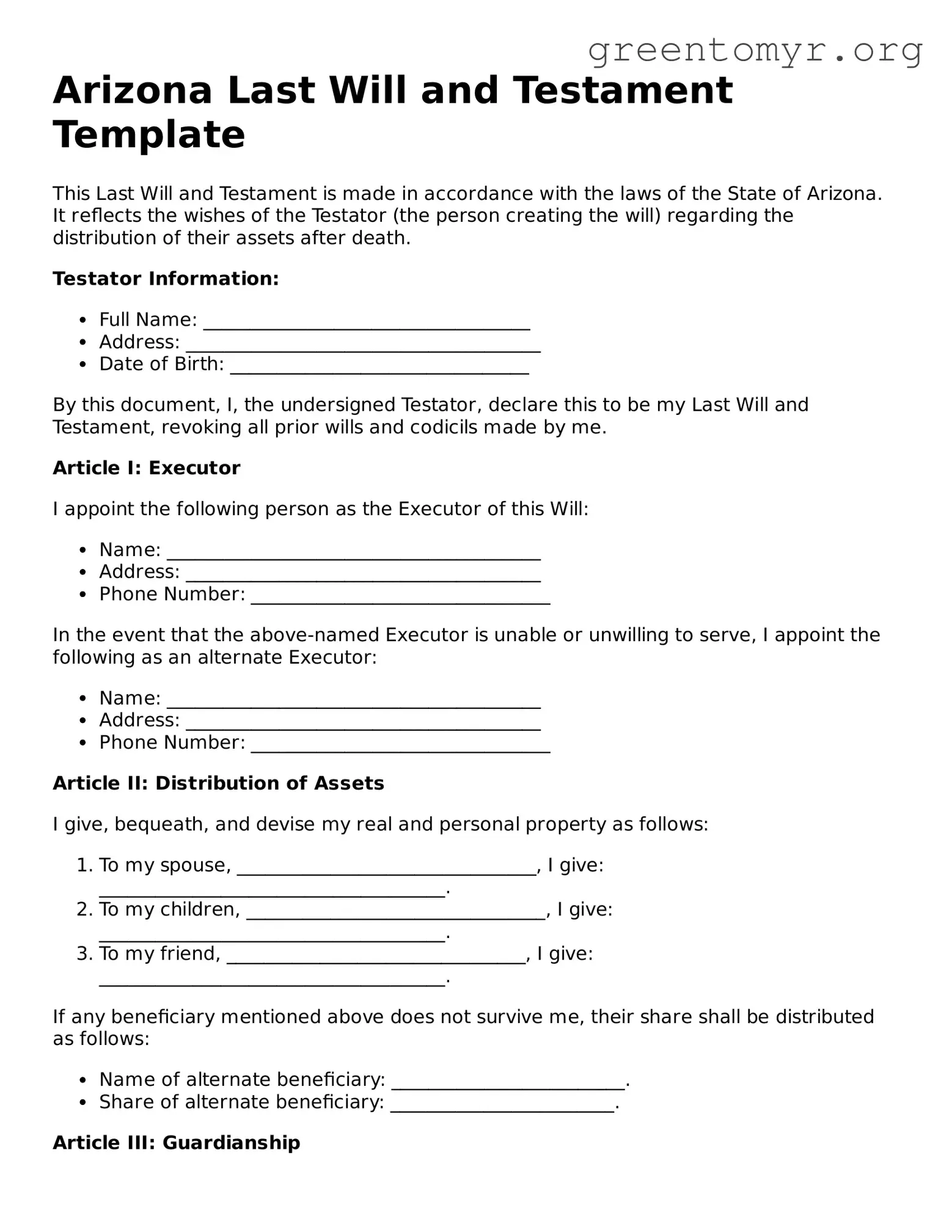

Arizona Last Will and Testament Template

This Last Will and Testament is made in accordance with the laws of the State of Arizona. It reflects the wishes of the Testator (the person creating the will) regarding the distribution of their assets after death.

Testator Information:

- Full Name: ___________________________________

- Address: ______________________________________

- Date of Birth: ________________________________

By this document, I, the undersigned Testator, declare this to be my Last Will and Testament, revoking all prior wills and codicils made by me.

Article I: Executor

I appoint the following person as the Executor of this Will:

- Name: ________________________________________

- Address: ______________________________________

- Phone Number: ________________________________

In the event that the above-named Executor is unable or unwilling to serve, I appoint the following as an alternate Executor:

- Name: ________________________________________

- Address: ______________________________________

- Phone Number: ________________________________

Article II: Distribution of Assets

I give, bequeath, and devise my real and personal property as follows:

- To my spouse, ________________________________, I give: _____________________________________.

- To my children, ________________________________, I give: _____________________________________.

- To my friend, ________________________________, I give: _____________________________________.

If any beneficiary mentioned above does not survive me, their share shall be distributed as follows:

- Name of alternate beneficiary: _________________________.

- Share of alternate beneficiary: ________________________.

Article III: Guardianship

In the event that I have minor children at the time of my passing, I nominate the following person(s) as guardian(s) of my children:

- Name: ________________________________________

- Address: ______________________________________

- Relationship: _________________________________

Article IV: Miscellaneous

This Will shall be interpreted according to the laws of Arizona. If any provision of this Will is found to be invalid, the remaining provisions shall continue in full force and effect.

In witness whereof, I have hereunto subscribed my name this ____ day of __________, 20__.

_______________________________

Signature of Testator

Witnesses

We, the undersigned witnesses, hereby affirm that the Testator signed this Last Will and Testament in our presence and that we are of legal age and competent to serve as witnesses.

_______________________________

Signature of Witness 1

Name: ________________________________________

Address: ______________________________________

_______________________________

Signature of Witness 2

Name: ________________________________________

Address: ______________________________________