BOE-400-SPA REV. 1 (FRONT) (7-05) |

|

|

|

|

|

|

|

|

|

|

|

|

STATE OF CALIFORNIA |

APPLICATION FOR SELLER’S PERMIT |

|

|

|

|

|

|

|

|

|

BOARD OF EQUALIZATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. PERMIT TYPE: (check one) |

Regular |

Temporary |

|

|

|

FOR BOARD USE ONLY |

|

|

|

2. TYPE OF OWNERSHIP (check one) |

|

* Must provide partnership agreement |

TAX |

|

IND |

OFFICE |

|

|

|

PERMIT NUMBER |

Sole Owner |

|

|

Husband/Wife Co-ownership |

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporation |

|

|

Limited Liability Company (LLC) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unincorporated Business Trust |

NAICS CODE |

BUS CODE |

A.C.C. |

REPORTING BASIS |

|

TAX AREA CODE |

General Partnership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Limited Liability Partnership (LLP) * |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Limited Partnership (LP) * |

|

|

|

|

|

RETURN TYPE |

|

|

|

|

|

(Registered to practice law, accounting or architecture) |

PROCESSED BY |

PERMIT ISSUE |

|

|

(1) 401-A |

|

(2) 401-EZ |

|

|

|

Registered Domestic Partnership |

|

|

|

|

|

|

|

|

|

|

|

|

DATE |

|

VERIFICATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other (describe) |

|

|

|

|

|

|

|

|

___ / ___ / ___ |

|

|

DL |

|

PA |

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

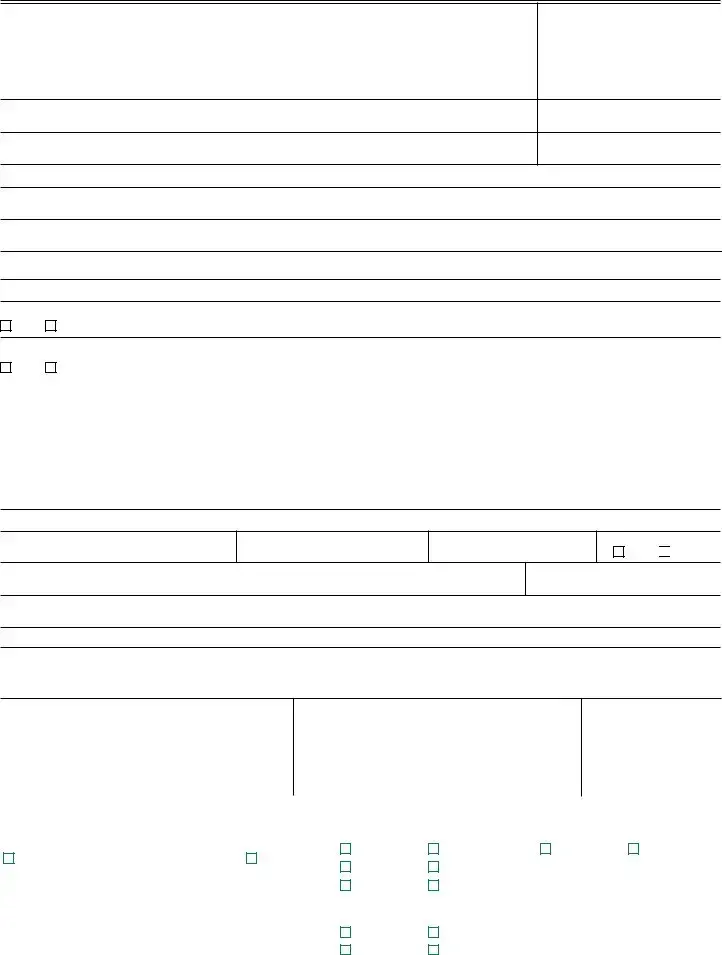

3. NAME OF SOLE OWNER, CORPORATION, LLC, PARTNERSHIP, OR TRUST |

|

|

|

4. STATE OF INCORPORATION OR ORGANIZATION |

|

|

|

|

|

|

|

|

|

|

|

|

5. BUSINESS TRADE NAME / “DOING BUSINESS AS” [DBA] (if any) |

|

|

|

|

|

6. DATE YOU WILL BEGIN BUSINESS ACTIVITIES (month, day, and year) |

|

|

|

|

|

|

|

|

|

|

7. CORPORATE, LLC, LLP OR LP NUMBER FROM CALIFORNIA SECRETARY OF STATE |

|

|

|

8. FEDERAL EMPLOYER IDENTIFICATION NUMBER (FEIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHECK ONE |

Owner/Co-Owners |

Partners |

Registered Domestic |

Corp. Officers |

LLC Officers/Managers/ |

|

|

Trustees/ |

|

|

|

|

|

Partners |

|

|

|

|

Members |

|

|

|

|

Beneficiaries |

Use additional sheets to include information for more than three individuals.

