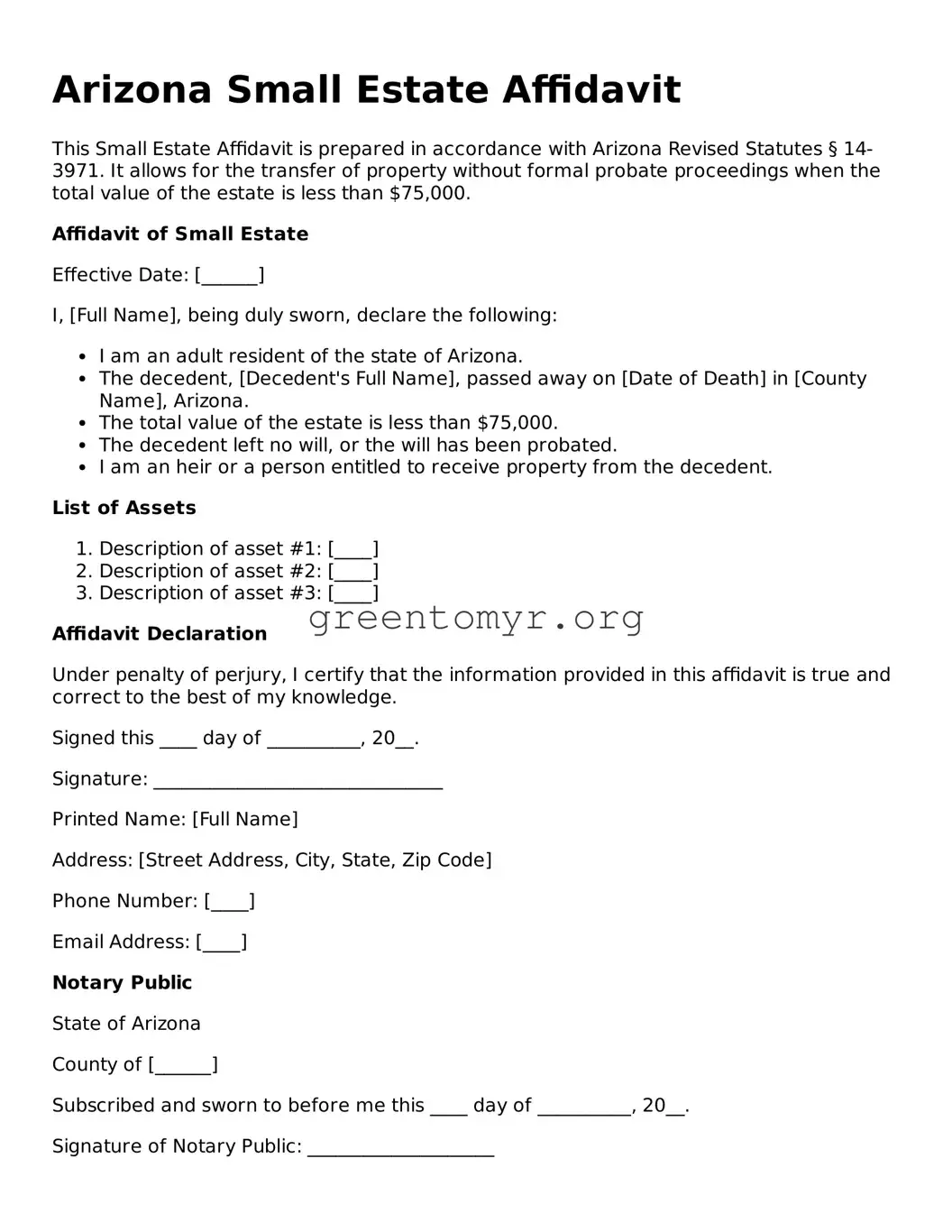

Arizona Small Estate Affidavit

This Small Estate Affidavit is prepared in accordance with Arizona Revised Statutes § 14-3971. It allows for the transfer of property without formal probate proceedings when the total value of the estate is less than $75,000.

Affidavit of Small Estate

Effective Date: [______]

I, [Full Name], being duly sworn, declare the following:

- I am an adult resident of the state of Arizona.

- The decedent, [Decedent's Full Name], passed away on [Date of Death] in [County Name], Arizona.

- The total value of the estate is less than $75,000.

- The decedent left no will, or the will has been probated.

- I am an heir or a person entitled to receive property from the decedent.

List of Assets

- Description of asset #1: [____]

- Description of asset #2: [____]

- Description of asset #3: [____]

Affidavit Declaration

Under penalty of perjury, I certify that the information provided in this affidavit is true and correct to the best of my knowledge.

Signed this ____ day of __________, 20__.

Signature: _______________________________

Printed Name: [Full Name]

Address: [Street Address, City, State, Zip Code]

Phone Number: [____]

Email Address: [____]

Notary Public

State of Arizona

County of [______]

Subscribed and sworn to before me this ____ day of __________, 20__.

Signature of Notary Public: ____________________

My commission expires: [____]