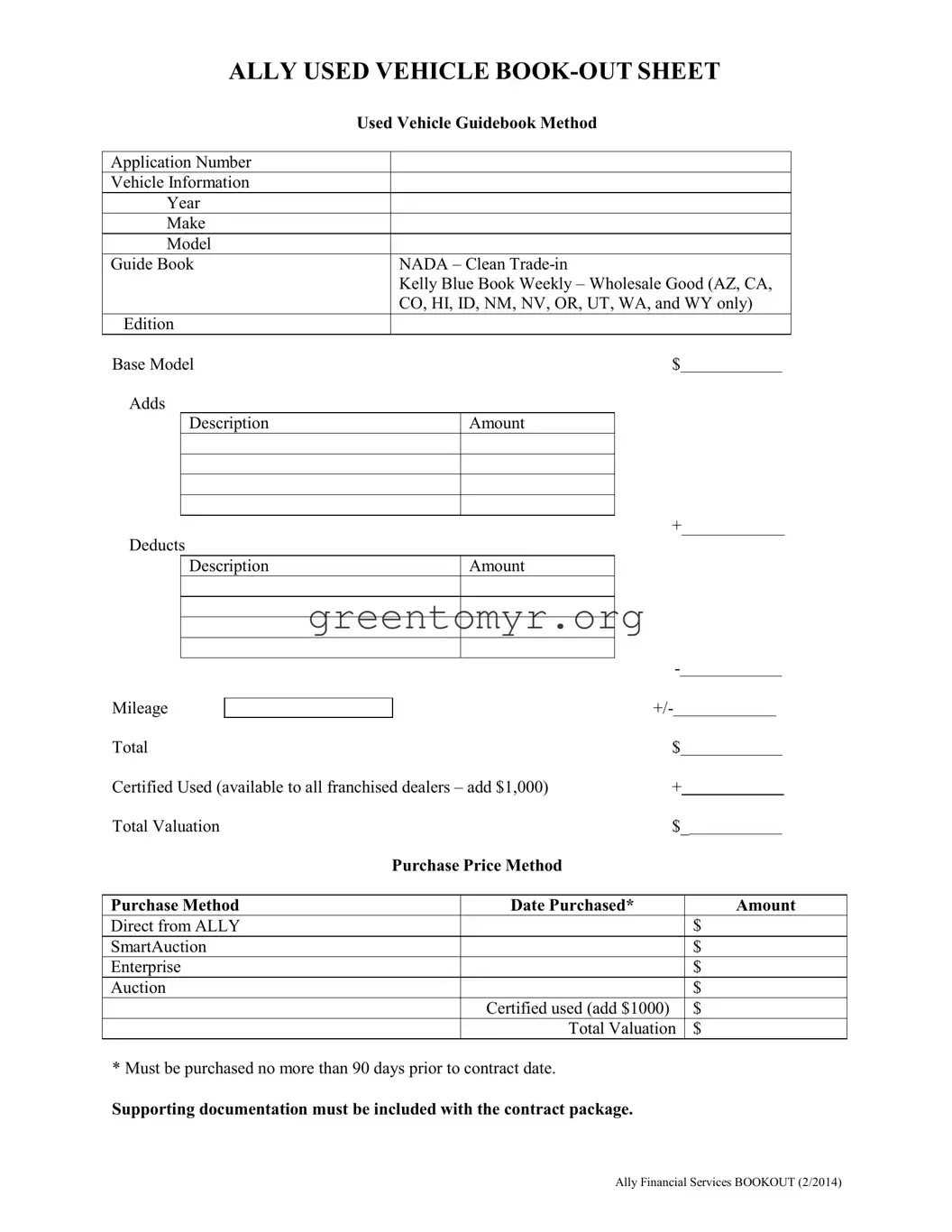

Filling out the Book Out Sheet form is crucial for accurate vehicle valuation. Yet, many people trip up on simple details that can complicate the process or lead to inaccuracies. One common mistake is failing to include the method of purchase. Different purchase methods, whether direct from Ally, SmartAuction, Enterprise, or auction, require specific documentation. Omitting this information can delay processing and cause confusion regarding the transaction.

Another frequent error involves entering the purchase date incorrectly. The date must be no more than 90 days prior to the contract date. If this isn’t observed, it might result in discrepancies that could impact valuations. Make sure to double-check the date against your records to ensure accuracy.

People often miscalculate the total valuation by either adding or subtracting amounts incorrectly. These small mistakes in arithmetic can lead to a final figure that doesn’t reflect the vehicle’s true worth. It’s wise to use a calculator or review totals several times before submission.

Inaccurate entries in the vehicle information section are also a common pitfall. This includes mistakes in the year, make, or model of the vehicle. Double-checking these details helps ensure the valuation process flows smoothly and avoids problems down the line.

Another area where errors happen is in the calculation of certified used vehicle adjustments. If a vehicle qualifies as certified, remember to add the appropriate amounts. Forgetting to include this can undervalue the vehicle.

People sometimes skip including supporting documentation, which is essential for verifying the details provided in the form. Documentation, such as the title, bill of sale, or previous purchase agreement, should always be included with the contract package for a complete submission.

Another mistake is leaving out repair or enhancement adds and deducts. Details about any modifications or damages can significantly influence the vehicle’s value. Clear descriptions of these items, along with their corresponding amounts, must be included to give an accurate picture.

Some individuals overlook the mileage field or enter incorrect readings. Recording the precise mileage is essential since it directly affects valuation calculations. Always cross-reference this information with the vehicle's odometer.

People often neglect to review the guidebook sources used for valuation. It’s important to ensure the correct and up-to-date resources are referenced, such as NADA or Kelly Blue Book, since outdated or improper guides can lead to inaccurate vehicle valuations.

Lastly, an overlooked yet critical mistake is the lack of attention to the overall presentation of the form. An illegible or messy form can lead to processing delays. Taking the time to fill it out neatly and correctly can make a significant difference in ensuring a smooth review and submission process.