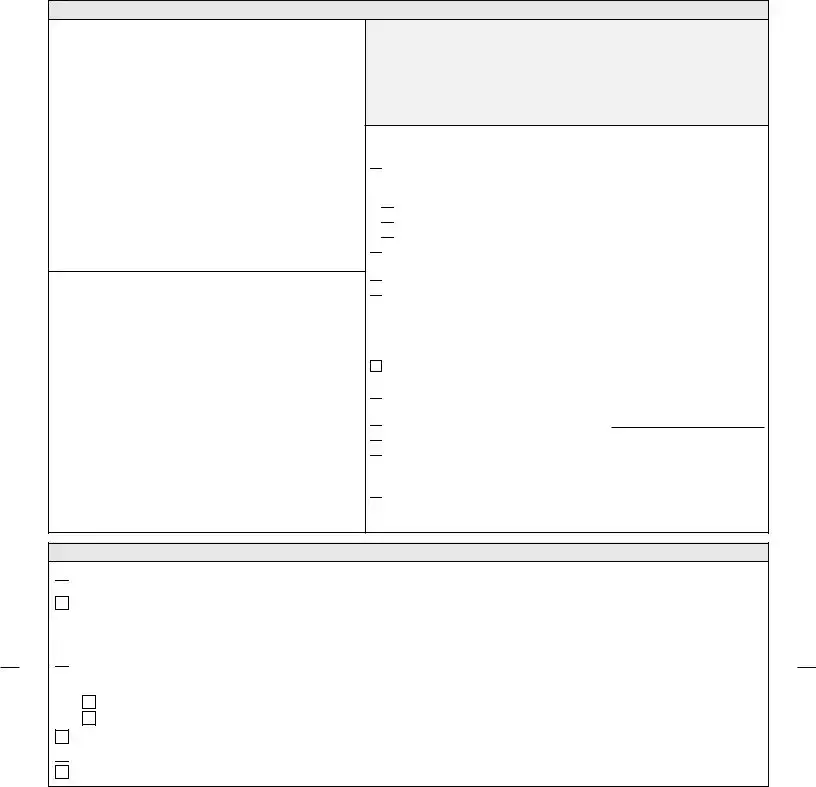

A 5% state sales tax must be collected for all nonexempt private party or dealer sales. County tax will also apply if the OHM is

(1)received in a taxable county or

(2)stored or used in a taxable county, whichever occurs first.

County Tax – If the county tax applies a 1/2% county tax must be paid.

For purchases before 3/31/2020 check DORs website for stadium taxes: www.revenue.wi.gov

Exemptions From Tax – Your purchase will not be subject to sales tax if any of the following situations apply.

Code 1. The Item was previously registered in Wisconsin and purchased OR received from a parent, spouse or child. NOTE: A sibling or grandparent is not tax exempt. Important: check one of the below options:

Code 1. The Item was previously registered in Wisconsin and purchased OR received from a parent, spouse or child. NOTE: A sibling or grandparent is not tax exempt. Important: check one of the below options:

P = If purchased from your parent, stepparent, father-in-law, mother-in-law;

P = If purchased from your parent, stepparent, father-in-law, mother-in-law;

S = If purchased from your spouse;

S = If purchased from your spouse;

C = If purchased from your child, stepchild, daughter-in-law, son-in-law

C = If purchased from your child, stepchild, daughter-in-law, son-in-law

Code 2. Retailer/lessor who will rent or sell the item. Must include the FEIN (Federal Employer Identification Number).

Code 2. Retailer/lessor who will rent or sell the item. Must include the FEIN (Federal Employer Identification Number).

Code 3. State of Wisconsin or government unit, agency or school.

Code 3. State of Wisconsin or government unit, agency or school.

Code 4. Tax paid to another state. Attach a copy of your bill of sale or verifica- tion of tax payment to the other state. NOTE: Sales tax paid to another state on the item reported on this application may be claimed as a credit to reduce the Wisconsin tax due. If tax was paid in another state, subtract the state, county or similar tax from the Wisconsin state, county/stadium tax. Enter the remaining amount of Wisconsin tax payable.

Code 4. Tax paid to another state. Attach a copy of your bill of sale or verifica- tion of tax payment to the other state. NOTE: Sales tax paid to another state on the item reported on this application may be claimed as a credit to reduce the Wisconsin tax due. If tax was paid in another state, subtract the state, county or similar tax from the Wisconsin state, county/stadium tax. Enter the remaining amount of Wisconsin tax payable.

Code 5. Purchased by a nonresident at least 90 days before registrant became a Wisconsin resident and brought and/or registered the item in this state

Code 6. Religious, charitable, educational organization. Must show the Depart- ment of Revenue exempt status number.

Code 6. Religious, charitable, educational organization. Must show the Depart- ment of Revenue exempt status number.

Code 7. Other. Enter reason (i.e., gift or even trade)

Code 7. Other. Enter reason (i.e., gift or even trade)

Code 8. The item was purchased from a dealer and tax was paid to the dealer.

Code 8. The item was purchased from a dealer and tax was paid to the dealer.

Code 9. Farming exemption (i.e., used 95% or more for agricultural purposes). Attach the Department of Revenue exemption certificate (Form S‑211) or a written statement claiming exemption.

Code 9. Farming exemption (i.e., used 95% or more for agricultural purposes). Attach the Department of Revenue exemption certificate (Form S‑211) or a written statement claiming exemption.

Code 10. Tax previously paid when off highway motorcycle was registered with the Wisconsin DOT.

Code 10. Tax previously paid when off highway motorcycle was registered with the Wisconsin DOT.

