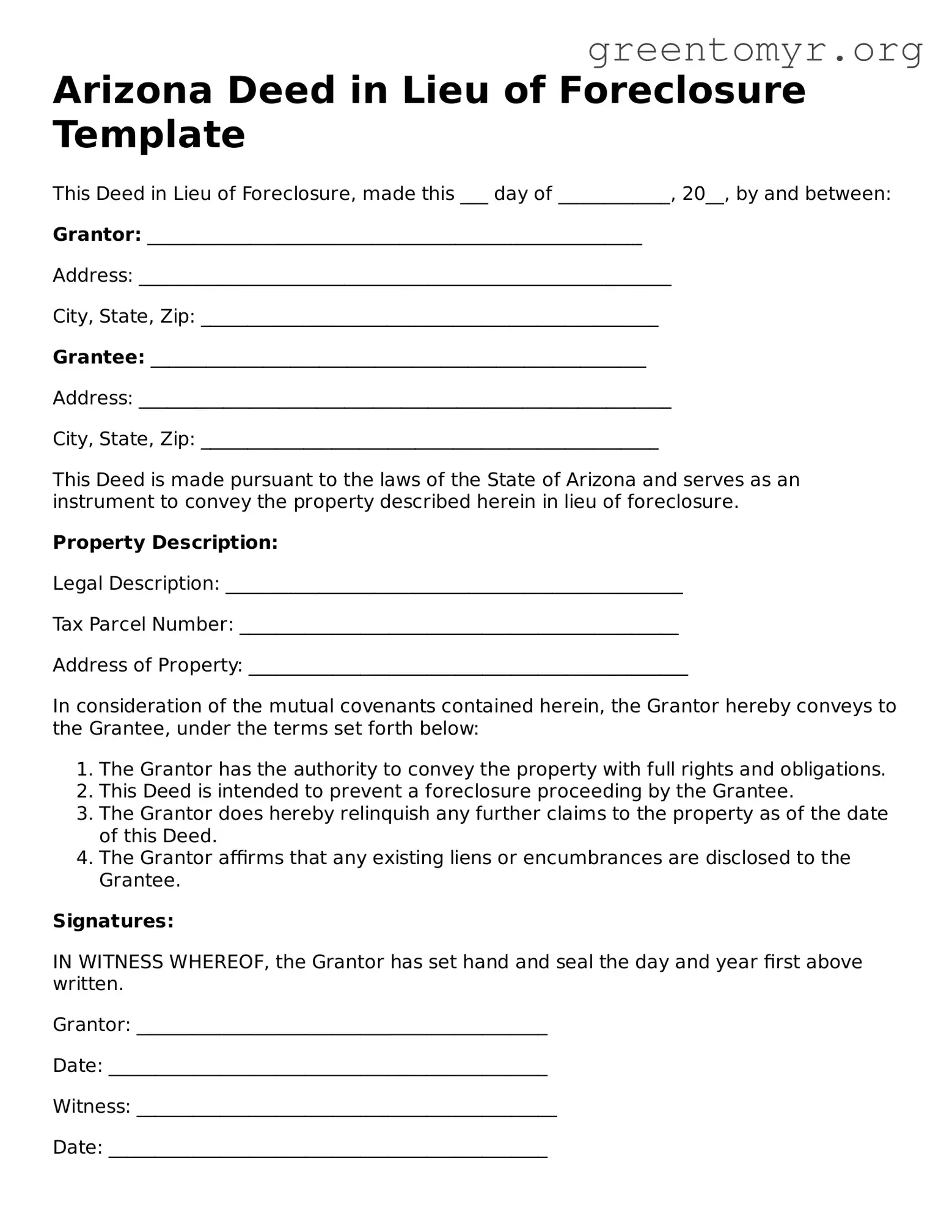

Arizona Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure, made this ___ day of ____________, 20__, by and between:

Grantor: _____________________________________________________

Address: _________________________________________________________

City, State, Zip: _________________________________________________

Grantee: _____________________________________________________

Address: _________________________________________________________

City, State, Zip: _________________________________________________

This Deed is made pursuant to the laws of the State of Arizona and serves as an instrument to convey the property described herein in lieu of foreclosure.

Property Description:

Legal Description: _________________________________________________

Tax Parcel Number: _______________________________________________

Address of Property: _______________________________________________

In consideration of the mutual covenants contained herein, the Grantor hereby conveys to the Grantee, under the terms set forth below:

- The Grantor has the authority to convey the property with full rights and obligations.

- This Deed is intended to prevent a foreclosure proceeding by the Grantee.

- The Grantor does hereby relinquish any further claims to the property as of the date of this Deed.

- The Grantor affirms that any existing liens or encumbrances are disclosed to the Grantee.

Signatures:

IN WITNESS WHEREOF, the Grantor has set hand and seal the day and year first above written.

Grantor: ____________________________________________

Date: _______________________________________________

Witness: _____________________________________________

Date: _______________________________________________

Notarization:

State of Arizona

County of __________________

On this ____ day of ____________, 20__, before me, a Notary Public, personally appeared ____________________________________________________, known to me to be the person(s) whose name(s) is (are) subscribed to the foregoing instrument and acknowledged that (he/she/they) executed the same for the purposes therein contained.

WITNESS my hand and official seal.

____________________________________

Notary Public

My Commission Expires: ___________________