9. FULL NAME (first, middle, last) |

|

|

|

|

|

|

|

|

|

10. TITLE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. SOCIAL SECURITY NUMBER (corporate officers excluded) |

|

|

|

|

|

12. DRIVER LICENSE NUMBER (attach copy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. HOME ADDRESS (street, city, state, zip code) |

|

|

|

|

|

|

|

|

14. HOME TELEPHONE NUMBER |

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

15. NAME OF A PERSONAL REFERENCE NOT LIVING WITH YOU |

16. ADDRESS (street, city, state, zip code) |

|

|

17. REFERENCE TELEPHONE NUMBER |

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. FULL NAME OF ADDITIONAL PARTNER, OFFICER, OR MEMBER (first, middle, last) |

|

|

|

|

|

19. TITLE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20. SOCIAL SECURITY NUMBER (corporate officers excluded) |

|

|

|

|

|

21. DRIVER LICENSE NUMBER (attach copy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22. HOME ADDRESS (street, city, state, zip code) |

|

|

|

|

|

|

|

|

23. HOME TELEPHONE NUMBER |

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

24. NAME OF A PERSONAL REFERENCE NOT LIVING WITH YOU |

25. ADDRESS (street, city, state, zip code) |

|

|

26. REFERENCE TELEPHONE NUMBER |

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27. FULL NAME OF ADDITIONAL PARTNER, OFFICER, OR MEMBER (first, middle, last) |

|

|

|

|

|

28. TITLE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29. SOCIAL SECURITY NUMBER (corporate officers excluded) |

|

|

|

|

|

30. DRIVER LICENSE NUMBER (attach copy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31. HOME ADDRESS (street, city, state, zip code) |

|

|

|

|

|

|

|

|

32. HOME TELEPHONE NUMBER |

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

33. NAME OF A PERSONAL REFERENCE NOT LIVING WITH YOU |

34. ADDRESS (street, city, state, zip code) |

|

|

35. REFERENCE TELEPHONE NUMBER |

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36. TYPE OF BUSINESS (check one that best describes your business) |

|

|

|

|

|

|

37. NUMBER OF SELLING LOCATIONS |

Retail |

Wholesale |

Mfg. |

Repair |

Service |

Construction |

Contractor |

|

Leasing |

|

|

(if 2 or more, see Item No. 66) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

38. WHAT ITEMS WILL YOU SELL? |

|

|

|

|

|

|

|

|

|

39. CHECK ONE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Full Time |

Part Time |

|

|

|

|

|

|

|

|

|

|

|

40. BUSINESS ADDRESS (street, city, state, zip code) [do not list P.O. Box or mailing service] |

|

|

|

|

|

41. BUSINESS TELEPHONE NUMBER |

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

42. MAILING ADDRESS (street, city, state, zip code) [if different from business address] |

|

|

|

|

|

43. BUSINESS FAX NUMBER |

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

44. BUSINESS WEBSITE ADDRESS |

|

|

45. BUSINESS EMAIL ADDRESS |

|

|

|

|

46. DO YOU MAKE INTERNET SALES? |

www. |

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

47. NAME OF BUSINESS LANDLORD |

|

|

48. LANDLORD ADDRESS (street, city, state, zip code) |

|

|

49. LANDLORD TELEPHONE NUMBER |

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

50. PROJECTED MONTHLY GROSS SALES |

|

51. PROJECTED MONTHLY TAXABLE SALES |

|

52. ALCOHOLIC BEVERAGE CONTROL LICENSE NUMBER (if applicable) |

$ |

|

|

|

$ |

|

|

|

|

___ ___ - ___ ___ ___ ___ ___ ___ |

|

|

|

|

|

|

|

|

|

|

|

53. SELLING NEW TIRES? |

|

|

54. SELLING COVERED ELECTRONIC DEVICES? |

|

|

55. SELLING TOBACCO AT RETAIL? |

Yes |

No |

|

|

Yes |

No |

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No

No