The BOS 678 form, also known as the Business Ownership Statement, is a document used to provide information about the ownership of a business entity. It is often required by government agencies for various purposes, including licensing and compliance. The form helps ensure that accurate ownership details are available for public records.

Businesses that are registering with a state agency or seeking certain licenses may need to complete the BOS 678 form. This includes both new startups and existing businesses that are making changes to their ownership structure. It's crucial to check with local regulations to determine if this form is necessary for your specific situation.

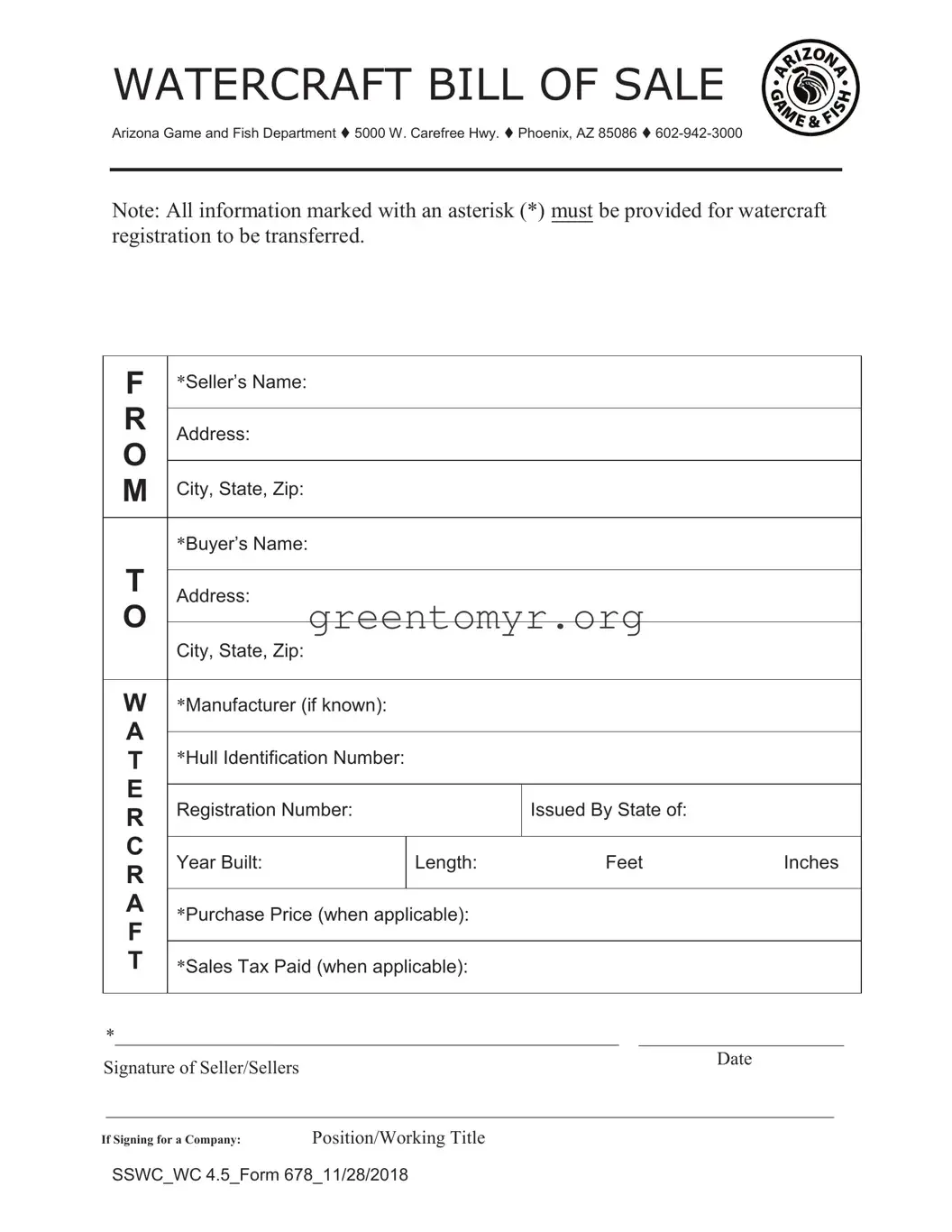

The BOS 678 form typically requires details such as:

-

The name of the business

-

Type of business structure (e.g., corporation, LLC, partnership)

-

Names and addresses of all owners or shareholders

-

Percentage of ownership held by each individual

-

Contact information for the business

Providing accurate and complete information is essential to avoid delays or complications in the filing process.

The submission process for the BOS 678 form varies by state and agency. Generally, you can file the form online through the official state business portal or by mailing a paper copy to the designated office. Some jurisdictions may require in-person submission. Always confirm the submission method specific to your state's requirements.

Many states do charge a filing fee for the BOS 678 form. The amount can differ based on the state and the type of business entity. It’s advisable to verify the current fee schedule on the relevant state’s business registration website before filing.

Once the BOS 678 form is submitted, the relevant agency will process the application. This may involve verifying the information provided and ensuring compliance with state laws. Depending on the agency’s workload, processing times can vary. Typically, you will receive confirmation of your filing, which may include an approval or request for additional information if needed.

Yes, it is generally possible to amend the BOS 678 form after it has been submitted. If ownership changes or corrections are needed, you will need to file an amendment form or follow the procedures specified by the state. Making timely updates is important to maintain accurate business records and comply with regulatory requirements.