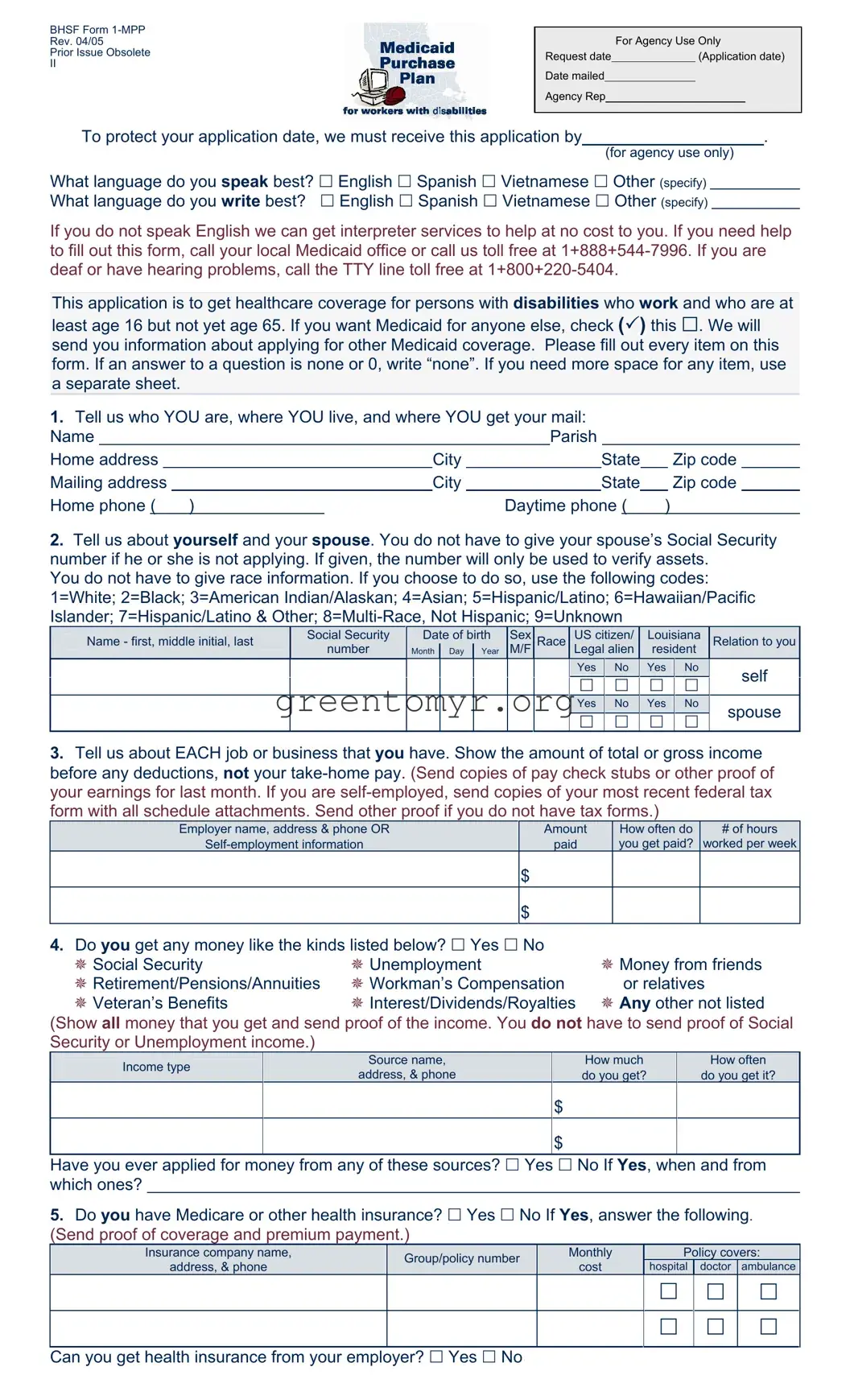

BHSF Form 1-MPP

Rev. 04/05

Prior Issue Obsolete

II

For Agency Use Only

Request date |

|

(Application date) |

Date mailed

Agency Rep

To protect your application date, we must receive this application by |

|

. |

(for agency use only)

What language do you speak best?

English

Spanish

Vietnamese

Other (specify) What language do you write best?

