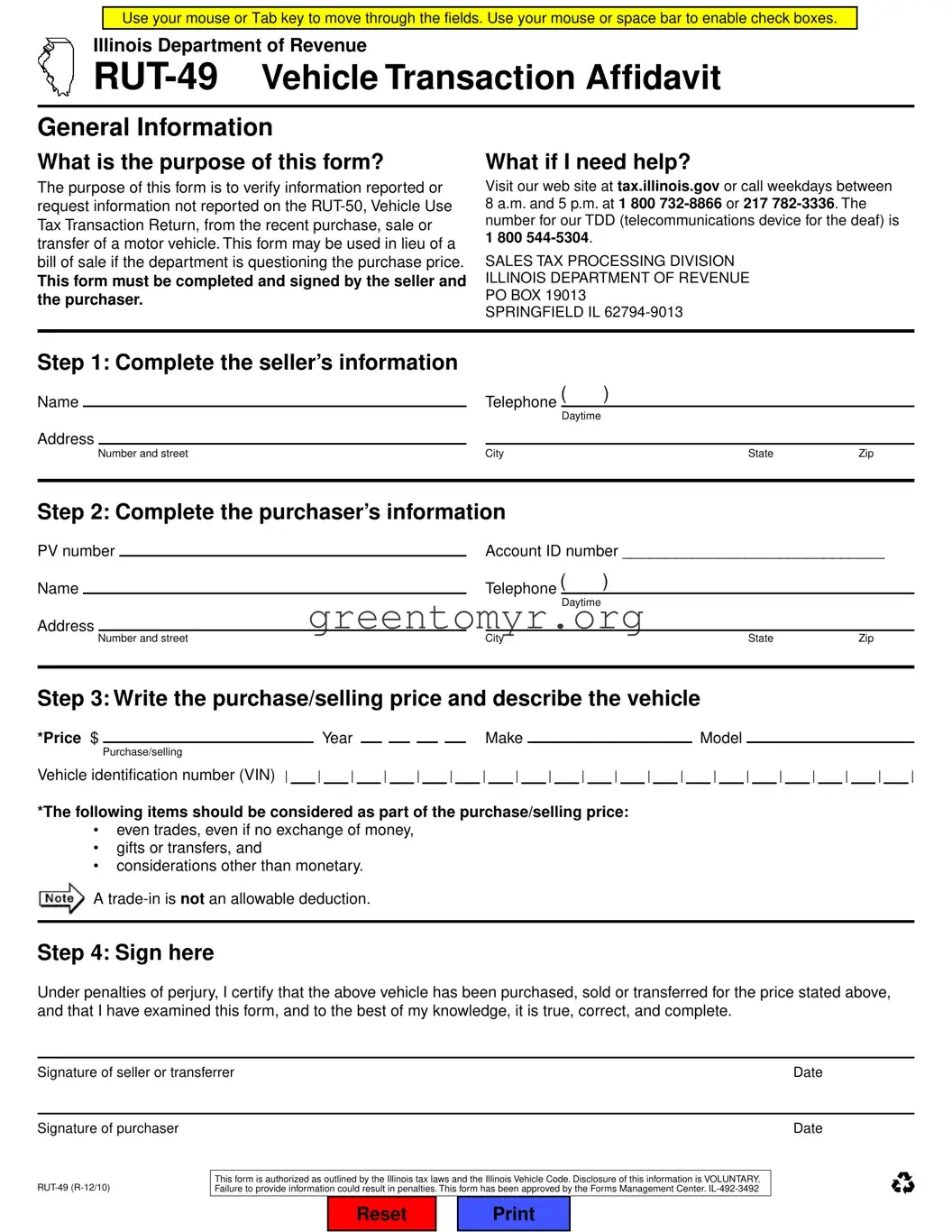

Filling out the BOS RUT-49 form correctly is crucial for individuals wanting to report changes related to vehicle registration or ownership. However, many people make common mistakes that can lead to delays, penalties, or even rejections. Understanding these mistakes can help ensure that your submission goes smoothly.

One frequent error occurs when individuals fail to provide accurate identification information. It's essential to double-check that names, addresses, and identification numbers are entered correctly. Any typos or mismatched information can cause significant problems down the line.

Another common mistake is omitting required signatures. When individuals skip signing the form, it renders the document incomplete. This can result in the processing being stalled or the form being sent back for correction.

People often underestimate the importance of including all necessary documentation. Supporting documents need to be attached to the BOS RUT-49 form. Failing to include required proofs, such as a bill of sale or evidence of existing registration, can complicate matters.

Additionally, some individuals overlook specific deadlines. Submitting the form past the due date can lead to penalties or issues with vehicle registration. Staying aware of important timelines is crucial for compliance.

Many people also forget to keep a copy of their submitted form. Maintaining a record of what has been filed is important for personal reference, and it provides proof if any disputes arise in the future.

Another mistake involves neglecting to check the form for completeness before submission. If the form remains partially filled out, it will not be accepted, leading to frustrating delays in processing. Taking a moment to review the form ensures all needed sections are completed.

Moreover, individuals sometimes submit the form without including payment when it is required. Pay careful attention to any fees that may be associated with your request, and ensure that payment details are correct to avoid unnecessary complications.

Lastly, failing to follow any specific instructions outlined for the form can lead to errors. Each form often has unique requirements depending on the circumstances it addresses. Careful reading of the instructions can prevent accidental mistakes.

A

A