What is a Tractor Bill of Sale in Arizona?

A Tractor Bill of Sale in Arizona is a document used to record the sale of a tractor between a seller and a buyer. It serves as a legal record, detailing the specifics of the transaction, including the purchase price, date of sale, and the identification of the tractor being sold. This document is important for both parties as it helps ensure that the transfer of ownership is clear and legally binding.

Why is a Tractor Bill of Sale necessary?

This document is essential for several reasons. First, it provides proof of the transaction, which can be important for tax purposes or if any disputes arise in the future. Second, it facilitates the transfer of ownership, allowing the new owner to register the tractor in their name. Lastly, having a Bill of Sale protects both parties by documenting the condition of the tractor at the time of sale, reducing the risk of misunderstandings later on.

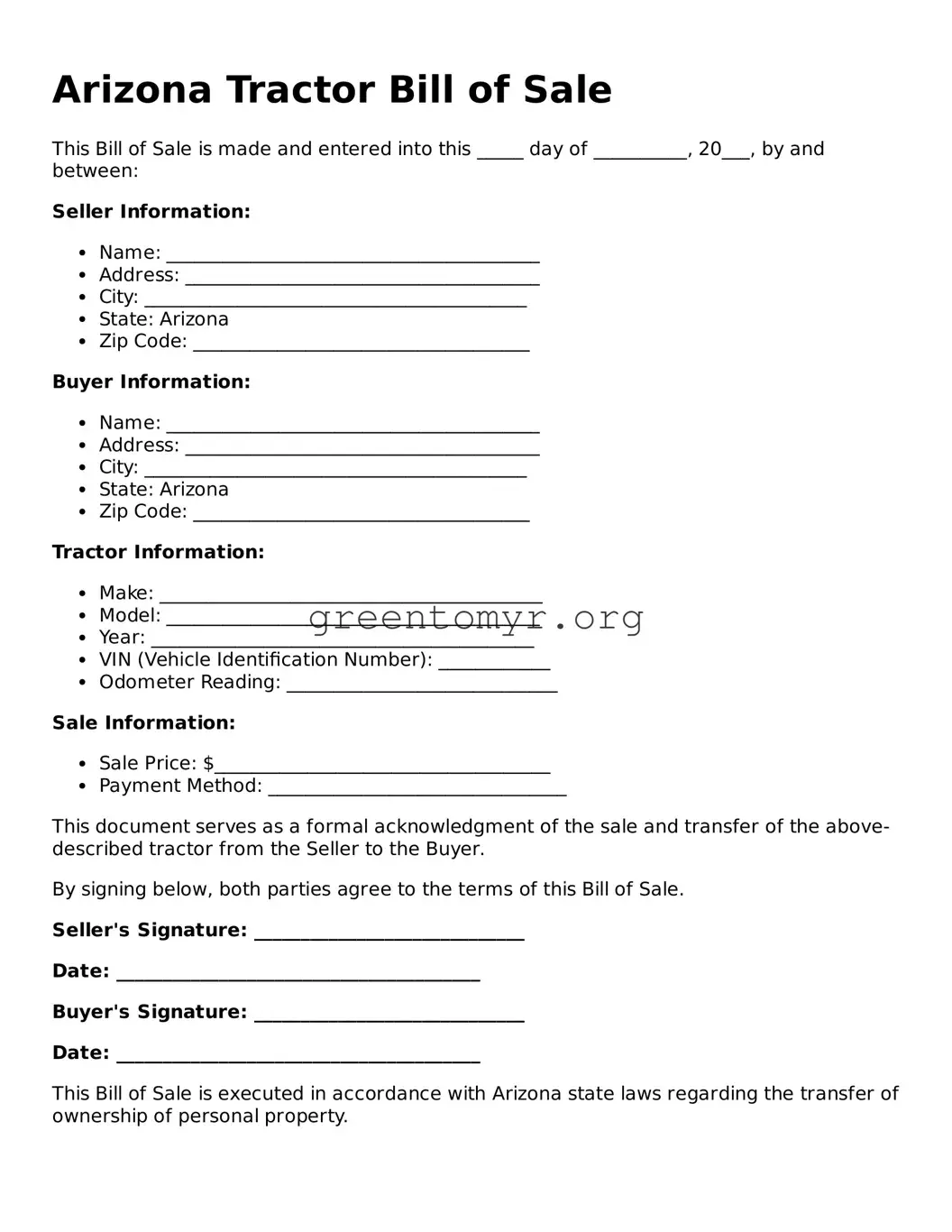

To ensure the Bill of Sale is comprehensive and legally sound, consider including the following information:

-

Names and contact information of both the seller and the buyer.

-

Date of the transaction.

-

Description of the tractor, including its make, model, year, Vehicle Identification Number (VIN), and any additional identifying details.

-

Purchase price or terms of payment.

-

Signatures of both the seller and the buyer.

Do I need to have the Tractor Bill of Sale notarized?

In Arizona, it is not required to have a Bill of Sale notarized for it to be valid. However, having it notarized can add an extra layer of authenticity, particularly if either party wants to safeguard their interests further. This process witnesses the signing of the document, making it more difficult to dispute the validity of the agreement in the future.

Can I create my own Tractor Bill of Sale?

Yes, you can create your own Tractor Bill of Sale as long as it includes all the necessary information required for it to be valid. Many templates are available online that can assist in formatting and ensuring the document meets legal standards. Just ensure that all details pertinent to the transaction are accurately captured.

What happens if there are issues after the sale?

If issues arise after the sale, such as disputes over the condition of the tractor or payment problems, the Bill of Sale will be a critical document. It serves as evidence of the agreed-upon terms and the state of the tractor at the time of the sale. In many cases, this document might help resolve misunderstandings amicably. However, legal action may be considered if a resolution cannot be reached through negotiation.

Tractor Bill of Sale forms can be obtained through various sources. Many websites offer free or paid templates. Additionally, local agricultural offices or legal consultants may provide forms tailored to Arizona's requirements. Always ensure that the form you use is updated and complies with state laws for the best protection during your transaction.