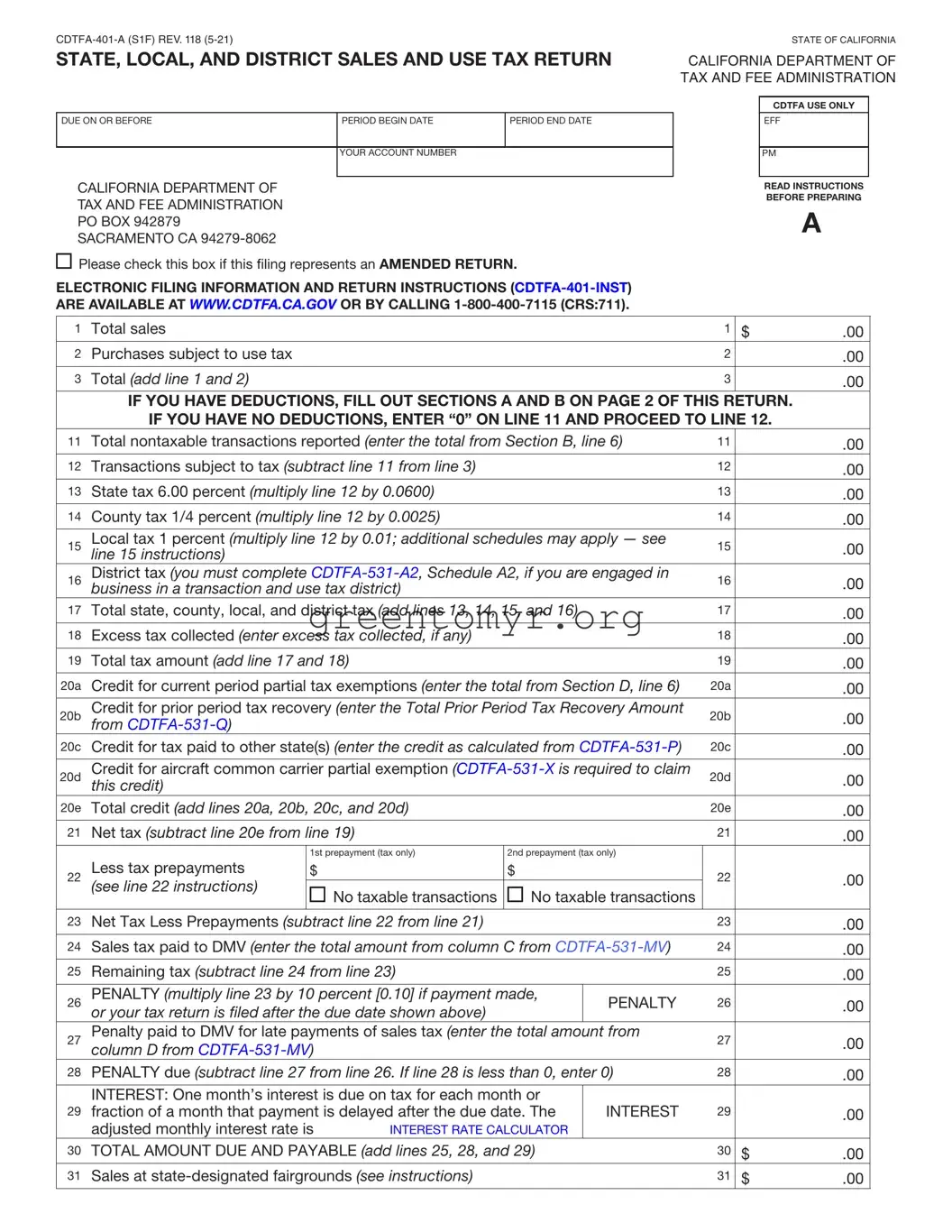

The BOE 401 A2 form, officially known as the State, Local, and District Sales and Use Tax Return, is issued by the California Department of Tax and Fee Administration (CDTFA). This form is crucial for businesses in California as it facilitates the reporting of sales and use tax obligations. The information contained within the form helps determine the total taxes owed based on sales made during a particular reporting period.

Businesses that make taxable sales or purchases subject to use tax in California are required to file this form. This includes retailers and service providers who exceed the tax filing thresholds established by the CDTFA. Even if you have no taxable transactions for a reporting period, you may still need to file.

The BOE 401 A2 form is typically due on or before the last day of the month following the close of the reporting period. For example, if the reporting period ends on December 31, the form is due by January 31 of the following year. It’s important to always confirm specific due dates on the CDTFA website or contact them directly for updates.

Filling out this form involves several steps:

-

Start by entering total sales and purchases subject to use tax.

-

Calculate any deductions, which must be reported in Section A and B.

-

Multiply taxable transactions by the appropriate tax rates to determine your tax liability.

-

Report any credits or deductions applicable to your situation.

-

Complete all sections, ensuring you have double-checked for accuracy before submission.

Detailed instructions are available on the CDTFA website and should be consulted to avoid common mistakes.

What if I do not have any taxable transactions?

If your business did not engage in any taxable sales or purchases during the reporting period, you still need to file the BOE 401 A2 form. In this case, simply enter “0” on the applicable lines where tax amounts would go, and submit the form before the due date.

What are the penalties for late filing?

Late filing of the BOE 401 A2 form can result in penalties. If you file after the due date, a penalty of 10% of the tax amount owed may apply. Additionally, interest can accrue on the unpaid tax balance for each month or fraction of a month until payment is made. It's in your best interest to file on time to avoid these additional costs.

Yes, the CDTFA provides options for electronic filing, which can expedite the process and reduce the chances of errors. Businesses are encouraged to utilize the CDTFA's online services for a more efficient way to file and pay applicable taxes.

If you discover an error after submitting your BOE 401 A2 form, you can file an amended return. To indicate that your filing is amended, check the designated box on the form. Be sure to provide corrected information and any additional documentation that supports your amendment. Submitting corrections promptly is crucial to minimize possible penalties.

For further assistance, businesses can visit the CDTFA website, which offers a wealth of resources including detailed filing instructions, FAQs, and contact information. Alternatively, you can call their customer service at 1-800-400-7115 for direct guidance.