What is a Promissory Note in Arizona?

A Promissory Note is a legal document that outlines the terms of a loan. It includes the borrower's promise to repay a specified amount of money to the lender, along with any interest and fees. In Arizona, this document must meet specific requirements to be enforceable in court.

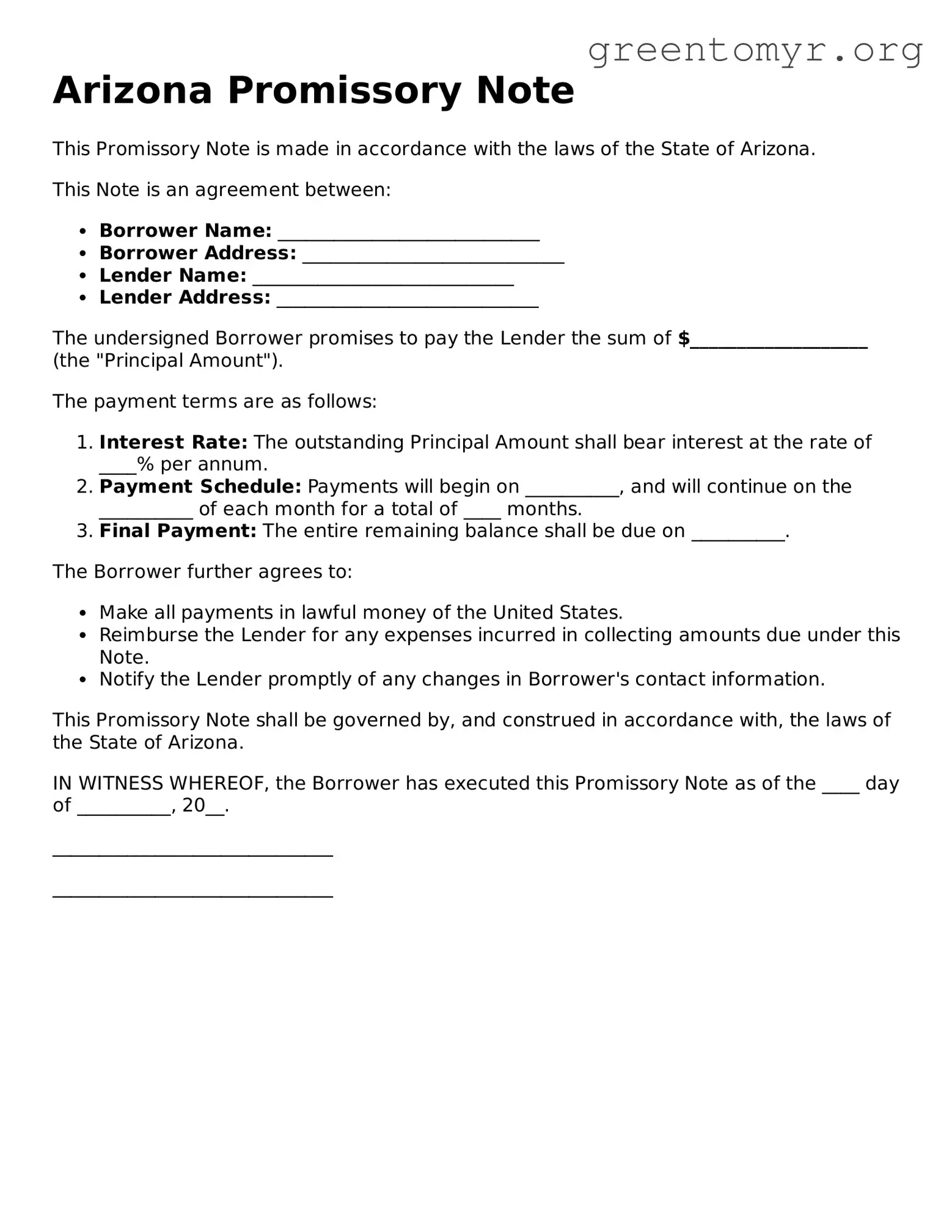

To create a valid Promissory Note in Arizona, the following information should be included:

-

The names and addresses of the borrower and lender

-

The principal amount of the loan

-

The interest rate and whether it is fixed or variable

-

The repayment schedule, including due dates

-

Any late fees or penalties for missed payments

-

Terms for prepayment, if applicable

-

Signatures of both parties

Do I need to have my Promissory Note notarized?

Notarization is not legally required for a Promissory Note to be valid in Arizona. However, having the document notarized can provide extra legal protection by verifying the identities of the parties involved and the authenticity of the signatures.

Can I modify a Promissory Note once it is signed?

Yes, a Promissory Note can be modified after it has been signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the revised terms to avoid disputes in the future.

What happens if I default on my loan?

If the borrower defaults, the lender has the right to take legal action to enforce the terms of the Promissory Note. This could include seeking a judgment for the owed amount or pursuing collection efforts. The specific consequences will depend on the terms outlined in the note and Arizona law.

Is it possible to use a Promissory Note for business loans?

Yes, Promissory Notes can be used for both personal and business loans in Arizona. When using a Promissory Note for business financing, it is important to clearly specify the terms and include information relevant to business operations.

What is the statute of limitations for a Promissory Note in Arizona?

In Arizona, the statute of limitations for enforcing a Promissory Note is typically six years. This means that the lender has six years from the date of default to file a lawsuit seeking repayment.

Can a Promissory Note be secured or unsecured?

A Promissory Note can be either secured or unsecured. A secured note is backed by collateral, which reduces the risk for the lender. An unsecured note does not have collateral backing, and, therefore, may involve higher interest rates due to increased risk for the lender.

Where can I find a Promissory Note template for Arizona?

Promissory Note templates can be found through various online legal document services, local legal aid offices, or through professional attorneys. Ensure that any template used complies with Arizona laws and is tailored to the specific needs of the parties involved.