English

Spanish

Vietnamese

Other (specify)

If you do not speak English we can get interpreter services to help at no cost to you. If you need help to fill out this form, call your local Medicaid office or call us toll free at 1+888+544-7996. If you are deaf or have hearing problems, call the TTY line toll free at 1+800+220-5404.

This application is to get healthcare coverage for persons with disabilities who work and who are at

least age 16 but not yet age 65. If you want Medicaid for anyone else, check ( ) this

. We will send you information about applying for other Medicaid coverage. Please fill out every item on this form. If an answer to a question is none or 0, write “none”. If you need more space for any item, use a separate sheet.

1.Tell us who YOU are, where YOU live, and where YOU get your mail:

Name |

|

|

|

Parish |

|

|

|

|

Home address |

|

City |

|

|

State |

|

Zip code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address |

|

City |

|

|

State |

|

Zip code |

|

|

|

|

|

|

|

|

|

|

|

|

Home phone ( ) |

|

Daytime phone ( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.Tell us about yourself and your spouse. You do not have to give your spouse’s Social Security number if he or she is not applying. If given, the number will only be used to verify assets.

You do not have to give race information. If you choose to do so, use the following codes: 1=White; 2=Black; 3=American Indian/Alaskan; 4=Asian; 5=Hispanic/Latino; 6=Hawaiian/Pacific Islander; 7=Hispanic/Latino & Other; 8=Multi-Race, Not Hispanic; 9=Unknown

Name - first, middle initial, last |

Social Security |

Date of birth |

Sex |

Race |

US citizen/ |

Louisiana |

Relation to you |

|

number |

Month |

Day |

Year |

M/F |

|

Legal alien |

resident |

|

|

Yes |

|

No |

|

Yes |

|

No |

|

self |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

No |

|

Yes |

|

No |

|

spouse |

|

|

|

|

|

|

3.Tell us about EACH job or business that you have. Show the amount of total or gross income before any deductions, not your take-home pay. (Send copies of pay check stubs or other proof of your earnings for last month. If you are self-employed, send copies of your most recent federal tax form with all schedule attachments. Send other proof if you do not have tax forms.)

Employer name, address & phone OR |

Amount |

How often do |

# of hours |

Self-employment information |

paid |

you get paid? |

worked per week |

$

$

4.Do you get any money like the kinds listed below?

Yes

No

Social Security |

Unemployment |

Money from friends |

Retirement/Pensions/Annuities |

Workman’s Compensation |

or relatives |

Veteran’s Benefits |

Interest/Dividends/Royalties |

Any other not listed |

(Show all money that you get and send proof of the income. You do not have to send proof of Social Security or Unemployment income.)

|

Income type |

|

Source name, |

|

|

How much |

|

How often |

|

|

|

address, & phone |

|

|

do you get? |

|

do you get it? |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

$

Have you ever applied for money from any of these sources?

Yes

No If Yes, when and from which ones?

5.Do you have Medicare or other health insurance?

Yes

No If Yes, answer the following. (Send proof of coverage and premium payment.)

|

Insurance company name, |

Group/policy number |

Monthly |

|

Policy covers: |

|

address, & phone |

cost |

hospital |

doctor |

ambulance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Can you get health insurance from your employer?

