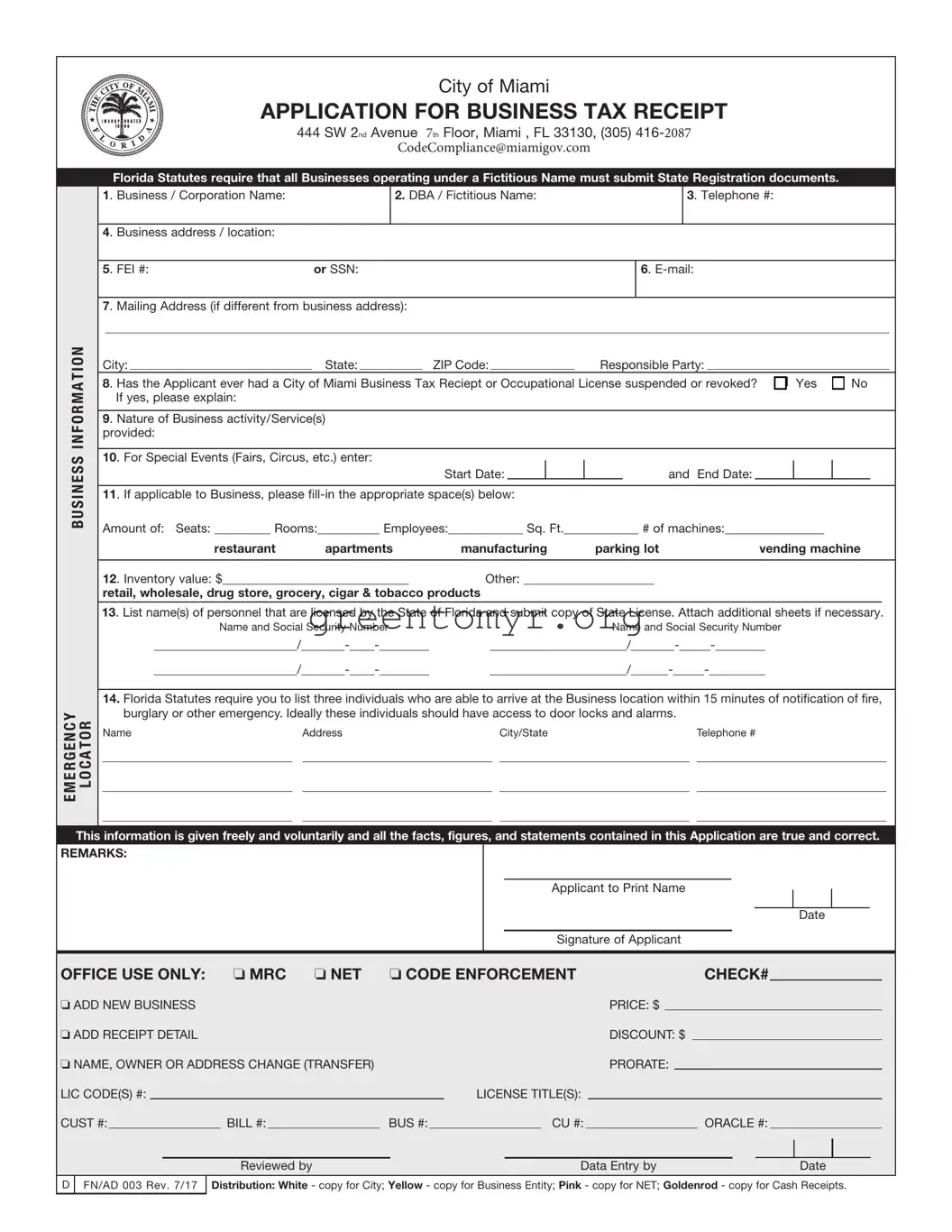

The Application For Business Tax Receipt form is a document that businesses must complete to operate legally in the City of Miami. It collects essential information about the business, including its name, address, and nature of operations. Submitting this application is a crucial step to ensure compliance with local regulations.

All businesses operating under a fictitious name or those needing a business tax receipt in the City of Miami must complete this form. This includes various types of businesses such as retail shops, restaurants, and service providers.

What documents are needed when submitting the application?

Along with the completed application, you may need to submit:

-

State Registration documents if operating under a fictitious name

-

Copy of any relevant state licenses for personnel

-

Verification of business address

How long does it take to process the application?

The processing time can vary based on factors like the completeness of your application and current workload of the processing office. Generally, expect it to take a few weeks. It’s wise to apply early to avoid delays.

What happens if my business tax receipt is denied?

If your application is denied, you will receive a notice explaining the reason for the denial. Common reasons include incomplete information or failure to meet local regulations. You may appeal the decision or correct the issues and reapply.

Is there a fee associated with the application?

Yes, there is a fee to process your application. The exact amount is detailed on the form, and it varies based on the type of business and other factors. Make sure to include payment with your application to avoid processing delays.

Yes, you can update your business information after receiving your tax receipt. If there are changes to ownership, location, or business type, it’s essential to notify the city. You can typically make these updates by filling out a separate form or contacting the local office.

What are the consequences of operating without a business tax receipt?

Operating without a valid business tax receipt can lead to penalties such as fines or business closure. It is illegal to conduct business activities without proper licensing in place. Compliance is crucial to avoid legal troubles.

You can contact the City of Miami’s Code Compliance office for assistance. They are available by phone at (305) 416-2087 or via email at [email protected]. Don’t hesitate to reach out if you have questions or need guidance on your application.