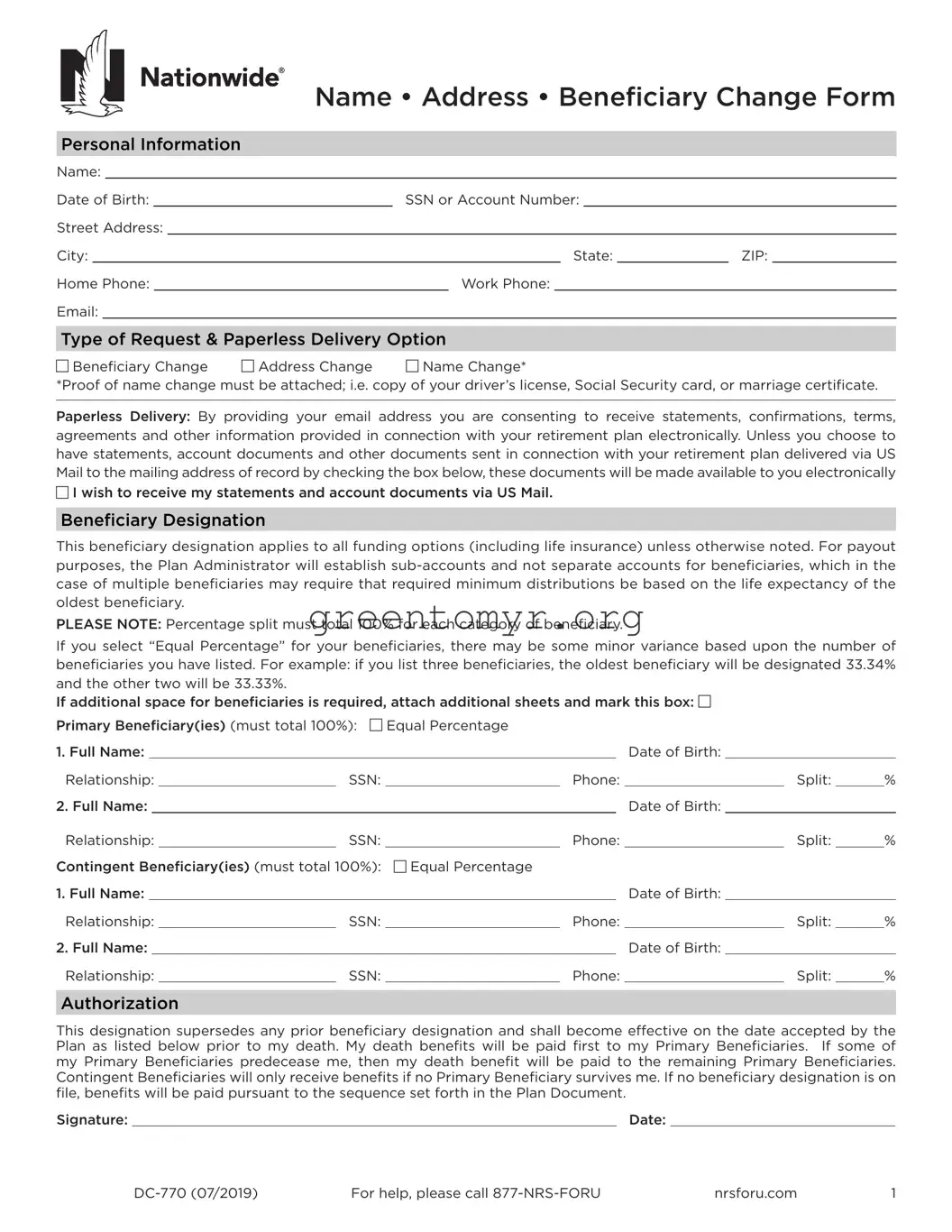

Name • Address • Beneficiary Change Form

Personal Information

Name:

Date of Birth: |

|

|

SSN or Account Number: |

|

|

|

|

Street Address: |

|

|

|

|

|

|

|

|

|

|

City: |

|

|

|

|

|

State: |

|

ZIP: |

|

Home Phone: |

|

|

|

Work Phone: |

|

|

|

|

Email: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type of Request & Paperless Delivery Option |

|

|

|

c Beneficiary Change |

c Address Change |

c Name Change* |

|

|

|

*Proof of name change must be attached; i.e. copy of your driver’s license, Social Security card, or marriage certificate.

Paperless Delivery: By providing your email address you are consenting to receive statements, confirmations, terms, agreements and other information provided in connection with your retirement plan electronically. Unless you choose to have statements, account documents and other documents sent in connection with your retirement plan delivered via US Mail to the mailing address of record by checking the box below, these documents will be made available to you electronically

cI wish to receive my statements and account documents via US Mail.

