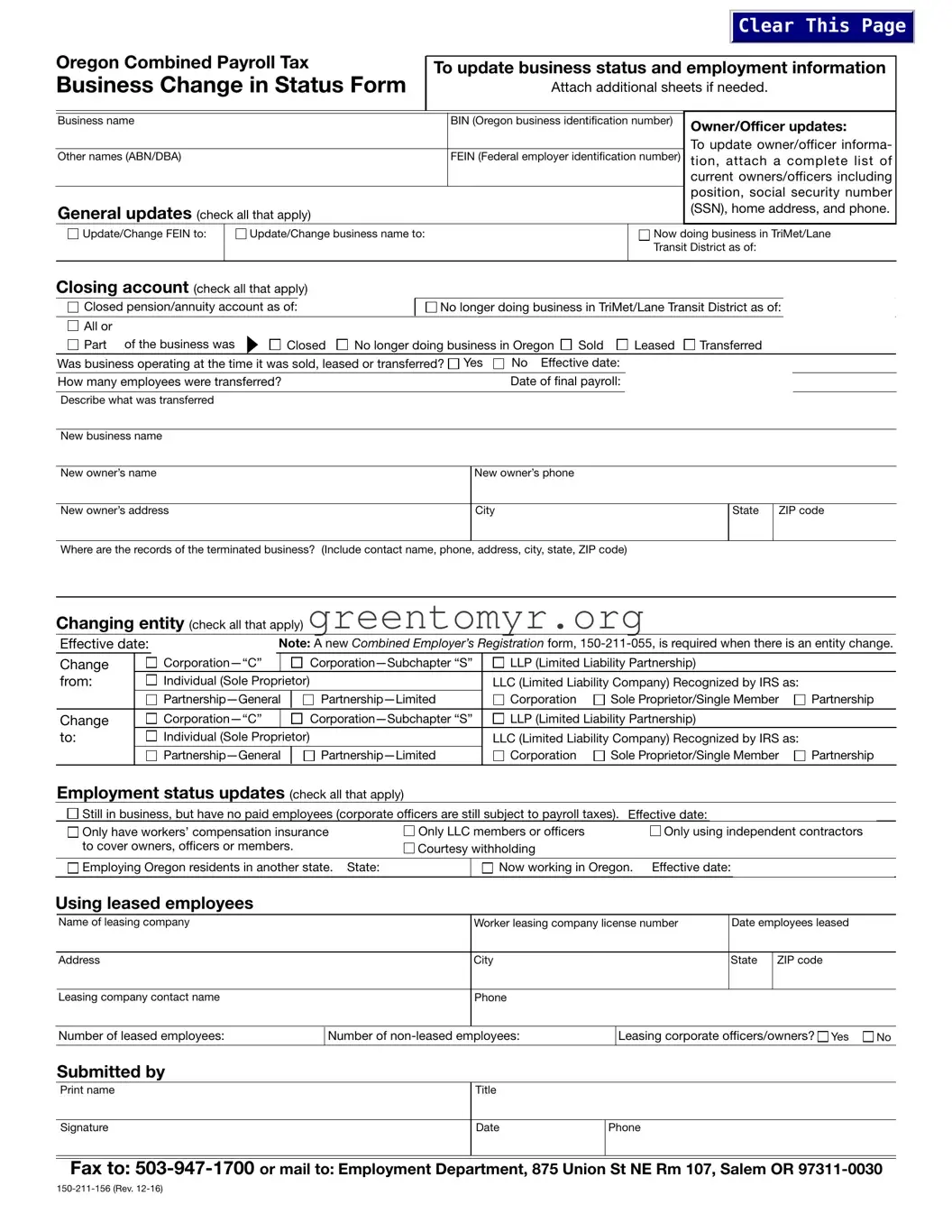

General updates

NOTE: Some federal employer identification number (FEIN) and name changes may require a new Combined Employer’s Registration, 150-211-055, form to be completed.

•Provide the correct FEIN for your business.

•Correct the business name and spelling errors as needed.

•Check the “Now doing business in TriMet/Lane Transit District” box and include the effective date if you’re an employer paying wages earned in the TriMet or Lane Transit District. You must register and file with the Oregon Department of Revenue. Wages include salaries, commis- sions, bonuses, fees, payments to a deferred compensation plan, or other items of value.

•For boundary questions, see the Oregon Combined Payroll Tax booklet, 150-211-155, for the list of cities and ZIP codes.

——The TriMet district includes parts of Multnomah, Wash- ington, and Clackamas counties. For TriMet boundary questions call 503-962-6466.

——Lane Transit District serves the Eugene-Springfield area. For Lane Transit District boundary questions call 541-682-6100.

Re-opened business

To re-open your business that you’ve closed for:

•Less than one year, file a:

—— Business Change in Status Form, 150-211-156.

•One year or more, file a:

—— Combined Employer’s Registration, 150-211-055.

For more questions contact DOR at 503-945-8091.

Employment status updates

•Check each box that applies to your business and include the effective date of change.

•If Oregon residents are working out of Oregon, indicate which state.

•Check box and indicate effective date of employees now working in Oregon that previously worked in another state.

Using leased employees

If you lease your employees from a Professional Employer Organization (PEO)/Worker Leasing Company, fill in the information requested.

Changing entity

Include the effective date of change, check the box of the entity you’re changing from and the box of the entity chang- ing to.

NOTE: Entity changes require the completion of a new Com- bined Employer’s Registration form.

Examples include, but aren’t limited to:

•Changing from a sole proprietorship to a partnership or corporation.

•Changing from a partnership to a sole proprietorship or corporation.

•Changing from a corporation to a sole proprietorship or partnership.

•Changing of members in a partnership of five or fewer partners.

•Adding or removing a spouse as a liable owner.

•Changing from a sole proprietorship, corporation, or part- nership to a limited liability company.

Still in business, but have no paid employees (corporate officers are still subject to payroll taxes). Effective date:

Still in business, but have no paid employees (corporate officers are still subject to payroll taxes). Effective date: