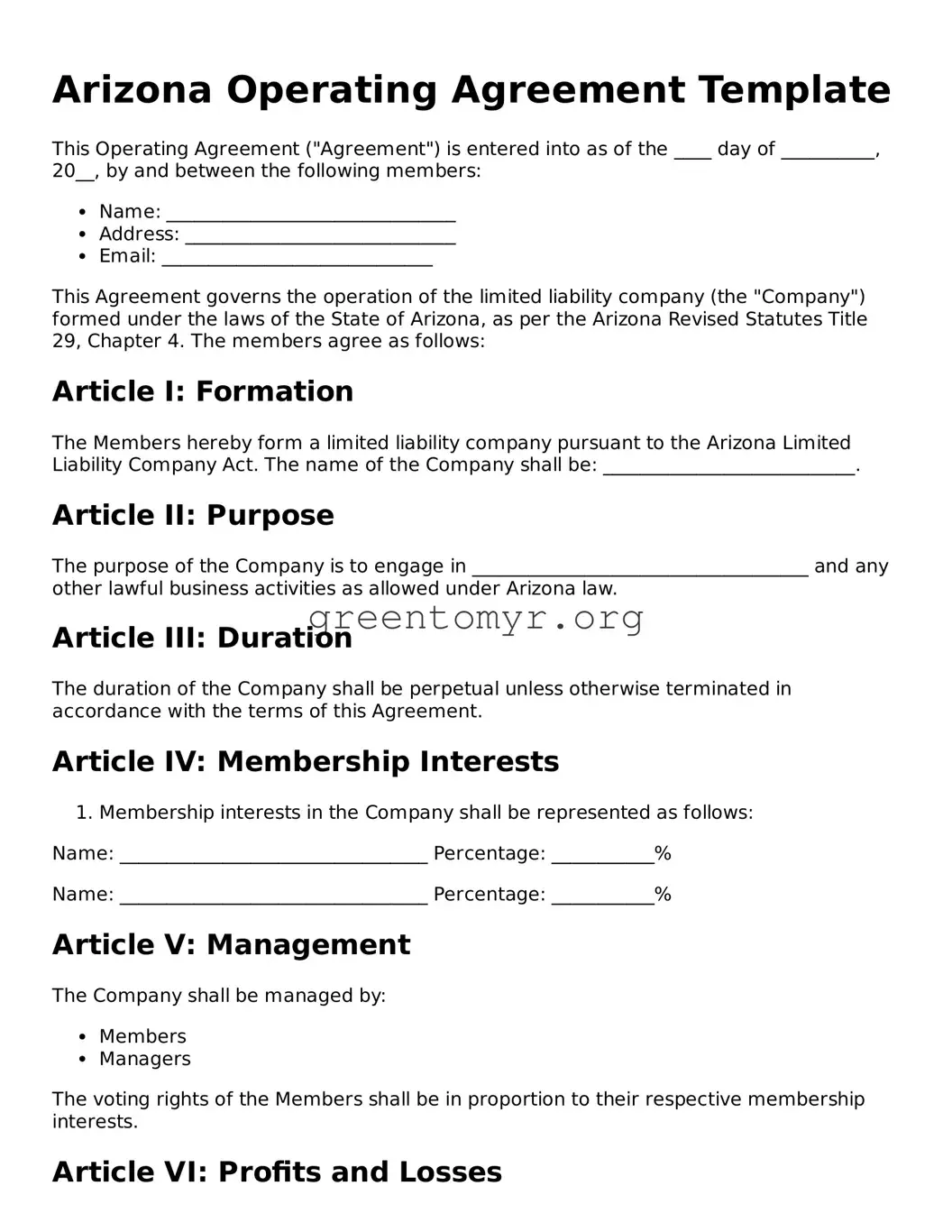

Arizona Operating Agreement Template

This Operating Agreement ("Agreement") is entered into as of the ____ day of __________, 20__, by and between the following members:

- Name: _______________________________

- Address: _____________________________

- Email: _____________________________

This Agreement governs the operation of the limited liability company (the "Company") formed under the laws of the State of Arizona, as per the Arizona Revised Statutes Title 29, Chapter 4. The members agree as follows:

Article I: Formation

The Members hereby form a limited liability company pursuant to the Arizona Limited Liability Company Act. The name of the Company shall be: ___________________________.

Article II: Purpose

The purpose of the Company is to engage in ____________________________________ and any other lawful business activities as allowed under Arizona law.

Article III: Duration

The duration of the Company shall be perpetual unless otherwise terminated in accordance with the terms of this Agreement.

Article IV: Membership Interests

- Membership interests in the Company shall be represented as follows:

Name: _________________________________ Percentage: ___________%

Name: _________________________________ Percentage: ___________%

Article V: Management

The Company shall be managed by:

The voting rights of the Members shall be in proportion to their respective membership interests.

Article VI: Profits and Losses

Profits and losses of the Company shall be allocated to the Members in proportion to their membership interests.

Article VII: Distributions

Distributions shall be made to the Members at such times and in such amounts as determined by the Members.

Article VIII: Indemnification

The Company shall indemnify the Members to the fullest extent permitted by Arizona law.

Article IX: Amendments

This Agreement may be amended only by a written agreement signed by all Members.

Article X: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Arizona.

IN WITNESS WHEREOF, the parties have executed this Operating Agreement as of the day and year first above written.

Member Signature: _________________________ Date: ___________

Member Signature: _________________________ Date: ___________