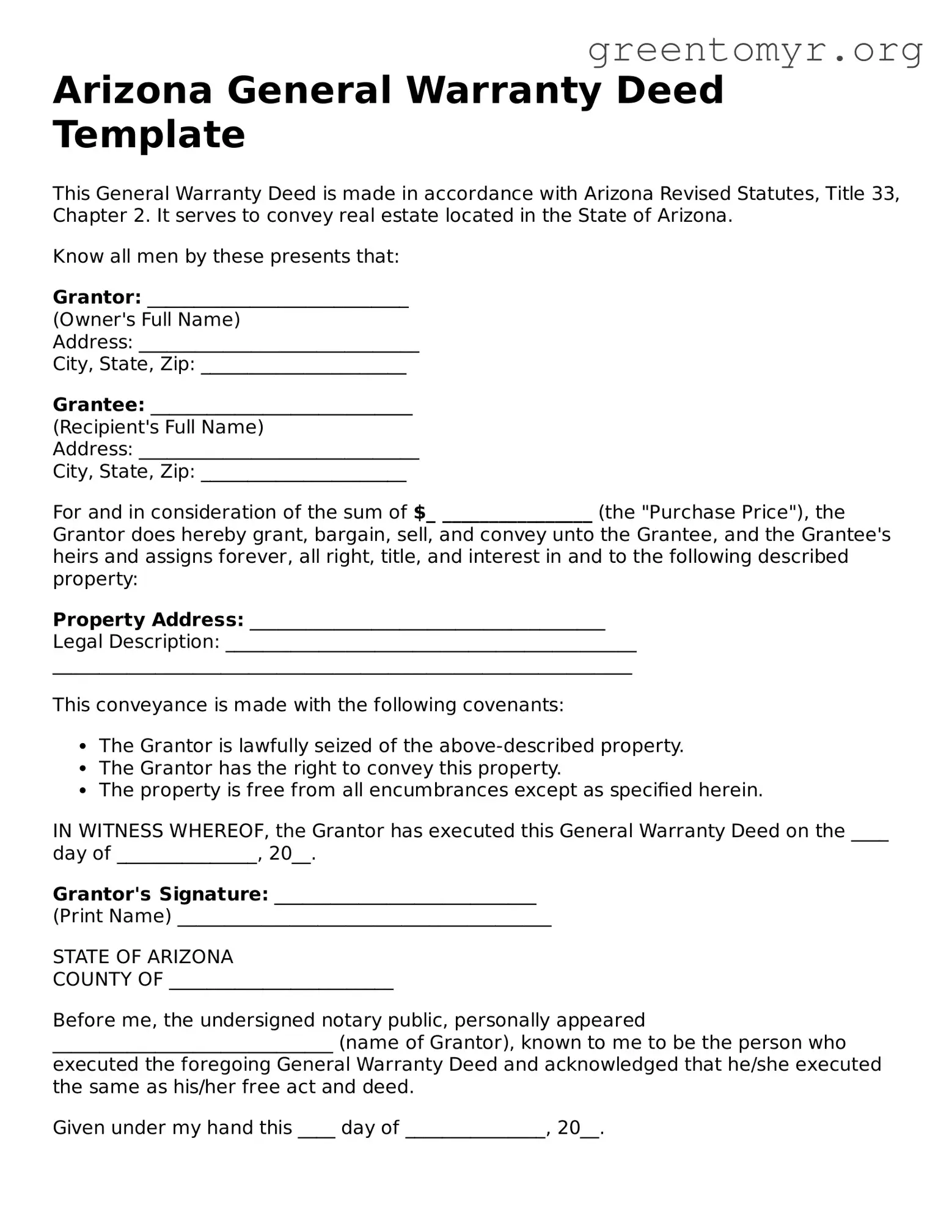

Arizona General Warranty Deed Template

This General Warranty Deed is made in accordance with Arizona Revised Statutes, Title 33, Chapter 2. It serves to convey real estate located in the State of Arizona.

Know all men by these presents that:

Grantor: ____________________________

(Owner's Full Name)

Address: ______________________________

City, State, Zip: ______________________

Grantee: ____________________________

(Recipient's Full Name)

Address: ______________________________

City, State, Zip: ______________________

For and in consideration of the sum of $_ ________________ (the "Purchase Price"), the Grantor does hereby grant, bargain, sell, and convey unto the Grantee, and the Grantee's heirs and assigns forever, all right, title, and interest in and to the following described property:

Property Address: ______________________________________

Legal Description: ____________________________________________

______________________________________________________________

This conveyance is made with the following covenants:

- The Grantor is lawfully seized of the above-described property.

- The Grantor has the right to convey this property.

- The property is free from all encumbrances except as specified herein.

IN WITNESS WHEREOF, the Grantor has executed this General Warranty Deed on the ____ day of _______________, 20__.

Grantor's Signature: ____________________________

(Print Name) ________________________________________

STATE OF ARIZONA

COUNTY OF ________________________

Before me, the undersigned notary public, personally appeared ______________________________ (name of Grantor), known to me to be the person who executed the foregoing General Warranty Deed and acknowledged that he/she executed the same as his/her free act and deed.

Given under my hand this ____ day of _______________, 20__.

Notary Public Signature: ____________________________

My Commission Expires: ____________________________