Yes

No

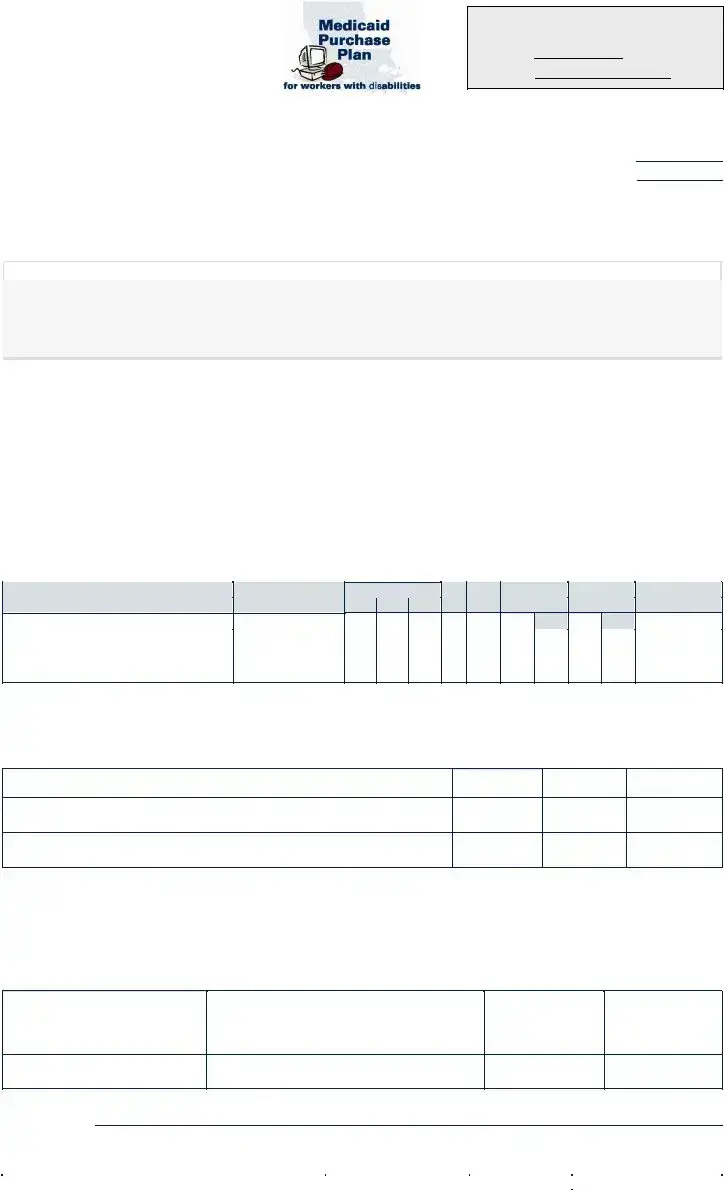

6.Do you, or you jointly with your spouse, have any assets or resources like those listed below?

Yes

No If Yes, give us the following information. (Send proof of ownership and value.)

|

Asset/Resource |

Company name, address, & phone; |

Value |

Amount owed |

|

|

Account number and/or description |

|

|

|

|

|

Checking/Savings accounts (type) |

|

$ |

|

|

|

|

|

|

|

Certificates of Deposit |

|

$ |

|

|

Retirement accounts |

|

$ |

|

|

Annuities/Trusts |

|

$ |

|

|

Stocks/Bonds |

|

$ |

|

|

Vehicles (if more than one) |

|

$ |

$ |

|

Property, other than your home |

|

$ |

$ |

|

Other (please be specific) |

|

$ |

$ |

7.Did you ever apply for or get Social Security Disability or Supplemental Security Income (SSI)

benefits?

Yes

No If Yes, when? |

|

Was a decision made?

Yes

No |

If Yes, what was the decision? |

|

|

|

|

|

|

8.What is your disability?

Tell us about the doctors or other medical providers who care for you:

Address & phone of this medical provider

9.Where did you find out about the Medicaid Purchase Plan?

Rights and Responsibilities

I declare that I am a U.S. citizen or in this country legally.

The information I gave on this form is true and correct to the best of my knowledge. I realize if I knowingly give information that is not true OR if I knowingly hold back information, I may get health benefits for which I am not eligible. If that happens, I can be lawfully punished for fraud. I may also have to pay Medicaid back for any medical bills which are paid incorrectly.

I understand that the information I give about my situation will be checked. I agree to help do that, and to let Medicaid get information it needs from government agencies, employers, medical providers, and other sources. If I refuse to help with this process or in later reviews caused by reported changes, or as part of a Recipient Eligibility review, it will mean that I can’t get Medicaid until I do help.

I know that Social Security numbers will only be used to get information from other government agencies to prove my eligibility.

I agree to tell Medicaid within 10 days if 1) I move out of state; 2) there are changes in where I live or get my mail; 3) there are any changes in other health insurance coverage; 4) there is any change in my work status.

By accepting Medicaid, I agree that any medical payments received from other sources will be sent to the Department of Health and Hospitals for any services that were covered by Medicaid.

I can ask for a Fair Hearing if I think the decision made on my case is unfair, incorrect or being made too late.

Medicaid can’t treat me differently because of my race, color, sex, age, disability, religion, nationality or political belief. If I think they have, I can call the U.S. DHHS Regional Office for Civil Rights in Dallas, TX at 1+800+368-1019 or write to Louisiana’s Department of Health & Hospitals, Human Resources at P. O. Box 1349 Baton Rouge, LA 70821-1349.

Signature of Applicant or Authorized Representative |

|

Date |

|

|

|

Signature of Agency Representative, if applicable |

|

Date |