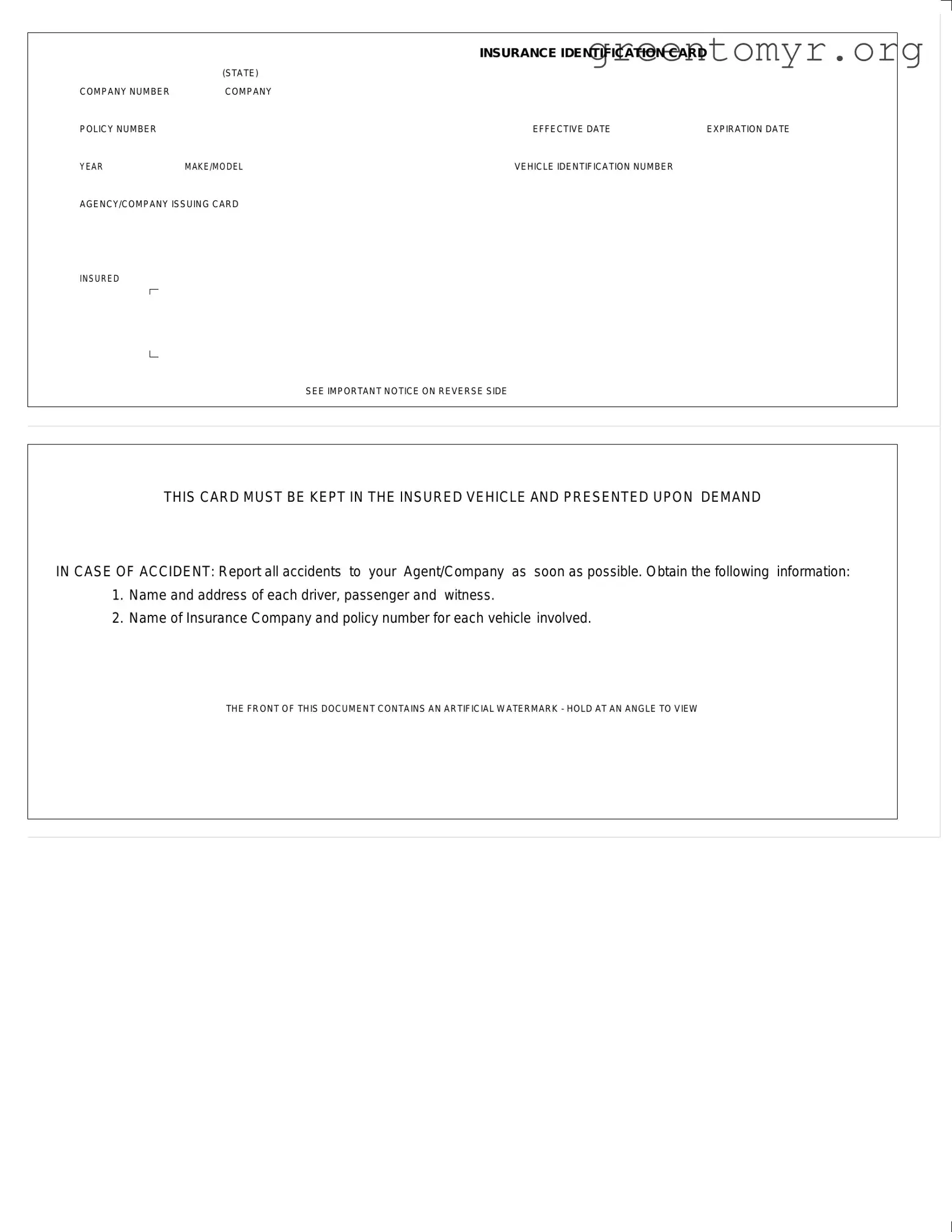

Fill in a Valid Auto Insurance Card Template

The Auto Insurance Card is an important document that provides proof of insurance coverage for your vehicle. It contains essential information such as the company policy number, effective dates, and details about your vehicle. Remember to keep this card in your car and always present it upon request, especially in the event of an accident.

If you need to fill out the Auto Insurance Card form, click the button below to get started.