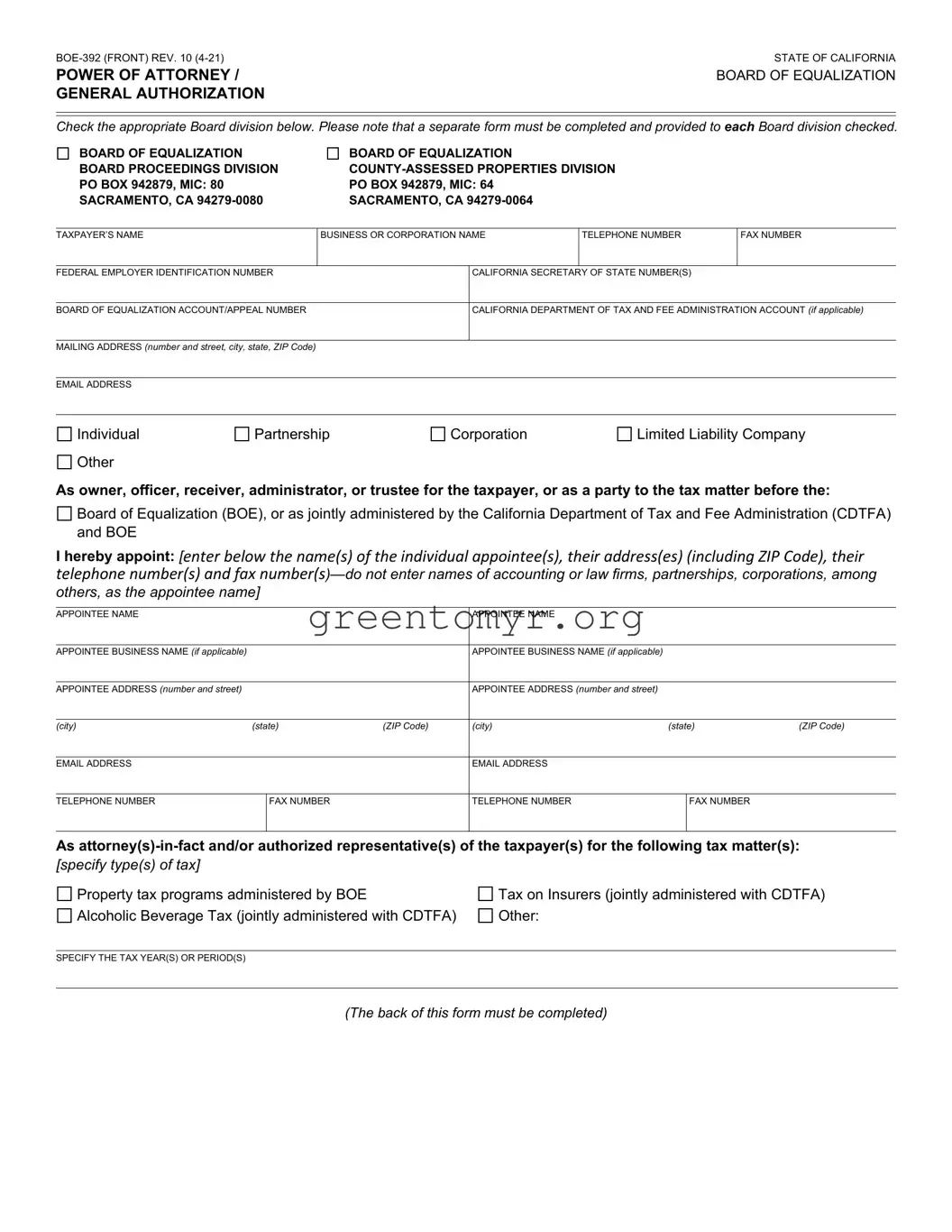

BOE-392 (FRONT) REV. 10 (4-21) |

STATE OF CALIFORNIA |

POWER OF ATTORNEY / |

BOARD OF EQUALIZATION |

GENERAL AUTHORIZATION |

|

Check the appropriate Board division below. Please note that a separate form must be completed and provided to each Board division checked.

BOARD OF EQUALIZATION BOARD PROCEEDINGS DIVISION PO BOX 942879, MIC: 80 SACRAMENTO, CA 94279-0080

BOARD OF EQUALIZATION COUNTY-ASSESSED PROPERTIES DIVISION PO BOX 942879, MIC: 64 SACRAMENTO, CA 94279-0064

BUSINESS OR CORPORATION NAME

FEDERAL EMPLOYER IDENTIFICATION NUMBER

CALIFORNIA SECRETARY OF STATE NUMBER(S)

BOARD OF EQUALIZATION ACCOUNT/APPEAL NUMBER

CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION ACCOUNT (if applicable)

MAILING ADDRESS (number and street, city, state, ZIP Code)

EMAIL ADDRESS

Individual |

Partnership |

Corporation |

Limited Liability Company |

Other |

|

|

|

As owner, officer, receiver, administrator, or trustee for the taxpayer, or as a party to the tax matter before the:

Board of Equalization (BOE), or as jointly administered by the California Department of Tax and Fee Administration (CDTFA) and BOE

Board of Equalization (BOE), or as jointly administered by the California Department of Tax and Fee Administration (CDTFA) and BOE