Questions on Tax contact DOR (608) 266‑2776

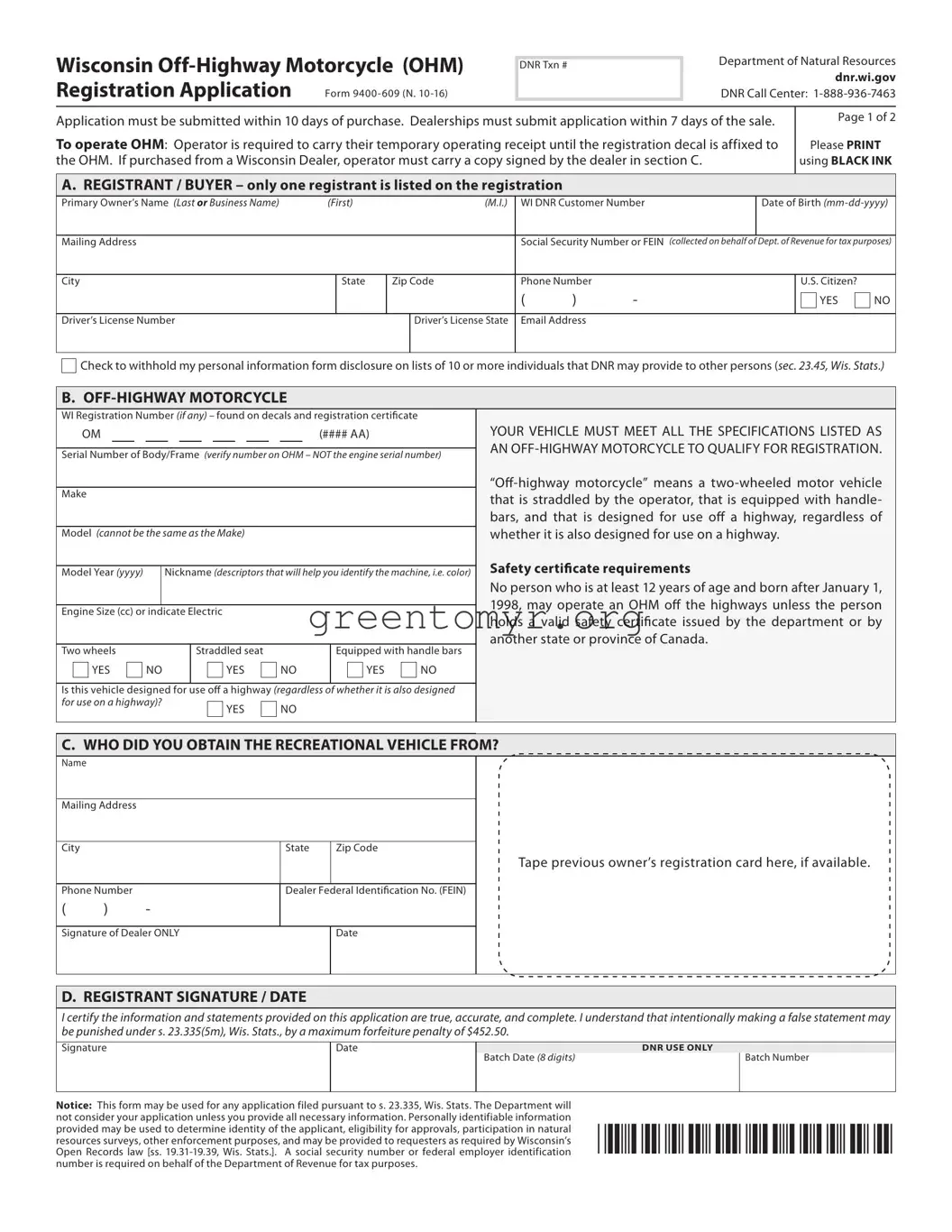

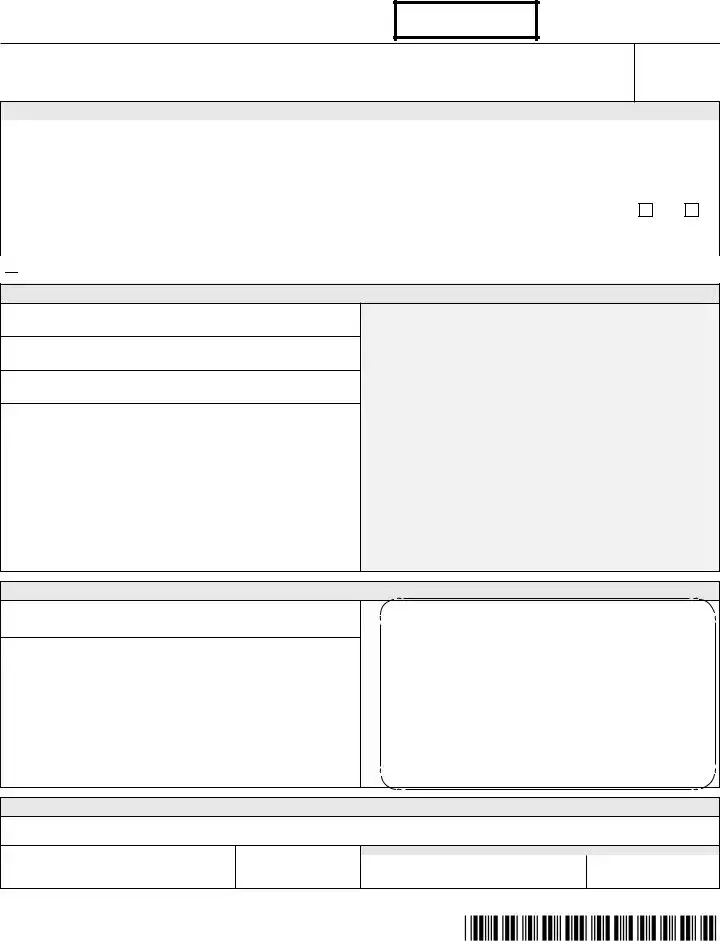

Check to withhold my personal information form disclosure on lists of 10 or more individuals that DNR may provide to other persons (

Check to withhold my personal information form disclosure on lists of 10 or more individuals that DNR may provide to other persons (

P = If purchased from your parent, stepparent,

P = If purchased from your parent, stepparent,

S = If purchased from your spouse;

S = If purchased from your spouse;

C = If purchased from your child, stepchild,

C = If purchased from your child, stepchild,

NEW Public Wisconsin Registration

NEW Public Wisconsin Registration