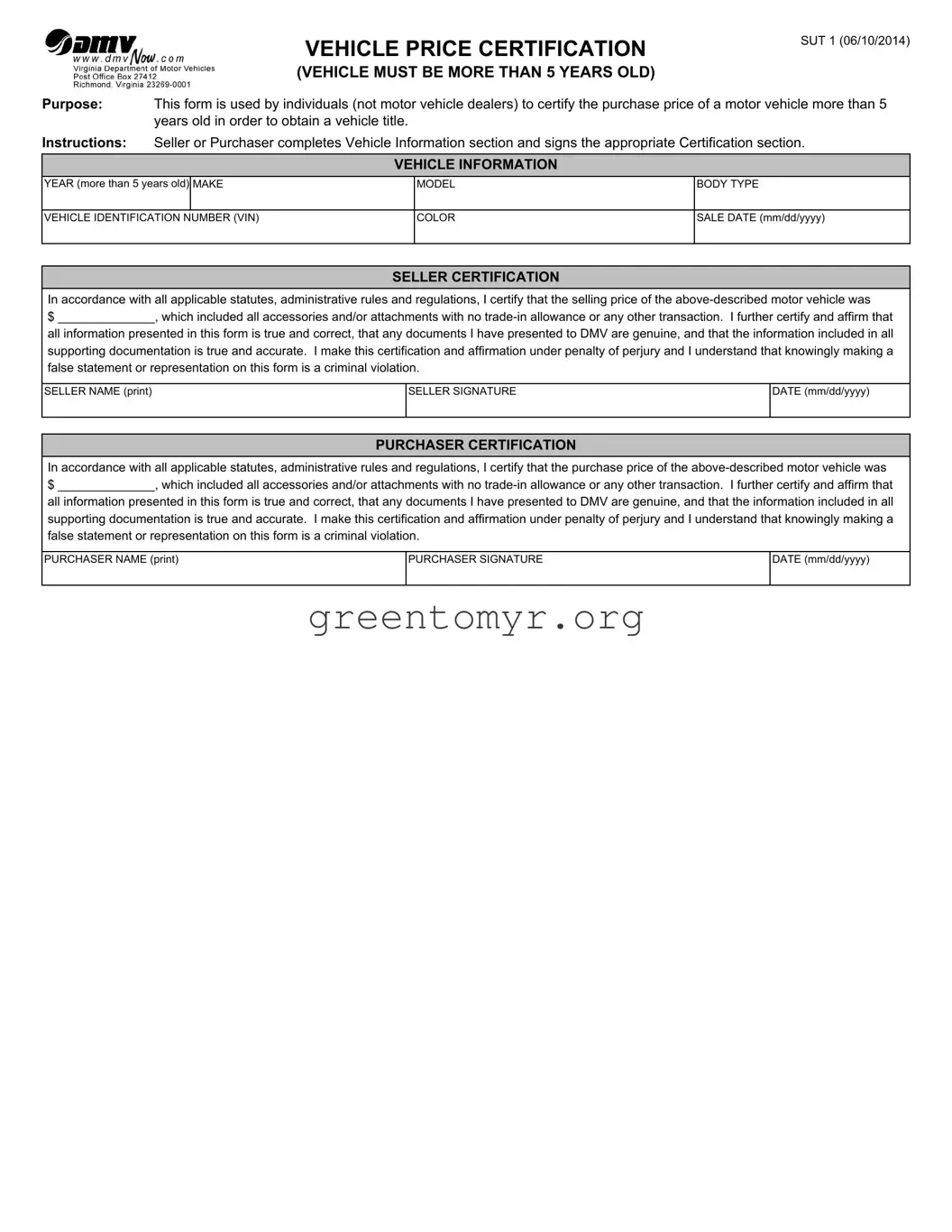

VEHICLE PRICE CERTIFICATION

(VEHICLE MUST BE MORE THAN 5 YEARS OLD)

Purpose: This form is used by individuals (not motor vehicle dealers) to certify the purchase price of a motor vehicle more than 5 years old in order to obtain a vehicle title.

Instructions: Seller or Purchaser completes Vehicle Information section and signs the appropriate Certification section.

VEHICLE INFORMATION

YEAR (more than 5 years old) MAKE

VEHICLE IDENTIFICATION NUMBER (VIN)

SELLER CERTIFICATION

In accordance with all applicable statutes, administrative rules and regulations, I certify that the selling price of the above-described motor vehicle was

$______________, which included all accessories and/or attachments with no trade-in allowance or any other transaction. I further certify and affirm that all information presented in this form is true and correct, that any documents I have presented to DMV are genuine, and that the information included in all supporting documentation is true and accurate. I make this certification and affirmation under penalty of perjury and I understand that knowingly making a false statement or representation on this form is a criminal violation.

PURCHASER CERTIFICATION

In accordance with all applicable statutes, administrative rules and regulations, I certify that the purchase price of the above-described motor vehicle was

$______________, which included all accessories and/or attachments with no trade-in allowance or any other transaction. I further certify and affirm that all information presented in this form is true and correct, that any documents I have presented to DMV are genuine, and that the information included in all supporting documentation is true and accurate. I make this certification and affirmation under penalty of perjury and I understand that knowingly making a false statement or representation on this form is a criminal violation.