I hereby appoint: [enter below the name(s) of the individual appointee(s), their address(es) (including ZIP Code), their telephone number(s) and fax number(s)—do not enter names of accounting or law firms, partnerships, corporations, among

others, as the appointee name]

APPOINTEE BUSINESS NAME (if applicable)

APPOINTEE BUSINESS NAME (if applicable)

APPOINTEE ADDRESS (number and street)

APPOINTEE ADDRESS (number and street)

(city) |

(state) |

(ZIP Code) |

(city) |

(state) |

(ZIP Code) |

As attorney(s)-in-fact and/or authorized representative(s) of the taxpayer(s) for the following tax matter(s): [specify type(s) of tax]

Property tax programs administered by BOE |

Tax on Insurers (jointly administered with CDTFA) |

Alcoholic Beverage Tax (jointly administered with CDTFA) |

Other: |

SPECIFY THE TAX YEAR(S) OR PERIOD(S)

(The back of this form must be completed)

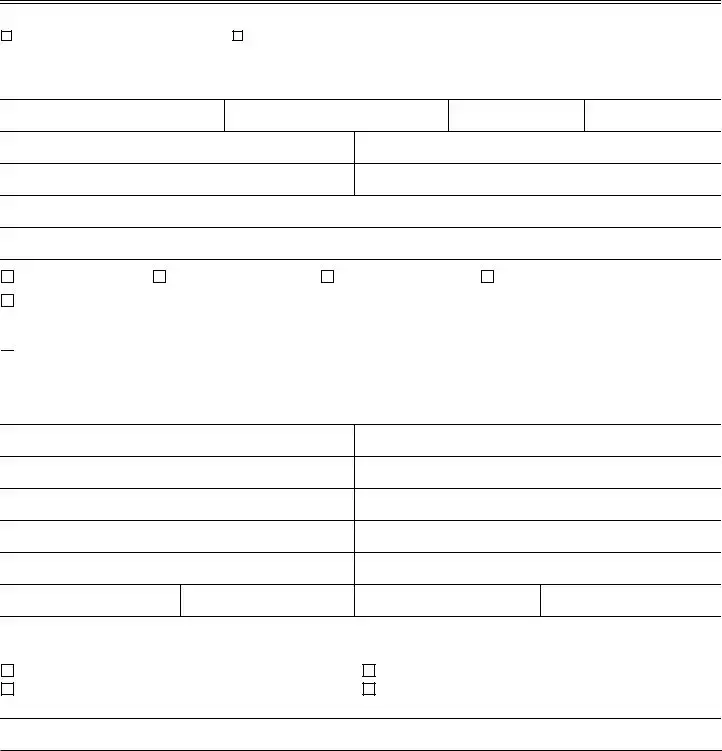

BOE-392 (BACK) REV. 10 (4-21)

The attorney(s)-in-fact and/or authorized representative(s) (or any of them) is/are authorized, subject to revocation, to receive confidential tax information, and to perform on behalf of the taxpayer(s) the following act(s) for the tax matter(s) described above:

[check the box(es) for the power(s) granted]

General authorization (including all acts described below).

Specific authorization (selected acts described below).

To confer and resolve any assessment, claim, or collection of a deficiency or other tax matter pending before the identified Board division and attend any meetings or hearings thereto for the specified matter(s) identified above.

To receive, but not to endorse and collect, checks in payment of any refund of taxes, penalties, or interest. To execute petitions, claims for refund, and/or amendments thereto.

To execute consents extending the statutory period for assessment or determination of taxes. To delegate authority or to substitute another representative.

Other (specify):

This power of attorney/general authorization revokes all earlier power(s) of attorney/general authorizations on file with the Board of Equalization as identified above for the same matters and years or periods covered by this form, except for the following: [specify to whom granted, date and address, or refer to attached copies of earlier power(s)]

DATE POWER OF ATTORNEY/GENERAL AUTHORIZATION GRANTED

ADDRESS (number and street, city, state, ZIP Code)

Unless limited, this power of attorney will remain in effect until the final resolution of all tax matters specified herein.

(specify expiration date if limited term)

TIME LIMIT/EXPIRATION DATE (for Board of Equalization purposes)

Signature of taxpayer(s)—If a tax matter concerns a joint return, both spouses must sign if joint representation is requested. If you are a corporate officer, partner, guardian, tax matters partner/person, executor, receiver, registered domestic partner, administrator, or trustee on behalf of the taxpayer, by signing this power of attorney/general authorization, you are certifying that you have the authority to execute this form on behalf of the taxpayer.

►IF THIS POWER OF ATTORNEY/GENERAL AUTHORIZATION IS NOT SIGNED AND DATED BY AN AUTHORIZED INDIVIDUAL, IT WILL BE RETURNED AS INVALID.

SIGNATURE |

TITLE (if applicable) |

DATE |

|

|

|

PRINT NAME |

|

TELEPHONE NUMBER |

|

|

|

SIGNATURE |

TITLE (if applicable) |

DATE |

|

|

|

PRINT NAME |

|

TELEPHONE NUMBER |

|

|

|

|

|

|

Board of Equalization (BOE), or as jointly administered by the California Department of Tax and Fee Administration (CDTFA) and BOE

Board of Equalization (BOE), or as jointly administered by the California Department of Tax and Fee Administration (CDTFA) and BOE