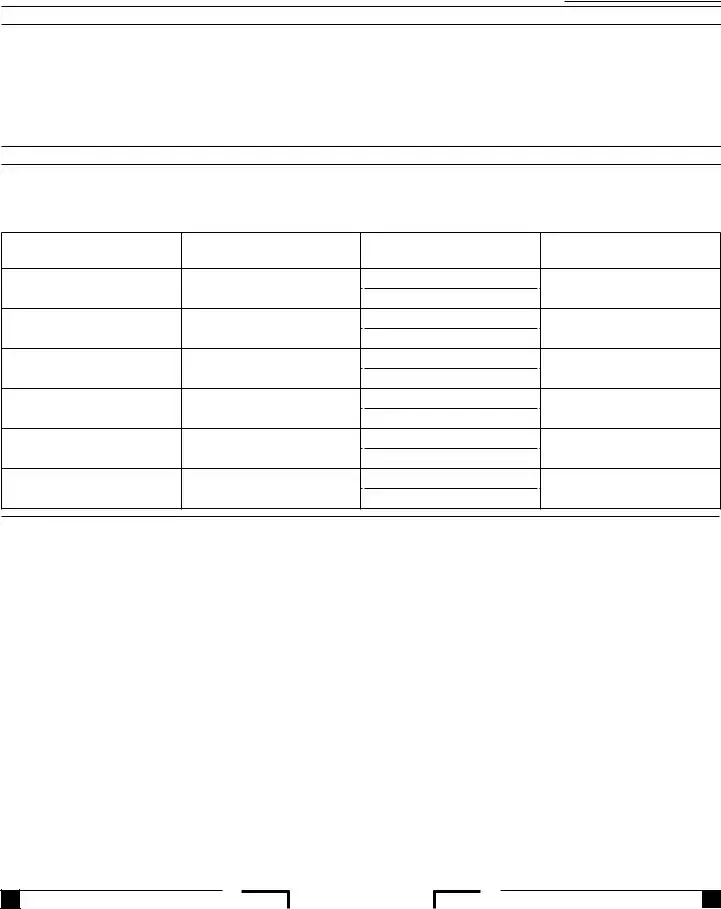

Schedule 1

Section A R&TC Section 23701a – Labor, agricultural, or horticultural organization

1 Are any services to be performed for members? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. . .□. Yes. . . . □. . No If “Yes,” explain .

2 |

Is the organization formed as a cooperative? |

|

|

If “Yes,” provide a copy of the federal exemption letter showing exemption under IRC Section 501(c)(5) |

2 □Yes □No |

Section B R&TC Section 23701b – Fraternal societies, orders, or associations, etc. (Lodge system with benefits)

Operating under the lodge system means carrying on activities under a form of organization that comprises local branches called lodges, chapters, or the like, that are largely self-governing and chartered by a parent organization .

1 Is the organization a college fraternity or sorority or a chapter of a college fraternity or sorority? . . . . . . . . . . . . . . . . . . . . . . . 1 □Yes □No

If “Yes,” college fraternities and sororities generally qualify as organizations described in R&TC Section 23701g .

For more information, get FTB Pub 1077, Guidelines for Social and Recreational Organizations . If R&TC Section 23701g appears to apply, do not complete Section B . Go to Section G on Schedule 3, Social and recreational organization .

2Does the organization operate, or plan to operate under the lodge system or for the exclusive benefit of the members of

|

the lodge system? |

. . . . . 2 |

□Yes |

□No |

|

|

|

|

|

|

3 |

Is the organization a subordinate of a national or state level organization? |

. . . . 3. |

. □. .Yes. . |

. □. No |

|

If “Yes,” attach a certificate signed by the secretary of the parent organization certifying that the subordinate is a duly |

|

|

|

|

|

constituted body operating under the jurisdiction of the parent body. |

|

|

|

|

|

|

|

|

|

|

4 |

Is the organization a parent or grand lodge? |

. . . . . 4 |

□Yes |

□No |

|

|

|

|

|

|

5Describe the types of benefits (life, sick, accident, or other benefits) paid, or to be paid, to members .

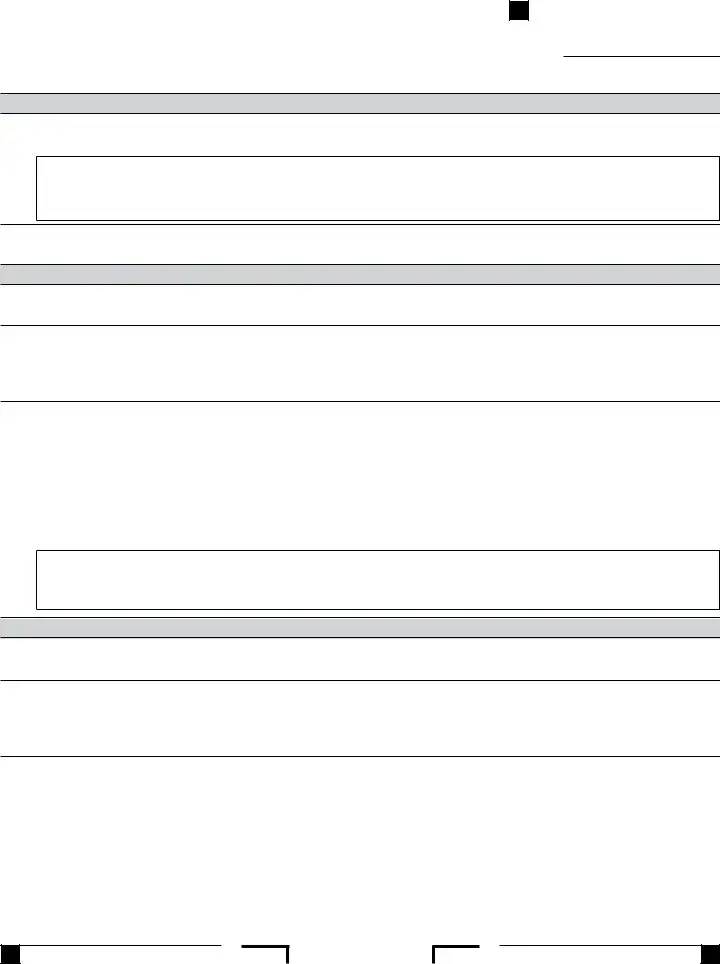

Section L R&TC Section 23701l – Fraternal beneficiary societies, orders, or associations, etc. (Lodge system with no benefits)

Operating under the lodge system means carrying on activities under a form of organization that comprises local branches (called lodges, chapters, or the like) that are largely self-governing and chartered by a parent organization .

1 Is the organization a college fraternity or sorority, or a chapter of a college fraternity or sorority? . . . . . . . . . . . . . . . 1. . □. .Yes. . . □No

If “Yes,” college fraternities and sororities generally qualify as organizations described in R&TC Section 23701g .

For more information, get FTB Pub 1077, Guidelines for Social and Recreational Organizations . If R&TC Section 23701g appears to apply, do not complete Section L . Go to Section G on Schedule 3, Social and recreational organization .

2Does the organization operate or plan to operate under the lodge system or for the exclusive benefit of the members of

|

a lodge system? |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. . |

.□. .Yes. . . |

□No |

|

|

|

|

|

3 |

Is the organization a subordinate of a national or state level organization? |

. . . . . . . . . . . . . . . . . . . . . . . . . . . 3. |

. □. .Yes. . . □. No |

|

|

|

|

|

|

4 |

Is the organization a parent or grand lodge? |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 |

□Yes |

□No |