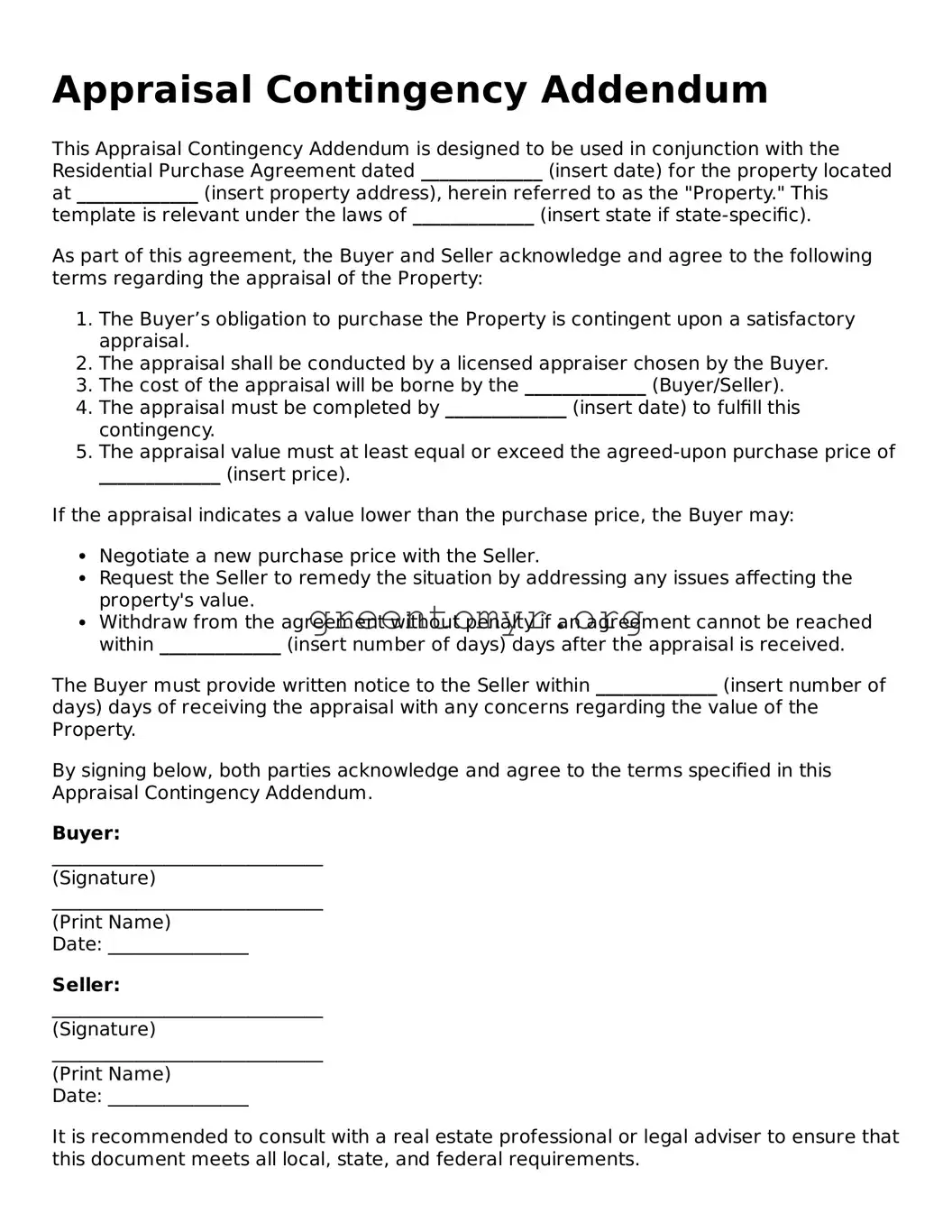

Appraisal Contingency Addendum

This Appraisal Contingency Addendum is designed to be used in conjunction with the Residential Purchase Agreement dated _____________ (insert date) for the property located at _____________ (insert property address), herein referred to as the "Property." This template is relevant under the laws of _____________ (insert state if state-specific).

As part of this agreement, the Buyer and Seller acknowledge and agree to the following terms regarding the appraisal of the Property:

- The Buyer’s obligation to purchase the Property is contingent upon a satisfactory appraisal.

- The appraisal shall be conducted by a licensed appraiser chosen by the Buyer.

- The cost of the appraisal will be borne by the _____________ (Buyer/Seller).

- The appraisal must be completed by _____________ (insert date) to fulfill this contingency.

- The appraisal value must at least equal or exceed the agreed-upon purchase price of _____________ (insert price).

If the appraisal indicates a value lower than the purchase price, the Buyer may:

- Negotiate a new purchase price with the Seller.

- Request the Seller to remedy the situation by addressing any issues affecting the property's value.

- Withdraw from the agreement without penalty if an agreement cannot be reached within _____________ (insert number of days) days after the appraisal is received.

The Buyer must provide written notice to the Seller within _____________ (insert number of days) days of receiving the appraisal with any concerns regarding the value of the Property.

By signing below, both parties acknowledge and agree to the terms specified in this Appraisal Contingency Addendum.

Buyer:

_____________________________

(Signature)

_____________________________

(Print Name)

Date: _______________

Seller:

_____________________________

(Signature)

_____________________________

(Print Name)

Date: _______________

It is recommended to consult with a real estate professional or legal adviser to ensure that this document meets all local, state, and federal requirements.