Beneficiary Designation

This beneficiary designation applies to all funding options (including life insurance) unless otherwise noted. For payout purposes, the Plan Administrator will establish sub-accounts and not separate accounts for beneficiaries, which in the case of multiple beneficiaries may require that required minimum distributions be based on the life expectancy of the oldest beneficiary.

PLEASE NOTE: Percentage split must total 100% for each category of beneficiary.

If you select “Equal Percentage” for your beneficiaries, there may be some minor variance based upon the number of beneficiaries you have listed. For example: if you list three beneficiaries, the oldest beneficiary will be designated 33.34% and the other two will be 33.33%.

If additional space for beneficiaries is required, attach additional sheets and mark this box: c

Primary Beneficiary(ies) (must total 100%): c Equal Percentage

1. Full Name: |

|

|

|

|

|

|

Date of Birth: |

|

|

|

Relationship: |

|

SSN: |

|

Phone: |

|

|

Split: |

% |

2. Full Name: |

|

|

|

|

|

|

Date of Birth: |

|

|

|

|

Relationship: |

|

SSN: |

|

Phone: |

|

|

Split: |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Contingent Beneficiary(ies) (must total 100%): c Equal Percentage

1. Full Name: |

|

|

|

|

|

|

Date of Birth: |

|

|

|

Relationship: |

|

SSN: |

|

Phone: |

|

|

Split: |

% |

2. Full Name: |

|

|

|

|

|

|

Date of Birth: |

|

|

|

|

Relationship: |

|

SSN: |

|

Phone: |

|

|

Split: |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Authorization

This designation supersedes any prior beneficiary designation and shall become effective on the date accepted by the Plan as listed below prior to my death. My death benefits will be paid first to my Primary Beneficiaries. If some of my Primary Beneficiaries predecease me, then my death benefit will be paid to the remaining Primary Beneficiaries.

Contingent Beneficiaries will only receive benefits if no Primary Beneficiary survives me. If no beneficiary designation is on file, benefits will be paid pursuant to the sequence set forth in the Plan Document.

Signature: |

|

Date: |

|

|

DC-770 (07/2019) |

For help, please call 877-NRS-FORU |

|

nrsforu.com |

1 |

Model Beneficiary Designations

Indicate the full names of the beneficiaries, their Social Security numbers, date of birth, relationship to you, address, phone number, and split you’d like each one of them to receive. Please use the following designations as a guide when completing this form.

|

Name |

Split% |

Relationship |

SSN |

Date Of Birth |

1. |

Primary: Joan Nation |

100% |

spouse |

123-45-6789 |

01/02/1962 |

2. |

Primary: Joan Nation |

100% |

spouse |

123-45-6789 |

01/02/1962 |

|

Contingent: Henry Nation |

100% |

son |

987-65-4321 |

06/26/1984 |

3. |

Primary: Joan Nation |

100% |

spouse |

123-45-6789 |

01/02/1962 |

|

Contingent: Henry Nation |

50% |

son |

987-65-4321 |

06/26/1984 |

|

Contingent: Betty Nation |

50% |

daughter |

305-24-9731 |

02/12/1980 |

4. |

Primary: Henry Nation |

50% |

son |

987-65-4321 |

06/26/1984 |

|

Primary: Betty Nation |

50% |

daughter |

305-24-9731 |

02/12/1980 |

5. |

Primary: Henry Nation |

34% |

son |

987-65-4321 |

06/26/1984 |

|

Primary: Betty Nation |

33% |

daughter |

305-24-9731 |

02/12/1980 |

|

Primary: John Nation |

33% |

son |

876-91-3416 |

09/31/1986 |

6. |

Primary: Sara Nation |

60% |

mother |

811-61-1781 |

10/14/1950 |

|

Primary: George Nation |

40% |

father |

916-18-1781 |

12/30/1945 |

|

Contingent: Jean Nation |

100% |

sister |

913-19-3319 |

03/29/1971 |

7.Primary: My Estate

8.First National Bank of Canton, Ohio, as Trustee under Trust Agreement with Robert E. Nation dated January 1, 2002. (Attach a copy of the title and signature page of the Trust).

Generic beneficiary designations will not be accepted. Examples of generic designations include:

1.My spouse, parent(s), sister(s), brother(s), son(s), daughter(s).

2.My children.

3.Children of this marriage or any past marriage.

4.As designated in my will.

Form Return

By mail: |

Nationwide Retirement Solutions |

Email: |

[email protected] |

|

PO Box 182797 |

By fax: |

877-677-4329 |

|

Columbus, OH 43218-2797 |

|

|

2 |

DC-770 (07/2019) |

For help, please call 877-NRS-FORU |

nrsforu.com |