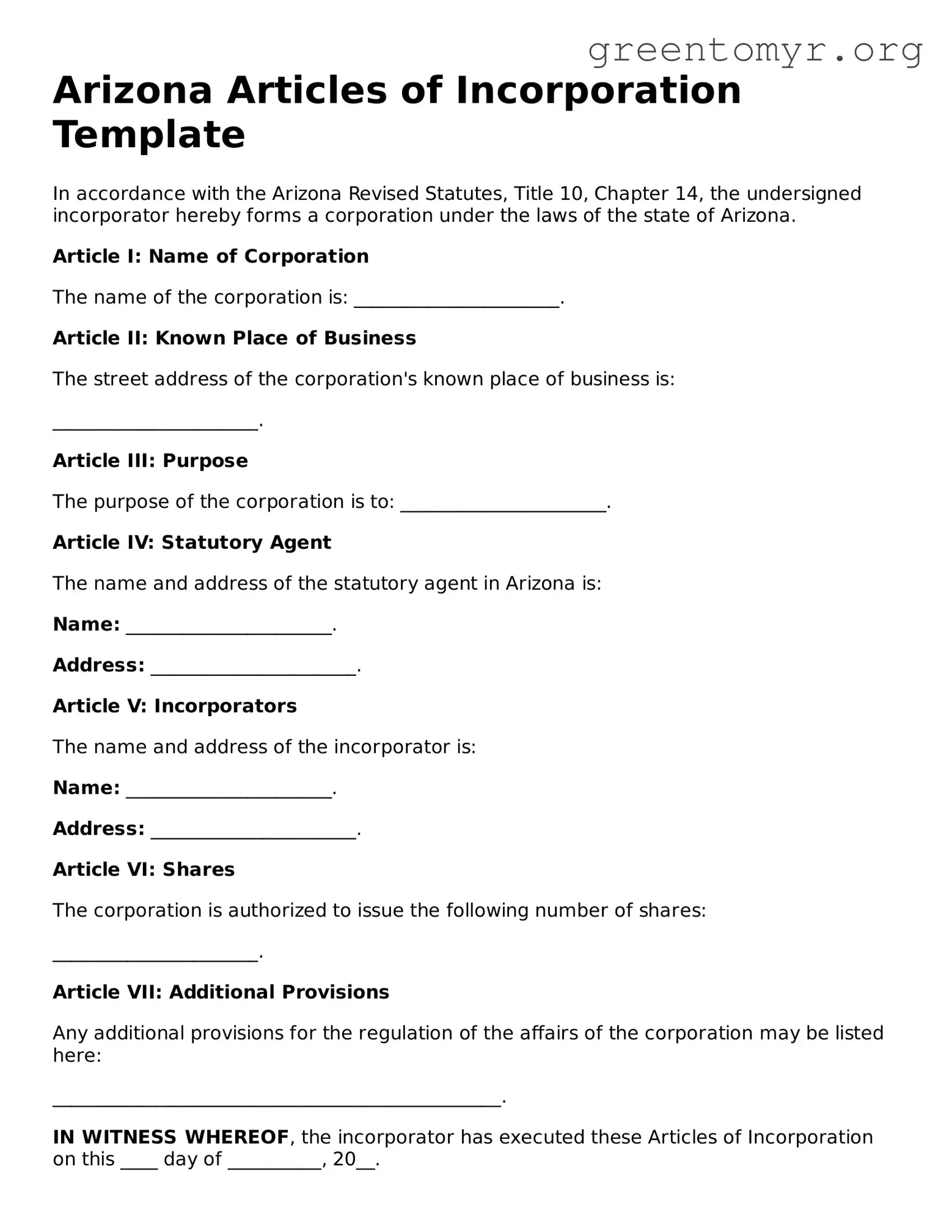

Arizona Articles of Incorporation Template

In accordance with the Arizona Revised Statutes, Title 10, Chapter 14, the undersigned incorporator hereby forms a corporation under the laws of the state of Arizona.

Article I: Name of Corporation

The name of the corporation is: ______________________.

Article II: Known Place of Business

The street address of the corporation's known place of business is:

______________________.

Article III: Purpose

The purpose of the corporation is to: ______________________.

Article IV: Statutory Agent

The name and address of the statutory agent in Arizona is:

Name: ______________________.

Address: ______________________.

Article V: Incorporators

The name and address of the incorporator is:

Name: ______________________.

Address: ______________________.

Article VI: Shares

The corporation is authorized to issue the following number of shares:

______________________.

Article VII: Additional Provisions

Any additional provisions for the regulation of the affairs of the corporation may be listed here:

________________________________________________.

IN WITNESS WHEREOF, the incorporator has executed these Articles of Incorporation on this ____ day of __________, 20__.

______________________ (Incorporator's Signature)

______________________ (Incorporator's Printed Name)