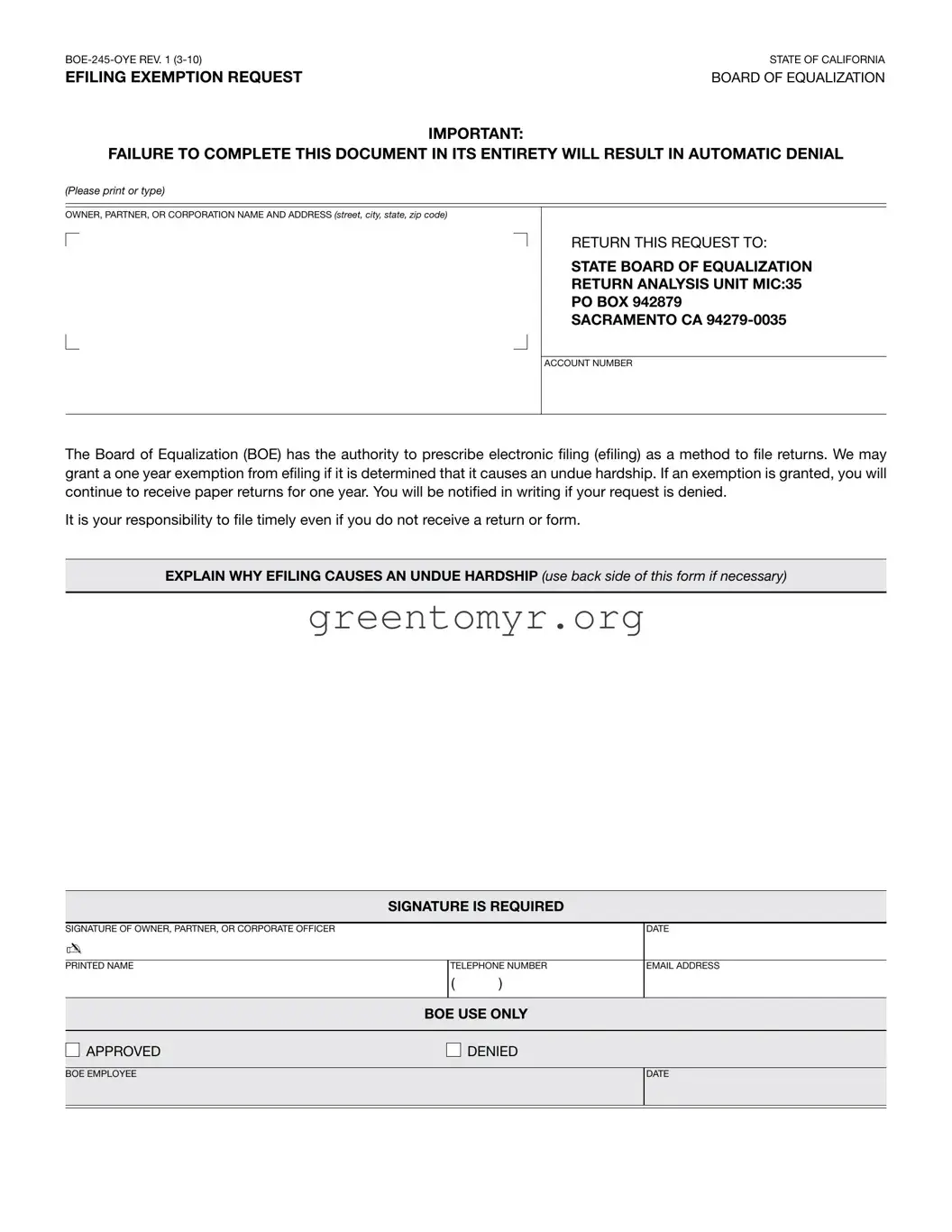

The BOE 245 Oye form is crucial for individuals and entities seeking an exemption from e-filing requirements mandated by the State of California's Board of Equalization. This form serves as a formal request for exemption and must be filled out completely to avoid automatic denial. It asks for the owner's name, address, and the account number for identification purposes. Additionally, applicants are required to explain how e-filing creates an undue hardship for them, with the option to provide an explanation on the reverse side. A signature is needed from the owner, partner, or corporate officer, along with the date of submission. Failure to adhere to these requirements could lead to denied requests, emphasizing the importance of meticulous completion. The form must be sent to the Board of Equalization's Return Analysis Unit in Sacramento, ensuring it reaches the appropriate office for processing. Understanding these key components is essential for anyone looking to navigate the exemption process effectively.