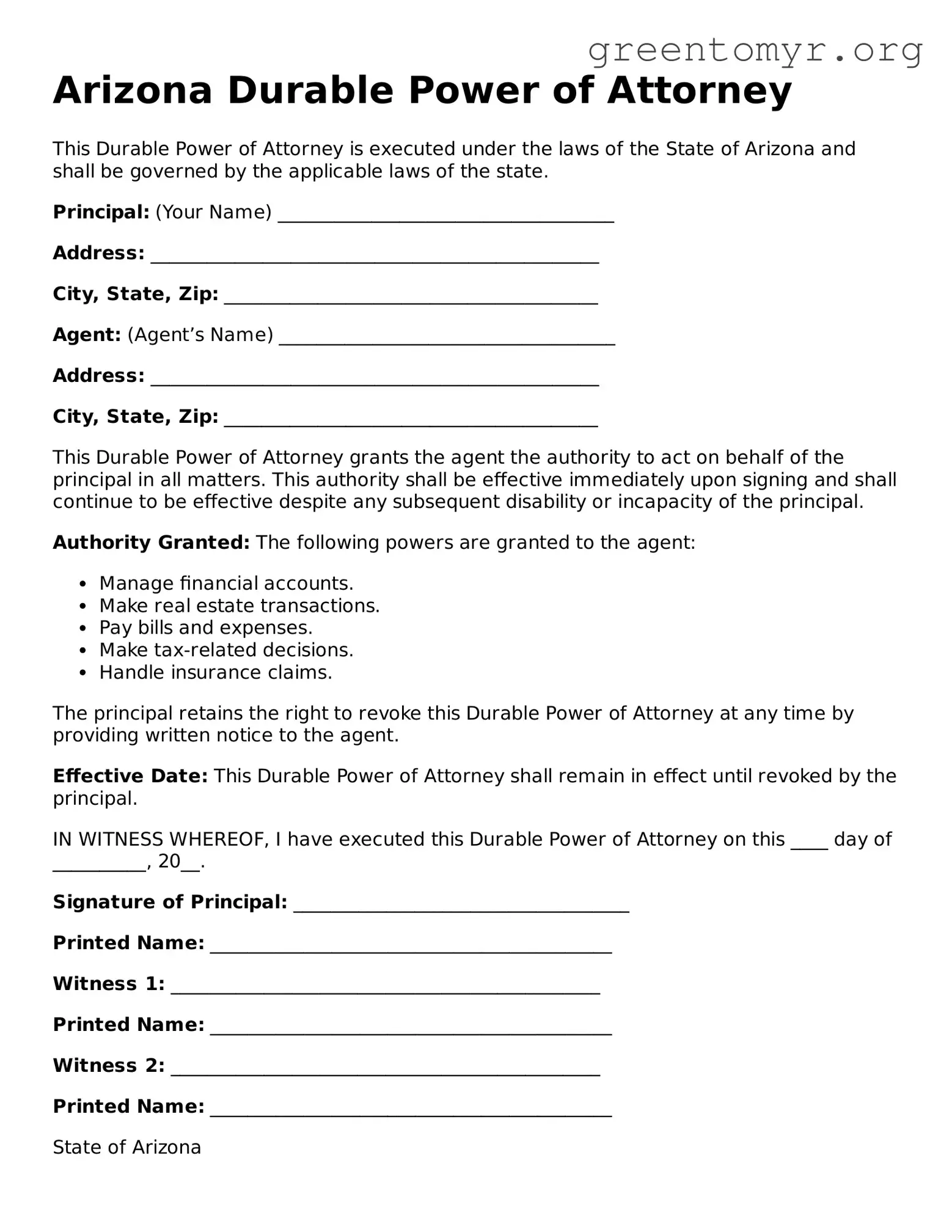

Arizona Durable Power of Attorney

This Durable Power of Attorney is executed under the laws of the State of Arizona and shall be governed by the applicable laws of the state.

Principal: (Your Name) ____________________________________

Address: ________________________________________________

City, State, Zip: ________________________________________

Agent: (Agent’s Name) ____________________________________

Address: ________________________________________________

City, State, Zip: ________________________________________

This Durable Power of Attorney grants the agent the authority to act on behalf of the principal in all matters. This authority shall be effective immediately upon signing and shall continue to be effective despite any subsequent disability or incapacity of the principal.

Authority Granted: The following powers are granted to the agent:

- Manage financial accounts.

- Make real estate transactions.

- Pay bills and expenses.

- Make tax-related decisions.

- Handle insurance claims.

The principal retains the right to revoke this Durable Power of Attorney at any time by providing written notice to the agent.

Effective Date: This Durable Power of Attorney shall remain in effect until revoked by the principal.

IN WITNESS WHEREOF, I have executed this Durable Power of Attorney on this ____ day of __________, 20__.

Signature of Principal: ____________________________________

Printed Name: ___________________________________________

Witness 1: ______________________________________________

Printed Name: ___________________________________________

Witness 2: ______________________________________________

Printed Name: ___________________________________________

State of Arizona

County of ____________________

On this ____ day of ____________, 20__, before me, a Notary Public in and for said County and State, personally appeared ______________________, known to me to be the person described in this Durable Power of Attorney.

Given under my hand and seal this ____ day of ____________, 20__.

Notary Public Signature: ________________________________

My Commission Expires: __________________________________